Formulario 480 7c 2009

What is the Formulario 480 7c

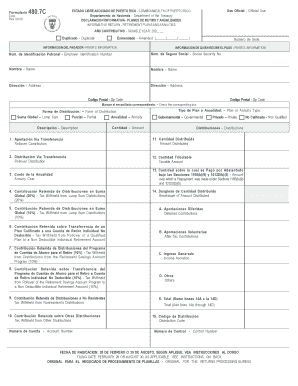

The Formulario 480 7c is a tax form used in Puerto Rico for reporting income and claiming tax credits. This form is specifically designed for individuals and entities that receive certain types of income, such as dividends, interest, and royalties. It serves as a means for taxpayers to report their earnings to the Puerto Rico Department of Treasury, ensuring compliance with local tax laws.

How to obtain the Formulario 480 7c

To obtain the Formulario 480 7c, individuals can visit the official website of the Puerto Rico Department of Treasury. The form is available for download in PDF format, allowing users to print it for completion. Additionally, taxpayers can request the form through local tax offices or by contacting the Department of Treasury directly for assistance.

Steps to complete the Formulario 480 7c

Completing the Formulario 480 7c involves several key steps:

- Gather all necessary documentation, including income statements and any relevant tax documents.

- Fill out the personal information section, ensuring accuracy in names and identification numbers.

- Report all applicable income sources in the designated sections of the form.

- Calculate any applicable tax credits and deductions as outlined in the instructions.

- Review the completed form for accuracy before submission.

Legal use of the Formulario 480 7c

The legal use of the Formulario 480 7c is essential for maintaining compliance with Puerto Rican tax regulations. Taxpayers are required to submit this form to report specific income types and claim eligible tax credits. Failure to accurately complete and submit the form can result in penalties and legal repercussions, emphasizing the importance of understanding its proper use.

Filing Deadlines / Important Dates

Filing deadlines for the Formulario 480 7c can vary based on the taxpayer's specific circumstances. Generally, the form must be submitted by the due date for annual income tax returns. It is crucial for taxpayers to stay informed about any changes in deadlines, which may be announced by the Puerto Rico Department of Treasury, to avoid late penalties.

Key elements of the Formulario 480 7c

Key elements of the Formulario 480 7c include:

- Personal Information: Details such as name, address, and identification numbers.

- Income Reporting: Sections dedicated to different income types, including dividends and interest.

- Tax Credits: Areas to claim eligible credits that can reduce overall tax liability.

- Signature Line: A section for the taxpayer's signature, confirming the accuracy of the information provided.

Quick guide on how to complete formulario 480 7c 397523587

Effortlessly Prepare Formulario 480 7c on Any Device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal environmentally-friendly substitute for conventional printed and signed documents, as it allows you to obtain the proper form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, alter, and eSign your documents swiftly without delays. Manage Formulario 480 7c on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The Easiest Way to Edit and eSign Formulario 480 7c with Ease

- Obtain Formulario 480 7c and hit Get Form to commence.

- Employ the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the information and click on the Done button to finalize your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or errors that require printing new copies. airSlate SignNow fulfills your document management needs in a few clicks from any device you prefer. Modify and eSign Formulario 480 7c and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct formulario 480 7c 397523587

Create this form in 5 minutes!

How to create an eSignature for the formulario 480 7c 397523587

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the formulario 480 7c and how can airSlate SignNow help with it?

The formulario 480 7c is a tax form used in Puerto Rico for reporting income. airSlate SignNow provides a streamlined process for filling out and signing this form digitally, ensuring compliance and ease of use for users.

-

How much does the airSlate SignNow service cost for handling formulario 480 7c?

airSlate SignNow offers flexible pricing plans to accommodate different business needs. You can choose a plan that suits your budget while easily managing and eSigning your formulario 480 7c documents.

-

What features does airSlate SignNow offer for managing formulario 480 7c?

airSlate SignNow features an intuitive document editor, customizable templates, and secure eSigning options, all tailored to facilitate efficient handling of formulario 480 7c. These tools help you create accurate forms and expedite the signing process.

-

Can I integrate airSlate SignNow with other applications for formulario 480 7c?

Yes, airSlate SignNow offers robust integrations with various applications, allowing you to seamlessly handle formulario 480 7c alongside your existing systems. This connectivity enhances productivity and simplifies document workflows.

-

What are the benefits of using airSlate SignNow for formulario 480 7c?

Using airSlate SignNow for formulario 480 7c offers numerous benefits, including time savings, enhanced accuracy, and improved compliance. The digital format allows for quick edits and secure storage, simplifying your reporting process.

-

Is airSlate SignNow secure for handling sensitive information on formulario 480 7c?

Absolutely, airSlate SignNow prioritizes security and employs advanced encryption methods for handling sensitive data, including that found in formulario 480 7c. Your documents are safe and protected during the eSigning process.

-

How do I get started with airSlate SignNow for formulario 480 7c?

Getting started with airSlate SignNow is easy. Simply sign up for an account, create your formulario 480 7c, and invite others to eSign. The platform provides a user-friendly interface to guide you through the process.

Get more for Formulario 480 7c

- Control number de p069 pkg form

- Annual financial check up form

- Control number de p077 pkg form

- Control number dep078 pkg form

- Delaware last will and testamentlegal will formsus

- Control number de p081 pkg form

- Control number de p082 pkg form

- Identity theftnewark de official website city of newark form

Find out other Formulario 480 7c

- eSign Texas Insurance Affidavit Of Heirship Myself

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free