Tax Form Tax TableAmarta Karya 2022

What is the Tax Form Tax TableAmarta Karya

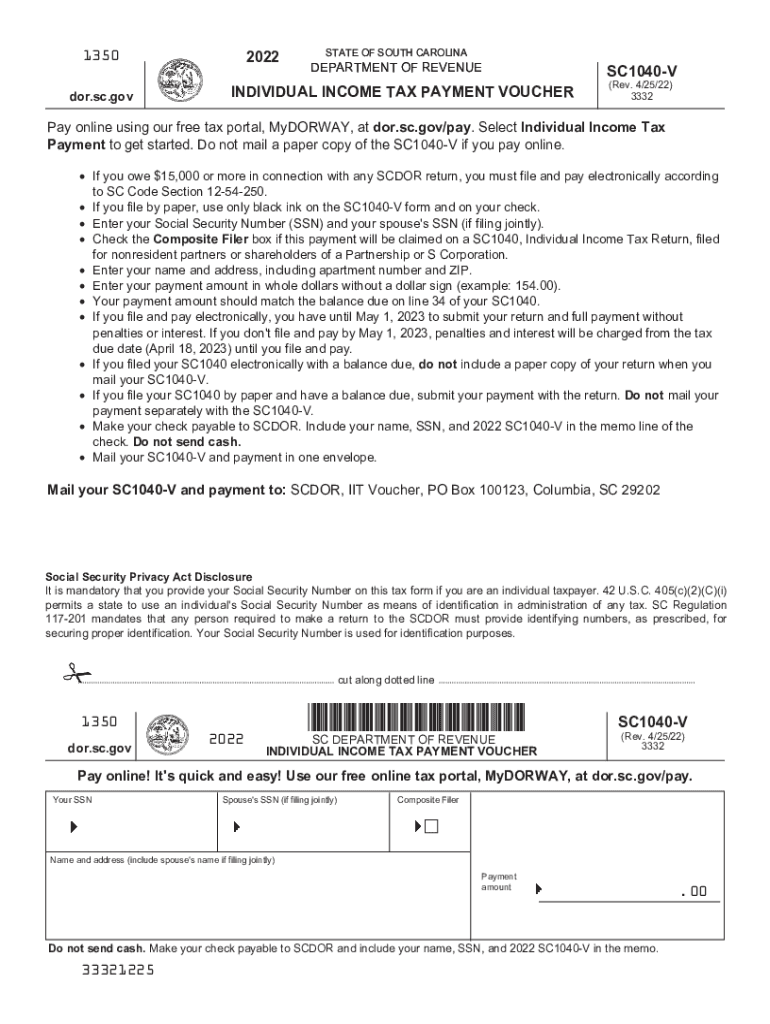

The Tax Form Tax TableAmarta Karya is a specific document utilized for reporting income and calculating tax liabilities in the United States. This form is essential for individuals and businesses to ensure compliance with federal tax regulations. It typically includes various sections that outline income categories, deductions, and applicable tax rates. Understanding this form is crucial for accurate tax filing and avoiding potential penalties.

How to use the Tax Form Tax TableAmarta Karya

Using the Tax Form Tax TableAmarta Karya involves several steps to ensure accurate completion. First, gather all necessary financial documents, including income statements and previous tax returns. Next, refer to the form's instructions to identify the appropriate sections relevant to your financial situation. Carefully input your income figures and apply any deductions as outlined in the table. Finally, review your entries for accuracy before submission to avoid errors that could lead to complications with the IRS.

Steps to complete the Tax Form Tax TableAmarta Karya

Completing the Tax Form Tax TableAmarta Karya can be broken down into a series of straightforward steps:

- Gather all relevant financial documents, such as W-2s and 1099s.

- Read the instructions accompanying the form to understand the requirements.

- Fill in your personal information, including your name and Social Security number.

- Report your total income as specified in the form.

- Apply any eligible deductions or credits based on your situation.

- Calculate your total tax liability using the provided tax tables.

- Review the completed form for accuracy before submitting it.

Key elements of the Tax Form Tax TableAmarta Karya

The Tax Form Tax TableAmarta Karya comprises several key elements that are essential for accurate tax reporting. These include:

- Personal Information: Details such as your name, address, and Social Security number.

- Income Reporting: Sections to report various types of income, including wages and self-employment earnings.

- Deductions: Areas to claim deductions that can lower your taxable income.

- Tax Calculation: Tables that help determine the amount of tax owed based on reported income.

- Signature Line: A section where you must sign to certify the accuracy of the information provided.

Filing Deadlines / Important Dates

Filing deadlines for the Tax Form Tax TableAmarta Karya are critical to ensure compliance with IRS regulations. Typically, individual tax returns are due on April fifteenth of each year. However, if this date falls on a weekend or holiday, the deadline may shift to the next business day. It is advisable to check the IRS website for any updates regarding filing extensions or changes to deadlines, as these can vary annually.

Who Issues the Form

The Tax Form Tax TableAmarta Karya is issued by the Internal Revenue Service (IRS), the federal agency responsible for tax collection and enforcement in the United States. The IRS provides the form along with detailed instructions to guide taxpayers in accurately reporting their income and calculating their tax obligations. It is important to ensure you are using the most current version of the form, as updates may occur annually.

Quick guide on how to complete tax form tax tableamarta karya

Complete Tax Form Tax TableAmarta Karya effortlessly on any device

Online document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Handle Tax Form Tax TableAmarta Karya on any device with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Tax Form Tax TableAmarta Karya with minimal effort

- Find Tax Form Tax TableAmarta Karya and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Make your eSignature with the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in a few clicks from any device you prefer. Edit and eSign Tax Form Tax TableAmarta Karya and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax form tax tableamarta karya

Create this form in 5 minutes!

How to create an eSignature for the tax form tax tableamarta karya

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Tax Form Tax TableAmarta Karya?

The Tax Form Tax TableAmarta Karya is a comprehensive tax table designed to help users understand and manage their tax obligations. This resource simplifies the complexities of tax calculations, making it easier for businesses to stay compliant with tax regulations. Utilizing this table can save time and reduce errors in tax-related documents.

-

How can airSlate SignNow assist with Tax Form Tax TableAmarta Karya?

airSlate SignNow streamlines the process of sending and eSigning documents, including those related to the Tax Form Tax TableAmarta Karya. Our platform allows you to easily manage tax documents and securely obtain signatures, ensuring that you meet deadlines and maintain compliance. With our solution, you can reduce administrative burdens associated with tax documentation.

-

What are the pricing options for using airSlate SignNow with Tax Form Tax TableAmarta Karya?

airSlate SignNow offers flexible pricing plans to fit different business needs, with options for solo users, small businesses, and large enterprises. Each plan provides access to features that make the management of Tax Form Tax TableAmarta Karya efficient and straightforward. Pricing is competitive and designed to deliver value for your investment in tax documentation.

-

What features does airSlate SignNow offer for managing Tax Form Tax TableAmarta Karya?

Our platform provides a variety of features that support the handling of Tax Form Tax TableAmarta Karya, including customizable templates, document routing, and easy eSigning capabilities. You can track the status of your documents, ensuring that all necessary signatures are obtained. Additionally, we offer integration with various systems to keep your workflows organized.

-

Can airSlate SignNow integrate with other software for Tax Form Tax TableAmarta Karya?

Yes, airSlate SignNow integrates seamlessly with numerous software applications, enhancing the management of Tax Form Tax TableAmarta Karya. This ability to connect with other tools allows for a more cohesive workflow, reducing the time spent on manual input and improving overall efficiency. Popular integrations include CRM systems, accounting software, and project management tools.

-

What benefits does airSlate SignNow provide for businesses dealing with Tax Form Tax TableAmarta Karya?

Using airSlate SignNow for your Tax Form Tax TableAmarta Karya needs can lead to signNow efficiency improvements for your business. Our platform reduces the time it takes to send, sign, and store tax documents securely. Additionally, businesses benefit from a smoother process, minimized errors, and enhanced compliance with tax requirements.

-

Is it secure to send Tax Form Tax TableAmarta Karya documents using airSlate SignNow?

Absolutely! airSlate SignNow prioritizes the security of your documents, including those related to the Tax Form Tax TableAmarta Karya. We implement industry-standard encryption and comply with legal regulations to ensure that your sensitive tax information remains protected during transmission and storage.

Get more for Tax Form Tax TableAmarta Karya

- Headquarters office form

- Did you receive a letterpbi research services form

- Verbal warning worksheetprintable form to document an

- Retrenchment letter form

- In consideration for offering quotunbundled legal servicesquot to form

- Letterhead of employer form

- Resurrection letter form

- Sample trustee letter form

Find out other Tax Form Tax TableAmarta Karya

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online