Form M 942 Rev 908 Instructions for Monthly Tax Return 2008-2026

Understanding the Form M-942 Rev 908 for Monthly Tax Returns

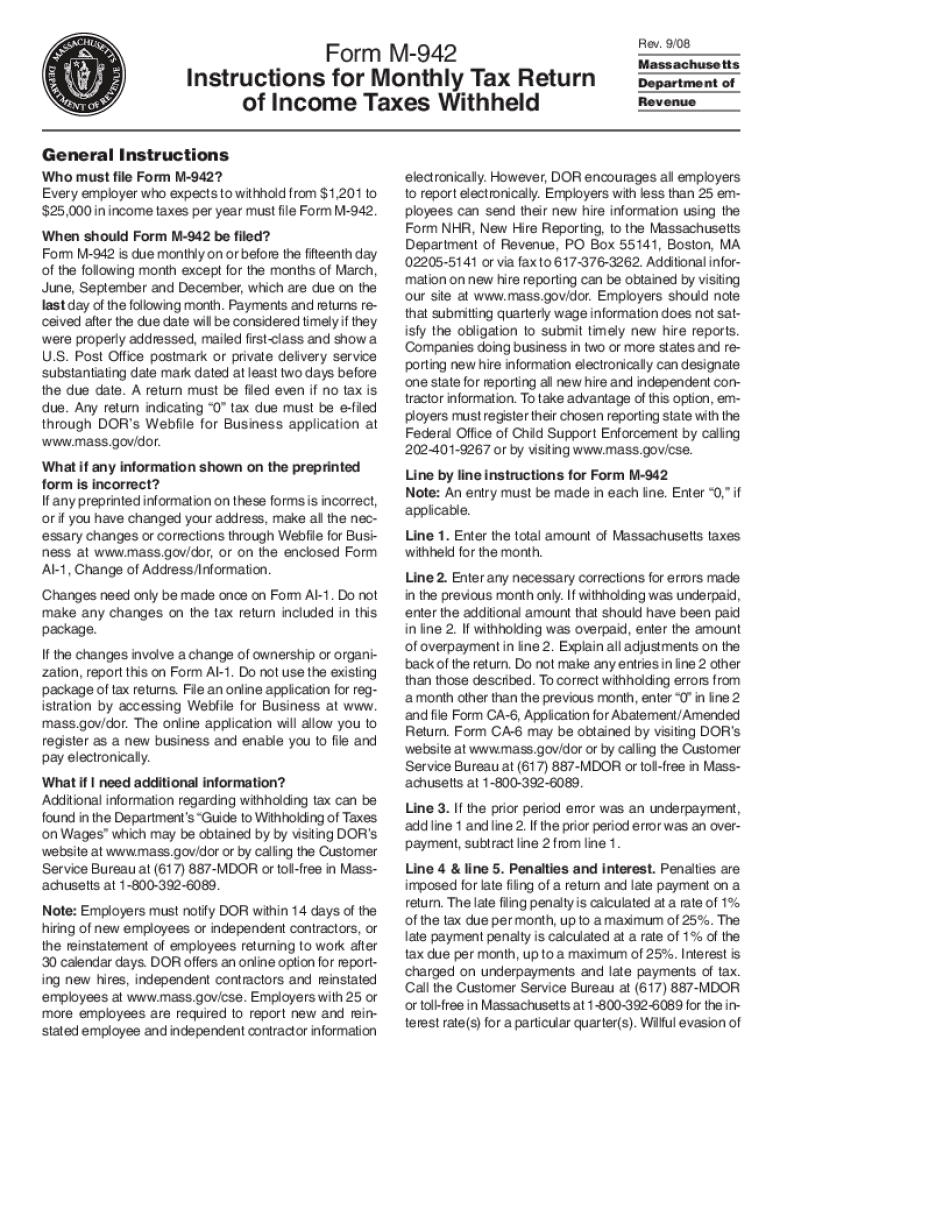

The Form M-942 Rev 908 is a crucial document for businesses in Massachusetts that need to report state income tax withholdings on a monthly basis. This form is specifically designed for employers to calculate and remit the appropriate amount of tax withheld from their employees' wages. It is essential for compliance with state tax regulations and helps ensure that businesses meet their tax obligations accurately and timely.

Steps to Complete the Form M-942 Rev 908

Completing the Form M-942 Rev 908 involves several key steps:

- Gather necessary information: Collect details about your business, including the employer identification number, total wages paid, and the amount of state income tax withheld.

- Fill out the form: Enter the collected data into the appropriate fields on the form. Ensure accuracy to prevent any discrepancies.

- Review for errors: Double-check all entries for accuracy. Mistakes can lead to penalties or delays in processing.

- Submit the form: Choose your preferred submission method, whether online, by mail, or in person.

Filing Deadlines for Form M-942 Rev 908

Timeliness is crucial when filing the Form M-942 Rev 908. Employers must submit this form by the 15th of the month following the reporting period. For instance, the form for January must be filed by February 15. Missing these deadlines can result in penalties and interest on unpaid taxes, so it’s important to stay organized and adhere to the schedule.

Legal Use of the Form M-942 Rev 908

The Form M-942 Rev 908 is legally required for employers in Massachusetts who withhold state income tax from employee wages. Failure to file this form can lead to significant penalties from the Massachusetts Department of Revenue. It serves as a formal declaration of the taxes withheld and ensures compliance with state tax laws.

Obtaining the Form M-942 Rev 908

The Form M-942 Rev 908 can be obtained through the Massachusetts Department of Revenue's website. It is available for download in a printable format, making it accessible for all employers. Additionally, businesses can request copies directly from the Department of Revenue if needed.

Examples of Using the Form M-942 Rev 908

Employers can use the Form M-942 Rev 908 in various scenarios, such as:

- Monthly payroll processing for employees, ensuring that the correct amount of state income tax is withheld.

- Adjusting withholdings based on changes in employee salaries or tax regulations.

- Reporting and remitting taxes for seasonal employees or temporary staff.

Quick guide on how to complete form m 942 rev 908 instructions for monthly tax return

Complete Form M 942 Rev 908 Instructions For Monthly Tax Return effortlessly on any device

Online document management has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents swiftly without interruptions. Handle Form M 942 Rev 908 Instructions For Monthly Tax Return on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The most effective way to modify and eSign Form M 942 Rev 908 Instructions For Monthly Tax Return with ease

- Locate Form M 942 Rev 908 Instructions For Monthly Tax Return and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you want to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate the hassle of lost or misfiles documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Adjust and eSign Form M 942 Rev 908 Instructions For Monthly Tax Return and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form m 942 rev 908 instructions for monthly tax return

Create this form in 5 minutes!

How to create an eSignature for the form m 942 rev 908 instructions for monthly tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of tax state income when using airSlate SignNow?

Understanding tax state income is crucial for businesses as it influences financial decisions and document management. With airSlate SignNow, users can sign and manage documents related to state income tax efficiently, ensuring compliance and accuracy. Our platform enables seamless workflows that aid in tracking tax obligations.

-

How does airSlate SignNow support tax state income documentation?

airSlate SignNow streamlines the process of handling tax state income documents by providing an easy-to-use interface. Users can quickly eSign and share critical documents, reducing processing time and enhancing accuracy. This feature aids in maintaining organized records for efficient tax filing.

-

Is there a pricing plan for airSlate SignNow focused on tax state income solutions?

Yes, airSlate SignNow offers pricing plans tailored for businesses dealing with tax state income requirements. Our cost-effective solutions scale according to business needs, ensuring you only pay for the features you need. Contact our sales team for detailed pricing options that match your requirements.

-

What features in airSlate SignNow assist with tax state income management?

Key features of airSlate SignNow for managing tax state income include eSigning, document templates, and integration capabilities. These tools simplify document preparation, improve turnaround time, and enhance data accuracy for tax filings. The platform also supports audit trails, ensuring compliance and security.

-

Can airSlate SignNow integrate with accounting software for tax state income?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, enhancing your ability to manage tax state income efficiently. This integration allows users to sync important data, streamline workflows, and ensure that all tax-related documents are accurately processed and signed electronically.

-

What benefits does airSlate SignNow provide for handling tax state income?

Using airSlate SignNow to manage tax state income offers numerous benefits including time savings, increased accuracy, and improved compliance. By digitizing the signing process, businesses can accelerate their document flow and reduce the risk of errors associated with manual handling. This leads to a more efficient tax filing process overall.

-

Is airSlate SignNow suitable for individuals filing tax state income?

Yes, airSlate SignNow is suitable for individuals filing tax state income, offering an accessible solution for document signing and management. Its user-friendly interface makes it easy for individuals to eSign tax forms and related documents quickly and securely from anywhere. This convenience is essential for timely tax submissions.

Get more for Form M 942 Rev 908 Instructions For Monthly Tax Return

- Relief of delegated responsibilities form

- Sample letter for b2 to f1 pearl bridgefinancial form

- Form of agreement and assignment of partnership interest

- 6 messages to the court clerk that could help your filingone form

- On behalf of organization i would like to thank you for donating your time and energy form

- Enclosed herewith please find a notice of filing orderentry of judgment relative to your case form

- Form of agreement of limited partnership secgov

- Condolence death of a loved one from a colleague form

Find out other Form M 942 Rev 908 Instructions For Monthly Tax Return

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document