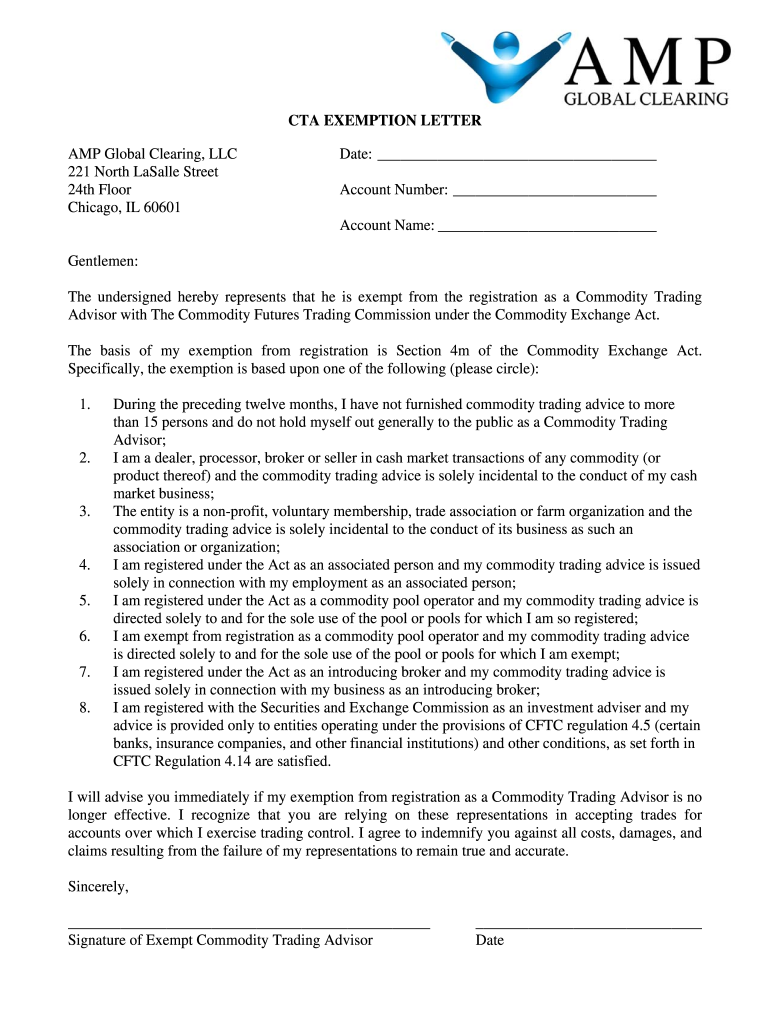

CTA EXEMPTION LETTER AMP Global Clearing LLC Date 221 Form

Understanding the Illinois Exemption Letter

The Illinois exemption letter is a crucial document that allows certain entities to claim exemption from specific taxes. This letter is often utilized by organizations, such as nonprofits and governmental bodies, to demonstrate their tax-exempt status. It is essential for ensuring compliance with Illinois tax laws and for avoiding unnecessary tax liabilities.

Steps to Obtain the Illinois Exemption Letter

To obtain an Illinois exemption letter, follow these steps:

- Determine eligibility by reviewing the criteria set by the Illinois Department of Revenue.

- Gather necessary documentation, including proof of your organization’s status and purpose.

- Complete the required application form, which may vary based on the type of exemption sought.

- Submit the application along with all supporting documents to the appropriate state office.

- Await confirmation from the state, which may take several weeks depending on the volume of applications.

Key Elements of the Illinois Exemption Letter

The Illinois exemption letter typically includes several key elements:

- The name and address of the organization claiming the exemption.

- The specific type of exemption being claimed.

- The effective date of the exemption.

- A unique identification number assigned by the Illinois Department of Revenue.

- Any conditions or limitations associated with the exemption.

Legal Use of the Illinois Exemption Letter

Using the Illinois exemption letter legally requires adherence to state regulations. Organizations must ensure that they only claim exemptions for eligible purchases and activities. Misuse of the exemption can lead to penalties, including fines and back taxes. It is important to maintain accurate records of all transactions where the exemption is applied.

Eligibility Criteria for the Illinois Exemption Letter

Eligibility for the Illinois exemption letter generally depends on the nature of the organization and its activities. Common criteria include:

- Nonprofit status, such as 501(c)(3) organizations.

- Educational institutions recognized by the state.

- Governmental entities at local, state, or federal levels.

Organizations must provide sufficient documentation to prove their eligibility when applying for the exemption.

Filing Deadlines and Important Dates

Filing deadlines for the Illinois exemption letter can vary based on the type of exemption and the organization’s fiscal year. It is advisable to check the Illinois Department of Revenue’s website for specific dates relevant to your application. Timely submission is essential to avoid penalties and ensure that your exemption is recognized for the intended period.

Quick guide on how to complete cta exemption letter amp global clearing llc date 221

Complete CTA EXEMPTION LETTER AMP Global Clearing LLC Date 221 effortlessly on any device

Digital document management has gained signNow traction among companies and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the right form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Manage CTA EXEMPTION LETTER AMP Global Clearing LLC Date 221 on any platform using the airSlate SignNow Android or iOS applications and enhance any document-related workflow today.

The easiest way to modify and eSign CTA EXEMPTION LETTER AMP Global Clearing LLC Date 221 with minimal effort

- Locate CTA EXEMPTION LETTER AMP Global Clearing LLC Date 221 and click Get Form to begin.

- Utilize the features we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Edit and eSign CTA EXEMPTION LETTER AMP Global Clearing LLC Date 221 to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cta exemption letter amp global clearing llc date 221

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an Illinois exemption letter?

An Illinois exemption letter is a document that provides proof of exemption from certain taxes or fees within the state. It is crucial for businesses that qualify for these exemptions to present the letter to avoid unnecessary charges. Understanding how to obtain and use an Illinois exemption letter can benefit your business financially.

-

How can airSlate SignNow help me manage my Illinois exemption letter?

airSlate SignNow streamlines the process of creating, signing, and storing your Illinois exemption letter. With its user-friendly interface, you can easily customize templates and send documents for eSignature, ensuring quick turnaround times. This simplifies compliance with state regulations and helps you keep your transactions organized.

-

Is there a cost associated with obtaining an Illinois exemption letter?

While getting an Illinois exemption letter itself might not have a direct fee, there may be costs related to document preparation or consultation with tax professionals. Using airSlate SignNow can signNowly reduce administrative costs by simplifying document management and allowing you to eSign your Illinois exemption letter online.

-

What are the advantages of using airSlate SignNow for my Illinois exemption letter?

Using airSlate SignNow for your Illinois exemption letter comes with multiple advantages, including speed, convenience, and security. You can easily create, manage, and send your exemption letter electronically, reducing paper waste and ensuring your documents are safely stored in the cloud. Additionally, the solution is cost-effective, helping your business save time and money.

-

Can I integrate airSlate SignNow with other software to manage my Illinois exemption letter?

Yes, airSlate SignNow offers integrations with various software solutions, making it easy to manage your Illinois exemption letter alongside your other business processes. By connecting with CRM and financial tools, you can streamline your workflows and enhance productivity. This integration capability ensures that your exemption letters are easily accessible and correctly managed.

-

What features does airSlate SignNow offer for creating an Illinois exemption letter?

airSlate SignNow provides various features for creating your Illinois exemption letter, including customizable templates, drag-and-drop editing, and seamless eSigning. These tools allow you to quickly generate a professional-looking document that meets Illinois requirements. This functionality makes it easier to address the needs of your business efficiently.

-

Is it secure to store my Illinois exemption letter in airSlate SignNow?

Absolutely! airSlate SignNow prioritizes security, utilizing encryption and secure cloud storage to protect your Illinois exemption letter and other sensitive documents. You can trust that your files are safeguarded from unauthorized access while remaining easily accessible when needed. This peace of mind is essential for managing important documentation.

Get more for CTA EXEMPTION LETTER AMP Global Clearing LLC Date 221

- Driver and vehicl minnesota department of public safety form

- Records access agreement form

- Pdf permitted transfer facility annual report form new york state

- Transfer station annual report form new york state department dec ny

- Ohio secretary of state renewal 482639399 form

- Annual report recyclables handling amp recovery facility form

- Recyclables handling and recovery facility annual report form

- Application for efda certification by examination commonwealth of portal state pa form

Find out other CTA EXEMPTION LETTER AMP Global Clearing LLC Date 221

- eSignature Louisiana Sports Rental Application Free

- Help Me With eSignature Nevada Real Estate Business Associate Agreement

- How To eSignature Montana Police Last Will And Testament

- eSignature Maine Sports Contract Safe

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement