NJsourcedocNDApplication Exemption for Sales Tax PDF Form

Understanding the NJ Urban Enterprise Zone Exempt Purchase Certificate

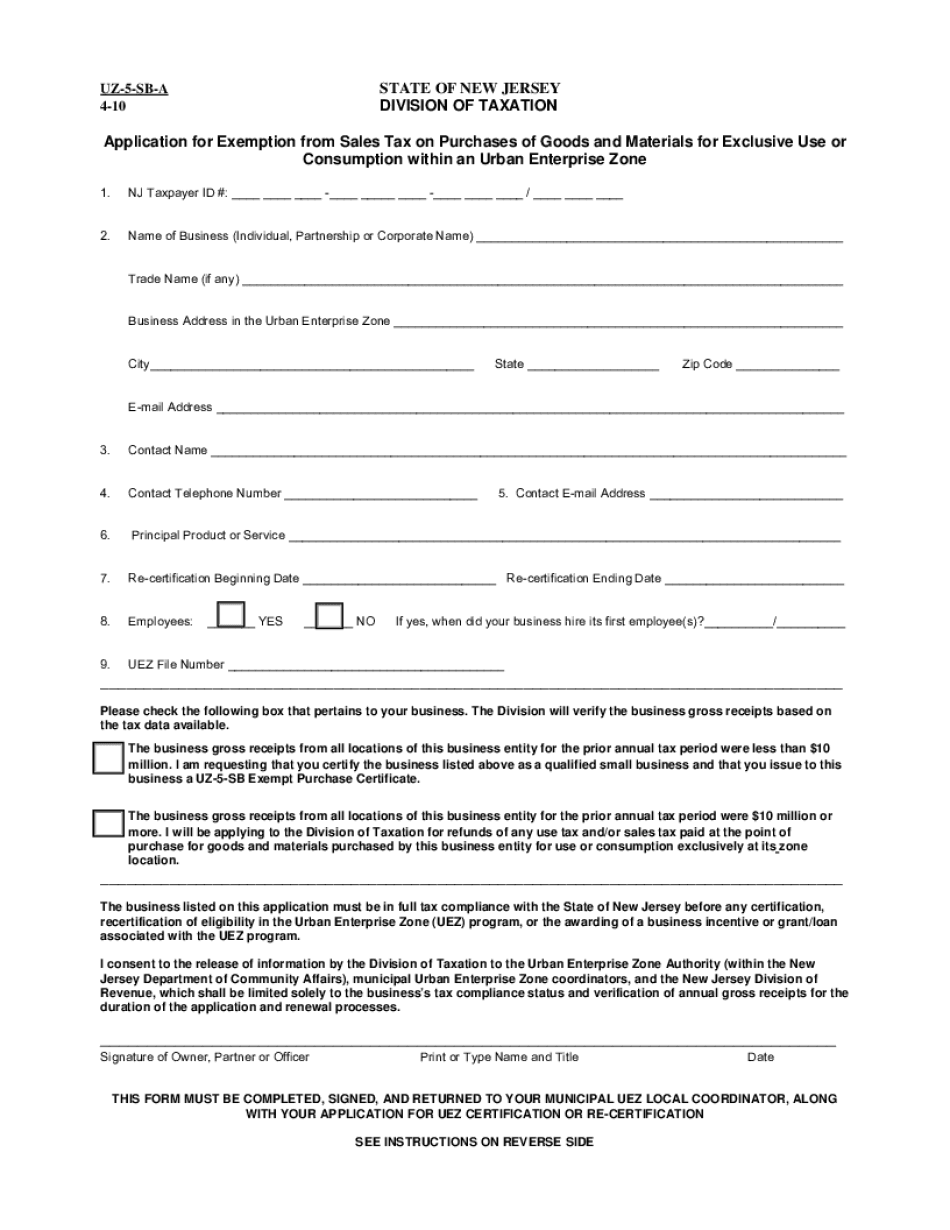

The NJ Urban Enterprise Zone Exempt Purchase Certificate, commonly referred to as the uz 5 certificate exempt sales track workbook, is a crucial document for businesses operating within designated urban enterprise zones. This certificate allows qualified businesses to make tax-exempt purchases on certain goods and services, thereby reducing their overall tax burden. The program aims to stimulate economic growth in urban areas by providing financial incentives to businesses that operate in these zones.

Eligibility Criteria for the NJ Urban Enterprise Zone Exempt Purchase Certificate

To qualify for the uz 5 certificate, businesses must meet specific eligibility criteria established by the New Jersey Division of Taxation. Generally, businesses must be located within an approved urban enterprise zone and must be registered with the state. Additionally, the business must be engaged in eligible activities that contribute to the economic development of the zone. It is essential for business owners to review the detailed requirements to ensure compliance.

Steps to Complete the NJ Urban Enterprise Zone Exempt Purchase Certificate

Completing the uz 5 certificate requires careful attention to detail. The following steps outline the process:

- Obtain the NJ Urban Enterprise Zone Exempt Purchase Certificate form from the New Jersey Division of Taxation.

- Fill out the form with accurate business information, including the business name, address, and tax identification number.

- Provide details about the specific purchases for which the exemption is being claimed.

- Sign and date the form to certify that the information is correct and that the purchases meet the eligibility criteria.

Once completed, the form should be retained for your records and presented to vendors when making tax-exempt purchases.

Legal Use of the NJ Urban Enterprise Zone Exempt Purchase Certificate

The uz 5 certificate must be used in accordance with New Jersey state laws governing tax exemptions. Businesses are responsible for ensuring that the purchases made with this certificate are eligible for tax exemption. Misuse of the certificate can lead to penalties, including back taxes and fines. It is advisable for businesses to maintain thorough records of all transactions made under this exemption to support compliance during audits.

Common Scenarios for Using the NJ Urban Enterprise Zone Exempt Purchase Certificate

Businesses in various sectors can benefit from the uz 5 certificate. Common scenarios include:

- Retail businesses purchasing inventory for resale within the urban enterprise zone.

- Construction companies buying materials for projects located in the designated area.

- Service providers acquiring equipment necessary for operations within the zone.

Understanding these scenarios helps businesses maximize their benefits under the urban enterprise zone program.

Required Documents for NJ Urban Enterprise Zone Exempt Purchase Certificate

To successfully utilize the uz 5 certificate, businesses must have the following documents ready:

- A completed NJ Urban Enterprise Zone Exempt Purchase Certificate form.

- Proof of business registration within an urban enterprise zone.

- Invoices or receipts for purchases made under the exemption.

Having these documents organized can streamline the process of claiming tax exemptions and ensure compliance with state regulations.

Quick guide on how to complete njsourcedocndapplication exemption for sales tax pdf

Effortlessly Prepare NJsourcedocNDApplication Exemption For Sales Tax pdf on Any Device

The management of documents online has become increasingly favored by both businesses and individuals. It offers an excellent environmentally friendly alternative to traditional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to generate, edit, and electronically sign your documents swiftly without delays. Handle NJsourcedocNDApplication Exemption For Sales Tax pdf on any gadget with the airSlate SignNow apps for Android or iOS, and enhance any document-driven process today.

The Easiest Way to Edit and Electronically Sign NJsourcedocNDApplication Exemption For Sales Tax pdf Seamlessly

- Find NJsourcedocNDApplication Exemption For Sales Tax pdf and click on Get Form to begin.

- Make use of the provided tools to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that reason.

- Generate your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require the printing of new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and electronically sign NJsourcedocNDApplication Exemption For Sales Tax pdf and maintain outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the njsourcedocndapplication exemption for sales tax pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 'uz 5 certificate exempt sales track workbook'?

The 'uz 5 certificate exempt sales track workbook' is a specialized tool designed to help businesses manage their exempt sales effectively. This workbook provides a structured format to track exempt sales transactions, ensuring compliance with relevant regulations. Using this workbook can simplify your record-keeping processes and enhance your overall business efficiency.

-

How does the 'uz 5 certificate exempt sales track workbook' benefit my business?

Utilizing the 'uz 5 certificate exempt sales track workbook' can signNowly benefit your business by providing clarity and organization to your exempt sales records. It helps in avoiding costly errors and ensures that you stay compliant with tax regulations. Additionally, it can streamline your audit preparations by keeping all necessary documents in one place.

-

Is the 'uz 5 certificate exempt sales track workbook' easy to use?

Yes, the 'uz 5 certificate exempt sales track workbook' is designed with user-friendliness in mind. Its intuitive layout allows users to input data efficiently, making it accessible even for those with minimal experience in sales tracking. This ease of use enhances productivity and helps you focus on your core business activities.

-

What features are included in the 'uz 5 certificate exempt sales track workbook'?

The 'uz 5 certificate exempt sales track workbook' includes several essential features such as customizable templates, detailed tracking fields for each transaction, and automated calculations. These features allow users to maintain accurate records and generate insightful reports at a glance. Furthermore, it is designed to easily accommodate varying sales scenarios.

-

Can I integrate the 'uz 5 certificate exempt sales track workbook' with other software?

Yes, the 'uz 5 certificate exempt sales track workbook' can be integrated with various accounting and business management software. This integration allows for seamless data transfer, reducing the need for manual entry and minimizing errors. This connectivity enhances your operational efficiency and data accuracy signNowly.

-

What is the pricing structure for the 'uz 5 certificate exempt sales track workbook'?

The pricing structure for the 'uz 5 certificate exempt sales track workbook' is competitive and designed to offer great value for businesses of all sizes. You can choose from various packages depending on the number of users and features needed. This flexibility ensures that you can select an option that best fits your budget while still benefiting from the workbook's functionalities.

-

Is customer support available for the 'uz 5 certificate exempt sales track workbook'?

Absolutely! Customer support for the 'uz 5 certificate exempt sales track workbook' is readily available to assist you with any queries or concerns. The support team is trained to provide guidance on features, integration, and troubleshooting, ensuring that you have a smooth experience while using the workbook. Users often appreciate the responsiveness and expertise of the support staff.

Get more for NJsourcedocNDApplication Exemption For Sales Tax pdf

- 2020 montana individual income tax return form

- Azdorgovformstax credits formscredit for contributions made or fees paid to public schools

- Wwwirsgovirb2020 12irbinternal revenue bulletin 2020 12 irs tax forms

- Form 8796 a rev 9 2021 request for returninformation federalstate tax exchange program state and local government use only

- Fillable form dcac dependent care assistance credits

- Form 1065 schedule k 1

- Developeriloveimgcom docsiloveimg api reference for developers form

- 46113 dual consolidated lossesinternal revenue service form

Find out other NJsourcedocNDApplication Exemption For Sales Tax pdf

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors