Profit and Loss Statement Chapter 13 Trustee Chapter13tacoma Form

What is the Profit And Loss Statement Chapter 13 Trustee Chapter13tacoma

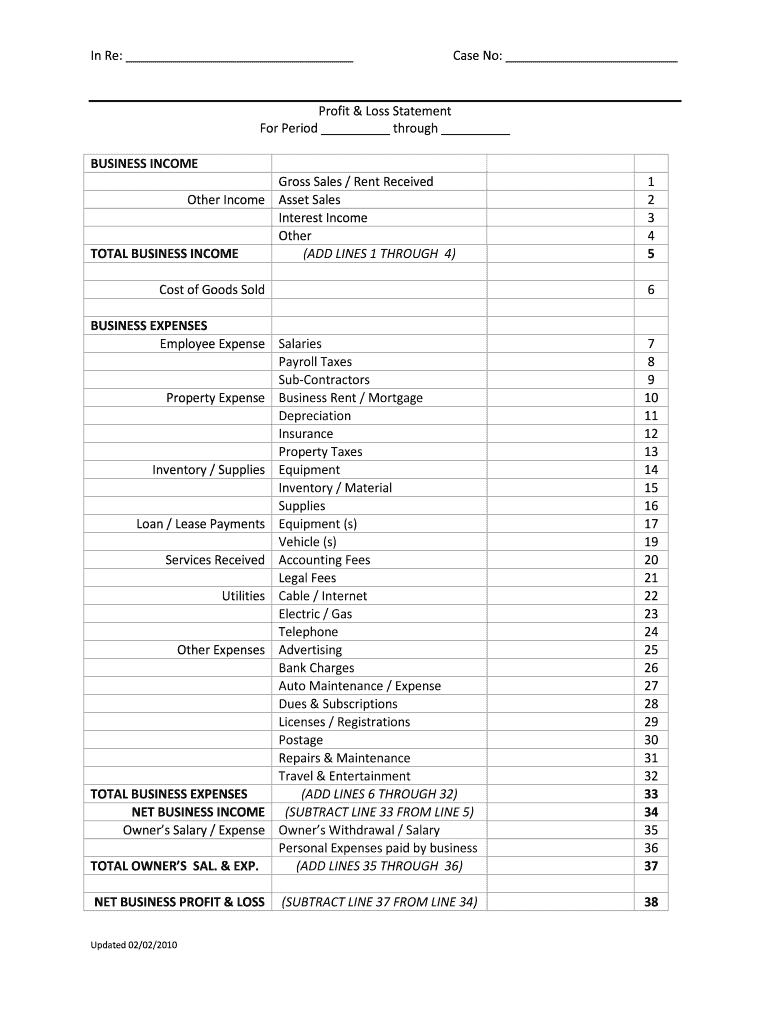

The Profit and Loss Statement, often referred to as an income statement, is a financial document that summarizes the revenues, costs, and expenses incurred during a specific period. In the context of a Chapter 13 Trustee, this statement is crucial for evaluating a debtor's financial situation. It provides insights into the debtor's income streams and expenses, which are essential for determining repayment plans in bankruptcy cases. The Chapter 13 Trustee uses this information to assess the feasibility of the proposed repayment plan and ensure that it aligns with the debtor's ability to pay.

How to use the Profit And Loss Statement Chapter 13 Trustee Chapter13tacoma

Utilizing the Profit and Loss Statement effectively involves compiling accurate financial data. Debtors should gather information on all sources of income, including wages, business profits, and any other earnings. It's equally important to document all expenses, such as housing costs, utilities, and other recurring payments. Once this data is organized, it can be entered into the Profit and Loss Statement format, providing a clear overview of the financial situation. This statement is then submitted to the Chapter 13 Trustee, who will review it to help formulate a repayment plan that is both realistic and compliant with bankruptcy regulations.

Steps to complete the Profit And Loss Statement Chapter 13 Trustee Chapter13tacoma

Completing the Profit and Loss Statement involves several key steps:

- Gather financial documents: Collect pay stubs, bank statements, and any relevant financial records.

- List income sources: Document all income streams, including salaries, side jobs, and any passive income.

- Detail expenses: Itemize all regular expenses, ensuring to include fixed and variable costs.

- Calculate totals: Sum up total income and total expenses to determine net income.

- Review for accuracy: Double-check all entries for completeness and accuracy before submission.

- Submit to the Trustee: Provide the completed statement to the Chapter 13 Trustee as part of the bankruptcy process.

Key elements of the Profit And Loss Statement Chapter 13 Trustee Chapter13tacoma

The key elements of the Profit and Loss Statement include:

- Total Revenue: This is the total income generated from all sources.

- Cost of Goods Sold (COGS): If applicable, this represents the direct costs attributable to the production of goods sold.

- Gross Profit: This is calculated by subtracting COGS from total revenue.

- Operating Expenses: These are the costs required to run the business, such as rent, utilities, and salaries.

- Net Income: This figure is derived by subtracting total expenses from gross profit, indicating the overall profitability.

Legal use of the Profit And Loss Statement Chapter 13 Trustee Chapter13tacoma

The Profit and Loss Statement is legally significant in Chapter 13 bankruptcy cases. It serves as a formal document that outlines a debtor's financial condition, which the Chapter 13 Trustee must consider when evaluating repayment plans. Accurate representation of income and expenses is critical, as any discrepancies can lead to complications in the bankruptcy process. Furthermore, this statement must comply with legal standards and be submitted within specified timelines to ensure adherence to bankruptcy laws.

Required Documents

When preparing the Profit and Loss Statement for submission to the Chapter 13 Trustee, several supporting documents are typically required:

- Recent pay stubs: To verify income sources.

- Bank statements: To provide a complete picture of financial activity.

- Tax returns: Often required to confirm reported income.

- Receipts for expenses: To substantiate claims made in the statement.

Quick guide on how to complete profit and loss statement chapter 13 trustee chapter13tacoma

Effortlessly prepare Profit And Loss Statement Chapter 13 Trustee Chapter13tacoma on any device

Digital document management has gained traction among organizations and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle Profit And Loss Statement Chapter 13 Trustee Chapter13tacoma on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and electronically sign Profit And Loss Statement Chapter 13 Trustee Chapter13tacoma with ease

- Locate Profit And Loss Statement Chapter 13 Trustee Chapter13tacoma and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you choose. Modify and electronically sign Profit And Loss Statement Chapter 13 Trustee Chapter13tacoma and ensure exceptional communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the profit and loss statement chapter 13 trustee chapter13tacoma

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Profit And Loss Statement for Chapter 13 Trustee in Chapter13tacoma?

A Profit And Loss Statement for a Chapter 13 Trustee in Chapter13tacoma is a financial document that outlines a debtor's income and expenses. It helps trustees assess the debtor's financial situation to create a repayment plan. Understanding your profit and loss is essential for compliance with Chapter 13 bankruptcy.

-

How can airSlate SignNow help with my Profit And Loss Statement for Chapter 13 Trustee?

airSlate SignNow simplifies the process of creating and eSigning your Profit And Loss Statement for Chapter 13 Trustee. Our user-friendly platform ensures that your documents are prepared accurately and securely. By using airSlate SignNow, you can streamline your bankruptcy documents and save valuable time.

-

Are there any associated costs for using airSlate SignNow for my Profit And Loss Statement?

Yes, airSlate SignNow offers various pricing plans tailored to your needs. Whether you're an individual or a business dealer in Chapter 13tacoma, we provide cost-effective solutions to help you eSign and send your Profit And Loss Statement. Explore our pricing options to find the best fit for your financial situation.

-

What features does airSlate SignNow provide for managing my Chapter 13 Trustee documents?

airSlate SignNow offers a suite of features designed for managing Chapter 13 Trustee documents, including the ability to create templates for your Profit And Loss Statements. You can also track document statuses, set reminders, and collaborate with your trustee securely. These features enhance efficiency and reduce the burden of paperwork.

-

Can I integrate airSlate SignNow with other software I use for financial management?

Absolutely! airSlate SignNow easily integrates with various financial management solutions, helping you manage your documents efficiently. This integration allows you to sync data seamlessly when preparing your Profit And Loss Statement for your Chapter 13 Trustee. Enjoy a cohesive workflow that can enhance your financial practices.

-

How secure are my documents when using airSlate SignNow for my Chapter 13 Trustee paperwork?

Security is a top priority at airSlate SignNow. We utilize industry-standard encryption protocols to protect your documents, including your Profit And Loss Statement for Chapter 13 Trustee. Our secure platform ensures that your sensitive information remains confidential and safe from unauthorized access.

-

What benefits does airSlate SignNow offer for clients in Chapter13tacoma dealing with bankruptcy?

Using airSlate SignNow provides multiple benefits for clients in Chapter13tacoma, including ease of document creation and the convenience of electronic signatures. You'll save time and reduce stress as you manage your Profit And Loss Statement and other bankruptcy-related documents. Our platform's user-friendly interface makes the process straightforward.

Get more for Profit And Loss Statement Chapter 13 Trustee Chapter13tacoma

- Assumed business name or form

- Fillable online sos mt this space is for the secretary of state only form

- 07 domesticlimitedpartnershipreinstatementdoc form

- Application for registration of foreign limited partnershipdoc form

- Certificate of registration of foreign limited form

- State of montana prepare sign and submit with an form

- Application for registration or form

- Articles of amendment for domestic limited form

Find out other Profit And Loss Statement Chapter 13 Trustee Chapter13tacoma

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later