Sales Tax South CarolinaSales Tax South CarolinaHomeSC Secretary of StatePT 100 INSTRUCTIONS South Carolina 2013

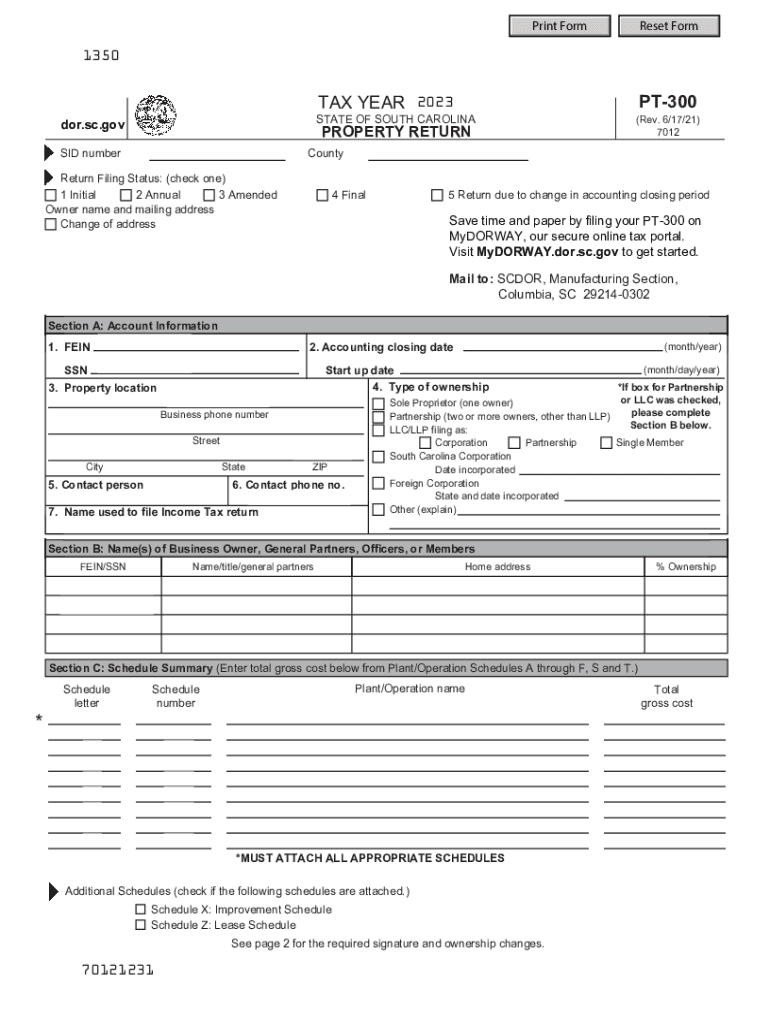

Understanding the South Carolina PT-300 Form

The South Carolina PT-300 form is a crucial document for taxpayers in the state, specifically designed for reporting and calculating taxable income. This form is utilized primarily by individuals and businesses to report their sales tax obligations accurately. Understanding the purpose and requirements of the PT-300 form is essential for compliance with state tax laws.

Steps to Complete the PT-300 Form

Completing the South Carolina PT-300 form involves several key steps:

- Gather necessary information, including your business details and sales records.

- Fill out the form accurately, ensuring all sections are completed, including taxable sales and exemptions.

- Calculate the total sales tax owed based on the provided rates.

- Review the form for accuracy before submission to avoid penalties.

Required Documents for Filing the PT-300

When filing the PT-300 form, certain documents are necessary to support your claims and calculations:

- Sales records and receipts for the reporting period.

- Any exemption certificates applicable to your sales.

- Previous tax returns for reference, if applicable.

Filing Deadlines for the PT-300 Form

It is important to be aware of the filing deadlines for the PT-300 form to avoid late fees and penalties. Typically, the form is due on the 20th day of the month following the end of the reporting period. For example, if you are reporting for the month of January, the form must be submitted by February 20.

Penalties for Non-Compliance with the PT-300 Form

Failure to file the PT-300 form on time or inaccuracies in reporting can lead to significant penalties. These may include:

- Late filing fees, which can accumulate over time.

- Interest on unpaid taxes, increasing the total amount owed.

- Potential audits by the South Carolina Department of Revenue.

Digital vs. Paper Submission of the PT-300 Form

Taxpayers have the option to submit the PT-300 form either digitally or via paper. Digital submission is often preferred for its convenience and speed. The South Carolina Department of Revenue provides an online portal for electronic filing, which can streamline the process and reduce the chances of errors. Paper submissions, while still accepted, may take longer to process and could result in delays.

Quick guide on how to complete sales tax south carolinasales tax south carolinahomesc secretary of statept 100 instructions south carolina

Prepare Sales Tax South CarolinaSales Tax South CarolinaHomeSC Secretary Of StatePT 100 INSTRUCTIONS South Carolina effortlessly on any device

Digital document management has gained traction among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed materials, as you can access the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and eSign your documents promptly without delays. Handle Sales Tax South CarolinaSales Tax South CarolinaHomeSC Secretary Of StatePT 100 INSTRUCTIONS South Carolina on any platform using airSlate SignNow Android or iOS applications and enhance any document-based procedure today.

The simplest way to modify and eSign Sales Tax South CarolinaSales Tax South CarolinaHomeSC Secretary Of StatePT 100 INSTRUCTIONS South Carolina effortlessly

- Obtain Sales Tax South CarolinaSales Tax South CarolinaHomeSC Secretary Of StatePT 100 INSTRUCTIONS South Carolina and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign feature, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you wish to return your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your requirements in document management in just a few clicks from any device you prefer. Alter and eSign Sales Tax South CarolinaSales Tax South CarolinaHomeSC Secretary Of StatePT 100 INSTRUCTIONS South Carolina and guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sales tax south carolinasales tax south carolinahomesc secretary of statept 100 instructions south carolina

Create this form in 5 minutes!

How to create an eSignature for the sales tax south carolinasales tax south carolinahomesc secretary of statept 100 instructions south carolina

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the SC PT300 2022 and how does it integrate with airSlate SignNow?

The SC PT300 2022 is a versatile document signing solution that seamlessly integrates with airSlate SignNow. This integration allows users to automate their document workflows, ensuring faster turnaround times and enhanced productivity. By utilizing SC PT300 2022 with airSlate SignNow, businesses can efficiently manage electronic signatures without any hassle.

-

What features does the SC PT300 2022 offer to enhance document signing?

The SC PT300 2022 features robust tools for document creation, tracking, and collaboration. With its user-friendly interface, businesses can easily send and eSign documents while keeping track of all transactions in real time. Incorporating SC PT300 2022 with airSlate SignNow signNowly improves the overall signing experience.

-

Is the SC PT300 2022 cost-effective for small businesses?

Yes, the SC PT300 2022 is designed to be cost-effective, making it an ideal choice for small businesses looking to streamline their document signing processes. airSlate SignNow offers affordable pricing plans that include the SC PT300 2022, allowing companies to save on time and resources while enhancing their operational efficiency.

-

How does airSlate SignNow ensure the security of documents signed with SC PT300 2022?

airSlate SignNow employs advanced security measures, including encryption and multi-factor authentication, to protect documents signed with the SC PT300 2022. These safeguards ensure that your sensitive information remains confidential and secure during the signing process. Businesses can sign documents with confidence using airSlate SignNow and SC PT300 2022.

-

Can the SC PT300 2022 be integrated with other software solutions?

Absolutely! The SC PT300 2022 can be integrated with various third-party applications, enhancing its functionality when used with airSlate SignNow. This flexibility allows businesses to customize their document management processes and streamline workflows to better meet their specific needs.

-

What are the benefits of using SC PT300 2022 with airSlate SignNow for remote teams?

Using SC PT300 2022 with airSlate SignNow provides substantial benefits for remote teams, such as simplifying the document signing process from any location. This integration fosters collaboration among team members regardless of their physical locations, enabling them to send and eSign documents seamlessly. As a result, teams can maintain efficiency and productivity while working remotely.

-

Is training required to use the SC PT300 2022 with airSlate SignNow?

No extensive training is required to use SC PT300 2022 with airSlate SignNow, thanks to its intuitive interface. Users can quickly learn how to navigate the software and utilize its features effectively. Support resources, including tutorials and customer service, are also available to assist users as they get started.

Get more for Sales Tax South CarolinaSales Tax South CarolinaHomeSC Secretary Of StatePT 100 INSTRUCTIONS South Carolina

- Enclosed a copy of the petition to close estate and for other relief that i will be filing form

- Letter protesting rent increase form

- Letter from wedding planner to caterer concerning scheduled appointment with form

- Letter from wedding planner to specialty vendor inquiring about availability of form

- Letter from newspapermagazine concerning how to submit an editorial form

- Letter from wedding planner to form

- Friendly reminder to relatives to pay for share of gift form

- Letter from wedding planner to limo service inquiring about the fee for service form

Find out other Sales Tax South CarolinaSales Tax South CarolinaHomeSC Secretary Of StatePT 100 INSTRUCTIONS South Carolina

- Can I eSign Utah Lease agreement form

- Can I eSign Washington lease agreement

- Can I eSign Alabama Non disclosure agreement sample

- eSign California Non disclosure agreement sample Now

- eSign Pennsylvania Mutual non-disclosure agreement Now

- Help Me With eSign Utah Non disclosure agreement sample

- How Can I eSign Minnesota Partnership agreements

- eSign Pennsylvania Property management lease agreement Secure

- eSign Hawaii Rental agreement for house Fast

- Help Me With eSign Virginia Rental agreement contract

- eSign Alaska Rental lease agreement Now

- How To eSign Colorado Rental lease agreement

- How Can I eSign Colorado Rental lease agreement

- Can I eSign Connecticut Rental lease agreement

- eSign New Hampshire Rental lease agreement Later

- Can I eSign North Carolina Rental lease agreement

- How Do I eSign Pennsylvania Rental lease agreement

- How To eSign South Carolina Rental lease agreement

- eSign Texas Rental lease agreement Mobile

- eSign Utah Rental agreement lease Easy