BUSINESS TAX RECEIPT APPLICATION Seminoletax Form

What is the BUSINESS TAX RECEIPT APPLICATION Seminoletax

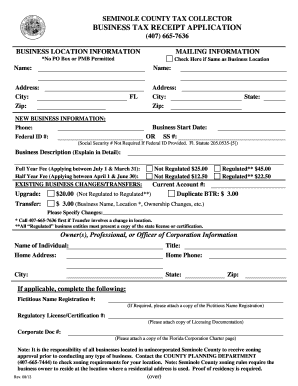

The BUSINESS TAX RECEIPT APPLICATION Seminoletax is a form used by businesses to apply for a tax receipt in Seminole County, Florida. This document is essential for operating legally within the county, as it verifies that a business has met all local tax obligations. The application typically requires details about the business, including its name, address, ownership structure, and nature of operations. Obtaining this receipt is crucial for compliance with local regulations and for establishing credibility with customers and suppliers.

How to obtain the BUSINESS TAX RECEIPT APPLICATION Seminoletax

To obtain the BUSINESS TAX RECEIPT APPLICATION Seminoletax, businesses can visit the Seminole County government website or their local tax office. The application is often available for download in a printable format or can be filled out online. It is important to ensure that all required information is accurate and complete to avoid delays in processing. If assistance is needed, local government offices typically offer support to guide applicants through the process.

Steps to complete the BUSINESS TAX RECEIPT APPLICATION Seminoletax

Completing the BUSINESS TAX RECEIPT APPLICATION Seminoletax involves several key steps:

- Gather necessary information about your business, including its legal name, address, and ownership details.

- Determine the appropriate business classification based on your operations.

- Complete the application form accurately, ensuring all sections are filled out.

- Attach any required documentation, such as proof of identity or business registration.

- Submit the application either online or in person at the designated office.

After submission, it is advisable to keep a copy of the application for your records.

Required Documents

When applying for the BUSINESS TAX RECEIPT APPLICATION Seminoletax, several documents may be required to support your application. Commonly required documents include:

- Proof of business registration, such as a certificate of incorporation or partnership agreement.

- Identification documents for the business owner or authorized representative.

- Any applicable licenses or permits related to your business activities.

It is essential to check with the local tax office for any additional documents that may be specific to your business type.

Legal use of the BUSINESS TAX RECEIPT APPLICATION Seminoletax

The BUSINESS TAX RECEIPT APPLICATION Seminoletax serves a legal purpose by ensuring that businesses comply with local tax laws. This document not only allows businesses to operate legally but also helps local governments track business activities for taxation purposes. Failure to obtain a tax receipt can result in penalties, including fines or the suspension of business operations. Therefore, it is crucial for business owners to understand the legal implications of this application and ensure timely submission.

Eligibility Criteria

Eligibility for the BUSINESS TAX RECEIPT APPLICATION Seminoletax typically includes several criteria that must be met by the applicant. These may include:

- The business must be located within Seminole County.

- The applicant must be the legal owner or an authorized representative of the business.

- The business must comply with all local zoning and operational regulations.

It is advisable to review specific eligibility requirements on the local government’s website or contact the tax office for clarification.

Quick guide on how to complete business tax receipt application seminoletax

Accomplish [SKS] effortlessly on any device

Online document management has become increasingly favored among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and store it securely online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without any delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and electronically sign [SKS] with ease

- Find [SKS] and then click Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your electronic signature using the Sign tool, which takes seconds and carries the same legal authority as a conventional handwritten signature.

- Review the information and then click on the Done button to save your changes.

- Choose your delivery method for your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or mistakes that require new document copies to be printed. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign [SKS] and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to BUSINESS TAX RECEIPT APPLICATION Seminoletax

Create this form in 5 minutes!

How to create an eSignature for the business tax receipt application seminoletax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the BUSINESS TAX RECEIPT APPLICATION Seminoletax?

The BUSINESS TAX RECEIPT APPLICATION Seminoletax is a streamlined digital tool that allows businesses to efficiently apply for, manage, and renew their business tax receipts. It simplifies the application process, making it easier to comply with local regulations. This application is designed for ease of use, helping businesses save time and resources.

-

How does the BUSINESS TAX RECEIPT APPLICATION Seminoletax work?

To use the BUSINESS TAX RECEIPT APPLICATION Seminoletax, simply create an account, fill out the required application forms, and submit them electronically. The application provides guidance throughout the process, ensuring all necessary information is included. Once submitted, you'll receive updates on your application's status directly through the platform.

-

What are the pricing options for the BUSINESS TAX RECEIPT APPLICATION Seminoletax?

Pricing for the BUSINESS TAX RECEIPT APPLICATION Seminoletax varies depending on the complexity of your business needs. We offer several plans to cater to different business sizes and requirements. For detailed pricing, it’s best to visit our website or contact our support team for personalized assistance.

-

What features does the BUSINESS TAX RECEIPT APPLICATION Seminoletax offer?

The BUSINESS TAX RECEIPT APPLICATION Seminoletax includes features such as easy online application submission, document tracking, and electronic signatures through airSlate SignNow. It's designed to be user-friendly, providing a seamless experience. Additionally, users can manage their applications and renewals all in one place.

-

How does the BUSINESS TAX RECEIPT APPLICATION Seminoletax benefit businesses?

The BUSINESS TAX RECEIPT APPLICATION Seminoletax benefits businesses by streamlining the application process and ensuring compliance with local tax regulations. This not only saves time but also reduces the likelihood of errors that could lead to penalties. By using this application, businesses can focus more on their core operations rather than getting bogged down in paperwork.

-

Is the BUSINESS TAX RECEIPT APPLICATION Seminoletax compatible with other software?

Yes, the BUSINESS TAX RECEIPT APPLICATION Seminoletax integrates seamlessly with various accounting and management software, enhancing your workflow. This compatibility allows for easy data transfers and reduces the need for duplicate work. Leveraging these integrations can help ensure your business remains organized and efficient.

-

What support is available for the BUSINESS TAX RECEIPT APPLICATION Seminoletax users?

Users of the BUSINESS TAX RECEIPT APPLICATION Seminoletax have access to dedicated customer support through multiple channels, including chat, email, and phone. Our knowledgeable support team is ready to assist with any queries or issues that may arise during the application process. We also provide a comprehensive FAQ section and user guides on our website to help you get started.

Get more for BUSINESS TAX RECEIPT APPLICATION Seminoletax

- Child support order summary form ada county

- Alabama statement of economic interest form

- Wiley ifrs practical implementation guide and workbook 3rd edition pdf form

- American red cross authorized provider form

- Thank you speech for award form

- Epass illinois login form

- Plaintiff unlawful detainer trial brief form

- Team ambassador information form march of dimes

Find out other BUSINESS TAX RECEIPT APPLICATION Seminoletax

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself