Schedule CT 1040WH IF 20170912 Indd Form

What is the Schedule CT 1040WH?

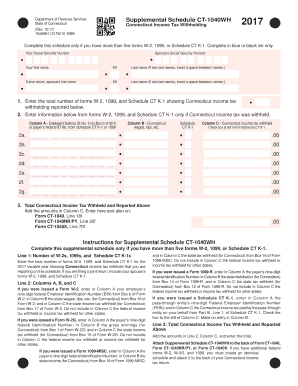

The Schedule CT 1040WH is a tax form used in Connecticut to report withholding for individuals. This form is essential for taxpayers who have had income tax withheld from their earnings throughout the year. The information provided on the 1040wh form helps the state determine the correct amount of tax liability and potential refunds for the taxpayer. Understanding the purpose of this form is crucial for accurate tax reporting and compliance with state regulations.

How to use the Schedule CT 1040WH

Using the Schedule CT 1040WH involves several steps to ensure accurate completion. First, gather all necessary documents, including W-2s and any other income statements that indicate tax withholding. Next, fill out the form by entering your personal information, including your name, address, and Social Security number. You will also need to report the total amount of state tax withheld as indicated on your income statements. After completing the form, review it for accuracy before submission.

Steps to complete the Schedule CT 1040WH

Completing the Schedule CT 1040WH requires careful attention to detail. Follow these steps:

- Collect all relevant income documents, such as W-2 forms.

- Enter your personal information accurately, including your name and Social Security number.

- Report the total amount of Connecticut state tax withheld as shown on your income statements.

- Double-check all entries for accuracy to avoid errors.

- Sign and date the form before submitting it.

Legal use of the Schedule CT 1040WH

The Schedule CT 1040WH is legally binding when completed accurately and submitted in accordance with Connecticut state tax laws. It is important to ensure that all information provided is truthful and complete, as any discrepancies may lead to penalties or audits. The form must be filed by the designated deadline to avoid late fees or additional interest charges on any owed taxes.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule CT 1040WH align with the state’s tax filing requirements. Typically, the form must be submitted by April 15 of the tax year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is essential to keep track of these dates to ensure timely filing and avoid any potential penalties.

Required Documents

To accurately complete the Schedule CT 1040WH, you will need several documents:

- W-2 forms from all employers showing state income tax withheld.

- Any additional 1099 forms if applicable, indicating other sources of income.

- Previous year’s tax return for reference, if necessary.

Having these documents on hand will streamline the completion process and help ensure accuracy in reporting.

Quick guide on how to complete schedule ct 1040wh if 20170912indd

Complete Schedule CT 1040WH IF 20170912 indd effortlessly on any device

Online document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the correct form and securely preserve it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly without delays. Manage Schedule CT 1040WH IF 20170912 indd on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven workflow today.

The simplest way to edit and eSign Schedule CT 1040WH IF 20170912 indd with ease

- Locate Schedule CT 1040WH IF 20170912 indd and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere moments and holds the same legal validity as a traditional handwritten signature.

- Verify all the details and click on the Done button to save your amendments.

- Choose your preferred method to share your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Schedule CT 1040WH IF 20170912 indd while ensuring seamless communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

-

How to decide my bank name city and state if filling out a form, if the bank is a national bank?

Somewhere on that form should be a blank for routing number and account number. Those are available from your check and/or your bank statements. If you can't find them, call the bank and ask or go by their office for help with the form. As long as those numbers are entered correctly, any error you make in spelling, location or naming should not influence the eventual deposit into your proper account.

-

How can I apply to Thapar University if I haven't filled out the form, and the last date for filling it out has passed?

Form filling was the most important thing. So, now you have only one option:- Contact the authorities and if they tell you to visit the campus, then don’t look for any other chance. Just come to campus.

-

How do I take admission in a B.Tech without taking the JEE Mains?

Admissions into B.Tech courses offered by engineering colleges in India is based on JEE Mains score and 12th percentile. Different private and government universities have already started B Tech admission 2019 procedure. However many reputed Private Colleges in India and colleges not affiliated with the Government colleges conduct state/region wise exams for admission or have their eligibility criterion set for admission.1. State Sponsored Colleges: These colleges have their state entrance exams for entry in such colleges. These colleges follow a particular eligibility criterion2. Private Colleges: These colleges either take admission on the basis of 10+2 score of the candidate or their respective entrance exam score. These colleges generally require students with Physics and Mathematics as compulsory subjects with minimum score requirement in each subject, as prescribed by them.3. Direct Admission: This lateral entry is introduced for students who want direct admission in 2nd year of their Bachelor’s course. However, there is an eligibility criterion for the same.Students should give as many entrance exams, to widen their possibility. College preference should always be based on certain factors like placement, faculty etc.

Create this form in 5 minutes!

How to create an eSignature for the schedule ct 1040wh if 20170912indd

How to create an electronic signature for the Schedule Ct 1040wh If 20170912indd in the online mode

How to make an electronic signature for your Schedule Ct 1040wh If 20170912indd in Chrome

How to generate an electronic signature for putting it on the Schedule Ct 1040wh If 20170912indd in Gmail

How to create an electronic signature for the Schedule Ct 1040wh If 20170912indd straight from your smart phone

How to create an electronic signature for the Schedule Ct 1040wh If 20170912indd on iOS

How to generate an eSignature for the Schedule Ct 1040wh If 20170912indd on Android OS

People also ask

-

What is 1040wh and how does it relate to airSlate SignNow?

1040wh is an essential form for tax filings that can be easily managed with airSlate SignNow. Our platform provides a user-friendly interface that simplifies the eSigning and sending of documents like the 1040wh, ensuring compliance and efficiency.

-

How much does airSlate SignNow cost for processing 1040wh forms?

airSlate SignNow offers competitive pricing plans that cater to various business needs, including those needing to handle 1040wh forms. You can select a plan that best suits your volume of transactions and required features, ensuring you only pay for what you need.

-

What features does airSlate SignNow offer for managing 1040wh documents?

With airSlate SignNow, you can easily create, send, and manage your 1040wh documents. Features like templates, customizable workflows, and secure eSignature capabilities streamline your tax document processes, saving you time and resources.

-

Can I integrate airSlate SignNow with other software for handling 1040wh forms?

Yes, airSlate SignNow offers seamless integrations with various software applications to manage your 1040wh forms efficiently. Connect with popular platforms like CRM systems or accounting software to enhance your document management workflows.

-

What are the benefits of using airSlate SignNow for 1040wh filings?

Using airSlate SignNow for your 1040wh filings provides numerous benefits, including faster processing times, enhanced security, and improved collaboration. Our platform simplifies the eSigning process, making it easier for all parties involved to complete their documents.

-

Is airSlate SignNow secure for signing 1040wh documents?

Absolutely! airSlate SignNow prioritizes security, ensuring that all documents, including 1040wh forms, are signed and stored safely. Our platform complies with industry standards, providing encryption and secure access to protect sensitive information.

-

How does airSlate SignNow improve the efficiency of 1040wh document workflows?

airSlate SignNow enhances the efficiency of 1040wh document workflows by automating tasks and reducing paperwork. Our platform enables you to track the status of signatures in real-time, minimizing delays and ensuring timely submissions.

Get more for Schedule CT 1040WH IF 20170912 indd

Find out other Schedule CT 1040WH IF 20170912 indd

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe