Authorization for Pre Tax Payroll Reduction Enrollment Form

Understanding the Authorization for Pre-Tax Payroll Reduction Enrollment

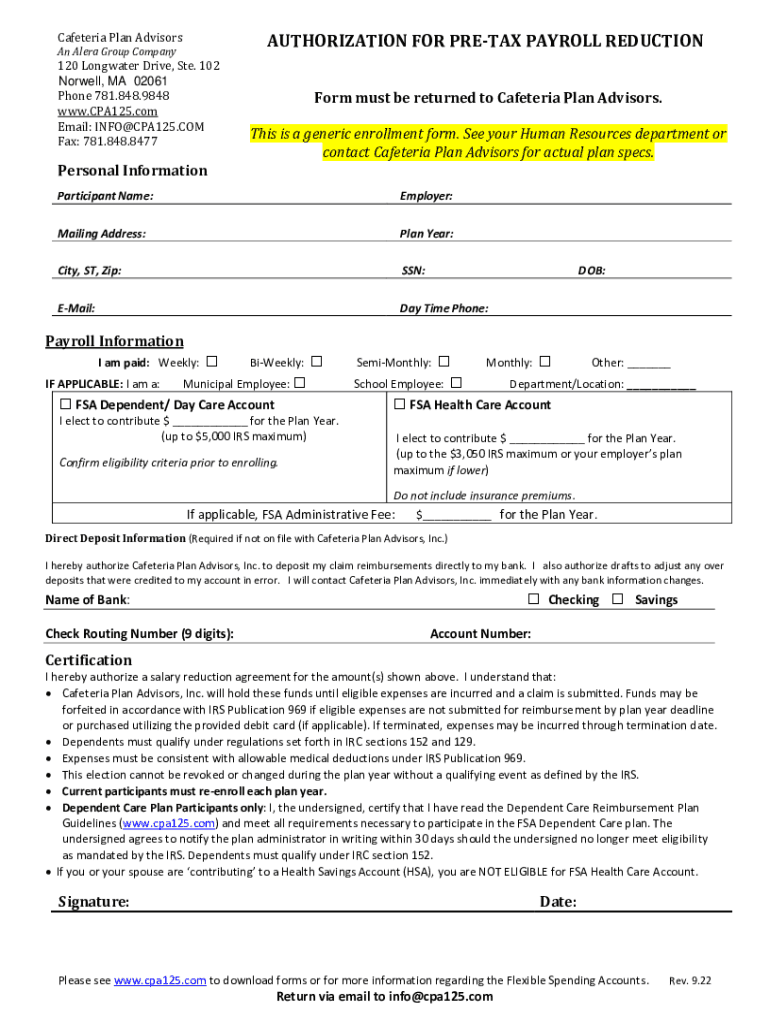

The Authorization for Pre-Tax Payroll Reduction Enrollment is a crucial document that allows employees to participate in pre-tax benefits offered by their employers. This form is essential for enabling employees to allocate a portion of their salary towards benefits such as health insurance premiums or retirement contributions before taxes are deducted. By utilizing this form, employees can effectively lower their taxable income, which may result in tax savings.

Steps to Complete the Authorization for Pre-Tax Payroll Reduction Enrollment

Completing the Authorization for Pre-Tax Payroll Reduction Enrollment involves several key steps:

- Obtain the form from your employer or human resources department.

- Fill out personal information, including your name, employee ID, and contact details.

- Specify the amount or percentage of your salary you wish to allocate to pre-tax benefits.

- Review the terms and conditions associated with the pre-tax payroll reduction.

- Sign and date the form to confirm your consent.

- Submit the completed form to your payroll department for processing.

Legal Use of the Authorization for Pre-Tax Payroll Reduction Enrollment

The Authorization for Pre-Tax Payroll Reduction Enrollment must be used in compliance with IRS regulations. Employers are required to maintain accurate records of all forms submitted for pre-tax deductions. This ensures that both the employer and employee adhere to tax laws and regulations, preventing any potential legal issues. Employees should also keep a copy of their submitted form for personal records and future reference.

Key Elements of the Authorization for Pre-Tax Payroll Reduction Enrollment

Several key elements are essential to the Authorization for Pre-Tax Payroll Reduction Enrollment:

- Employee Information: Personal details of the employee, including name and employee ID.

- Benefit Selection: Clear indication of the benefits for which pre-tax deductions are requested.

- Deduction Amount: Specification of the percentage or fixed amount to be deducted from the salary.

- Employer Acknowledgment: Signature or acknowledgment from the employer confirming receipt of the form.

Examples of Using the Authorization for Pre-Tax Payroll Reduction Enrollment

Employees can use the Authorization for Pre-Tax Payroll Reduction Enrollment in various scenarios:

- Participating in a health savings account (HSA) to save for medical expenses.

- Enrolling in a flexible spending account (FSA) for dependent care or medical costs.

- Contributing to a 401(k) retirement plan to prepare for future financial stability.

Filing Deadlines and Important Dates

It is important to be aware of any filing deadlines associated with the Authorization for Pre-Tax Payroll Reduction Enrollment. Typically, these forms should be submitted before the start of a new payroll period. Employers may have specific deadlines for enrollment in benefits, especially during open enrollment periods. Employees should consult their HR department for precise dates to ensure timely processing.

Quick guide on how to complete authorization for pre tax payroll reduction enrollment

Effortlessly Prepare Authorization For Pre Tax Payroll Reduction Enrollment on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the necessary form and securely save it online. airSlate SignNow provides all the resources you require to create, modify, and electronically sign your documents swiftly without delays. Manage Authorization For Pre Tax Payroll Reduction Enrollment on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Easiest Way to Edit and Electronically Sign Authorization For Pre Tax Payroll Reduction Enrollment with Ease

- Locate Authorization For Pre Tax Payroll Reduction Enrollment and click on Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your electronic signature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to submit your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Authorization For Pre Tax Payroll Reduction Enrollment and ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the authorization for pre tax payroll reduction enrollment

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is CPA125 and how does it relate to airSlate SignNow?

CPA125 is a crucial element for businesses looking to integrate electronic signatures with compliance needs. AirSlate SignNow provides a user-friendly platform that ensures documents signed under CPA125 meet all regulatory requirements. Utilizing airSlate SignNow can streamline your document processes while adhering to CPA125 standards.

-

How does airSlate SignNow compare in pricing to other eSignature solutions?

When considering CPA125 compliance, airSlate SignNow offers competitive pricing that gives businesses a cost-effective solution. Our pricing tiers provide flexible options, enabling you to choose the right plan that meets your needs while ensuring CPA125 compliance. This way, you can manage your budget effectively without sacrificing quality.

-

What key features does airSlate SignNow offer for CPA125 compliance?

AirSlate SignNow includes essential features such as secure document storage, robust authentication methods, and customizable templates, all designed to meet CPA125 standards. These features allow businesses to ensure that their eSignatures are legally binding and compliant with regulatory frameworks. Additionally, our platform enables seamless collaboration between stakeholders.

-

Can airSlate SignNow integrate with other software tools for CPA125 users?

Absolutely! AirSlate SignNow offers seamless integrations with various software applications to cater to CPA125 users. Whether you are using CRM systems, document management tools, or accounting software, our integration capabilities enhance your workflow. This ensures that your eSigning process remains efficient and compliant with existing systems.

-

What are the benefits of using airSlate SignNow for CPA125 compliance?

Using airSlate SignNow for CPA125 compliance brings numerous benefits, including enhanced security, improved efficiency, and reduced operational costs. The easy-to-use interface ensures that your team can quickly adopt the platform without extensive training. Additionally, compliance with CPA125 helps protect your organization from legal risks associated with improper eSigning processes.

-

Is airSlate SignNow suitable for small businesses needing CPA125 solutions?

Yes, airSlate SignNow is specifically designed to cater to businesses of all sizes, including small enterprises looking for CPA125 compliant solutions. Our tiered pricing and feature-rich offerings enable small businesses to access professional-grade eSigning capabilities without the financial burden. This empowers them to operate effectively in a competitive market.

-

How does airSlate SignNow ensure the security of documents for CPA125 users?

Security is a priority for airSlate SignNow, especially for CPA125 users who require stringent measures. We implement advanced encryption protocols and robust authentication methods to protect your documents at every stage of the signing process. This commitment to security ensures that your sensitive information remains confidential and compliant with CPA125 regulations.

Get more for Authorization For Pre Tax Payroll Reduction Enrollment

- Us foreclosure relief et al temporary restraining order form

- Seller shall sell to buyer the goods described in exhibit a attached hereto and incorporated herein by this form

- Information on the texas business and commerce code

- The supreme court flashcardsquizlet form

- Vtr 264 repossessed motor vehicle affidavit txdmvgov form

- Agreement for exhibition unpatented inventionus legal forms

- Terms of sale core ampamp main fire protection form

- Sale of goods agreementget free legal forms

Find out other Authorization For Pre Tax Payroll Reduction Enrollment

- Electronic signature Wisconsin Codicil to Will Later

- Electronic signature Idaho Guaranty Agreement Free

- Electronic signature North Carolina Guaranty Agreement Online

- eSignature Connecticut Outsourcing Services Contract Computer

- eSignature New Hampshire Outsourcing Services Contract Computer

- eSignature New York Outsourcing Services Contract Simple

- Electronic signature Hawaii Revocation of Power of Attorney Computer

- How Do I Electronic signature Utah Gift Affidavit

- Electronic signature Kentucky Mechanic's Lien Free

- Electronic signature Maine Mechanic's Lien Fast

- Can I Electronic signature North Carolina Mechanic's Lien

- How To Electronic signature Oklahoma Mechanic's Lien

- Electronic signature Oregon Mechanic's Lien Computer

- Electronic signature Vermont Mechanic's Lien Simple

- How Can I Electronic signature Virginia Mechanic's Lien

- Electronic signature Washington Mechanic's Lien Myself

- Electronic signature Louisiana Demand for Extension of Payment Date Simple

- Can I Electronic signature Louisiana Notice of Rescission

- Electronic signature Oregon Demand for Extension of Payment Date Online

- Can I Electronic signature Ohio Consumer Credit Application