Form RP 6704 C2718Joint Statement of School Tax Levy for the 2017

What is the Form RP 6704 C2718 Joint Statement Of School Tax Levy For The

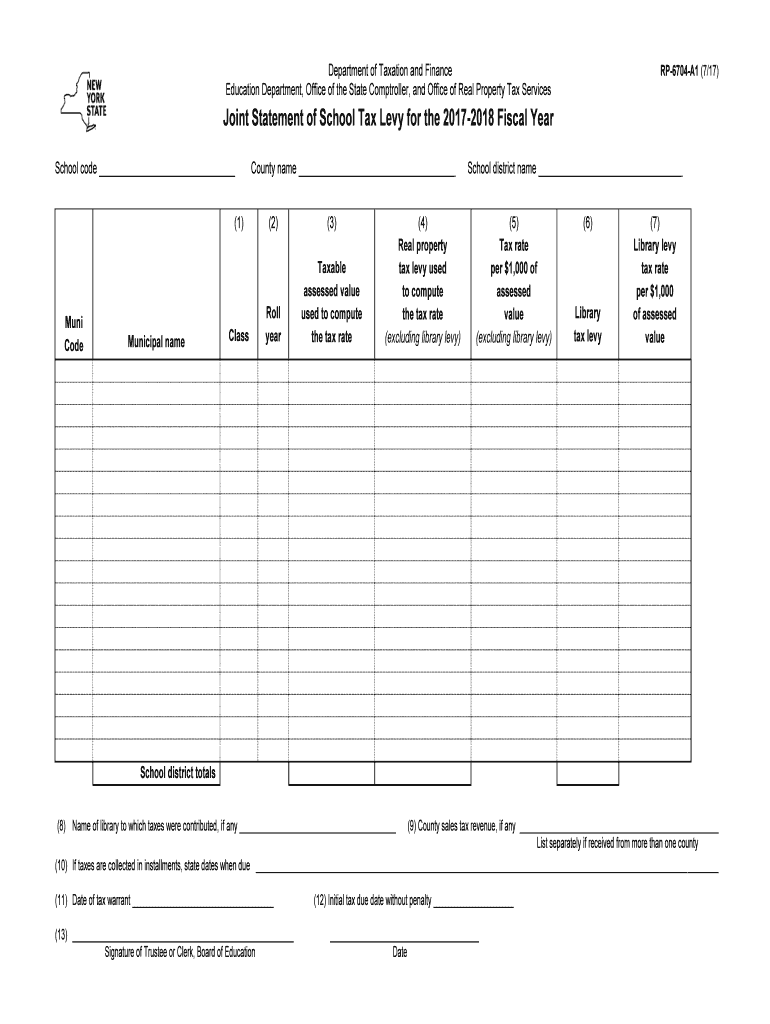

The Form RP 6704 C2718 Joint Statement Of School Tax Levy is a crucial document used in the United States for reporting school tax levies. This form is typically completed by local school districts and is essential for ensuring transparency in how tax revenues are allocated for educational purposes. It provides a detailed account of the tax levies imposed, which helps in maintaining accurate records for both taxpayers and educational institutions.

Steps to Complete the Form RP 6704 C2718 Joint Statement Of School Tax Levy For The

Completing the Form RP 6704 C2718 involves several key steps to ensure accuracy and compliance. First, gather all necessary information regarding the school tax levy, including the amounts and relevant dates. Next, fill out the form by entering the required data into the designated fields. It is important to review the information for any errors before submission. Once completed, the form must be signed and dated to validate the submission. Finally, ensure that the form is submitted by the appropriate deadline to avoid any penalties.

How to Obtain the Form RP 6704 C2718 Joint Statement Of School Tax Levy For The

The Form RP 6704 C2718 can be obtained through various channels. Typically, local school district offices provide physical copies of the form. Additionally, it may be available on official state or educational websites. For convenience, many users opt to download the form online, where it can be filled out digitally. Ensure that you are using the most current version of the form to comply with any recent updates or changes in regulations.

Legal Use of the Form RP 6704 C2718 Joint Statement Of School Tax Levy For The

The legal use of the Form RP 6704 C2718 is governed by state and federal regulations regarding tax reporting and school funding. This form must be completed accurately to reflect the true financial obligations of taxpayers towards school levies. Misrepresentation or failure to submit the form can lead to legal repercussions, including fines or audits. It is essential for individuals and school districts to understand the legal implications of the information provided on this form.

Key Elements of the Form RP 6704 C2718 Joint Statement Of School Tax Levy For The

Key elements of the Form RP 6704 C2718 include sections for identifying the school district, the specific tax levy amounts, and the purpose of the levies. Additionally, the form requires signatures from authorized representatives of the school district, ensuring accountability. Each section is designed to capture essential data that supports the overall financial integrity of the school funding process.

Filing Deadlines / Important Dates

Filing deadlines for the Form RP 6704 C2718 vary by state and local jurisdiction. It is important to be aware of these deadlines to ensure timely submission. Generally, forms must be filed annually, and specific dates may be set by local school boards or state education departments. Missing these deadlines can result in penalties or delays in funding, making it crucial for taxpayers and school districts to stay informed about important dates.

Quick guide on how to complete form rp 6704 c2718joint statement of school tax levy for the

Your assistance manual on how to prepare your Form RP 6704 C2718Joint Statement Of School Tax Levy For The

If you’re wondering how to finalize and dispatch your Form RP 6704 C2718Joint Statement Of School Tax Levy For The, here are some brief instructions on how to streamline tax filing.

To initiate, you simply need to sign up for your airSlate SignNow account to transform how you handle documents online. airSlate SignNow is an extremely user-friendly and powerful document solution that enables you to alter, draft, and finalize your income tax documents effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures, and revisit to modify entries as necessary. Enhance your tax management with sophisticated PDF editing, eSigning, and convenient sharing options.

Adhere to the steps below to complete your Form RP 6704 C2718Joint Statement Of School Tax Levy For The in just a few minutes:

- Create your account and begin handling PDFs in minutes.

- Utilize our directory to locate any IRS tax form; browse through variations and schedules.

- Click Get form to access your Form RP 6704 C2718Joint Statement Of School Tax Levy For The in our editor.

- Complete the necessary fillable fields with your details (text, numbers, checkmarks).

- Employ the Sign Tool to insert your legally-recognized eSignature (if needed).

- Examine your document and correct any discrepancies.

- Save changes, print your version, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Please remember that submitting in written form can increase return errors and delay refunds. Naturally, prior to e-filing your taxes, verify the IRS website for submission regulations in your area.

Create this form in 5 minutes or less

Find and fill out the correct form rp 6704 c2718joint statement of school tax levy for the

FAQs

-

The company I work for is taking taxes out of my paycheck but has not asked me to complete any paperwork or fill out any forms since day one. How are they paying taxes without my SSN?

WHOA! You may have a BIG problem. When you started, are you certain you did not fill in a W-4 form? Are you certain that your employer doesn’t have your SS#? If that’s the case, I would be alarmed. Do you have paycheck stubs showing how they calculated your withholding? ( BTW you are entitled to those under the law, and if you are not receiving them, I would demand them….)If your employer is just giving you random checks with no calculation of your wages and withholdings, you have a rogue employer. They probably aren’t payin in what they purport to withhold from you.

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

Create this form in 5 minutes!

How to create an eSignature for the form rp 6704 c2718joint statement of school tax levy for the

How to generate an electronic signature for the Form Rp 6704 C2718joint Statement Of School Tax Levy For The in the online mode

How to make an eSignature for the Form Rp 6704 C2718joint Statement Of School Tax Levy For The in Chrome

How to create an eSignature for signing the Form Rp 6704 C2718joint Statement Of School Tax Levy For The in Gmail

How to create an electronic signature for the Form Rp 6704 C2718joint Statement Of School Tax Levy For The right from your mobile device

How to make an electronic signature for the Form Rp 6704 C2718joint Statement Of School Tax Levy For The on iOS

How to make an eSignature for the Form Rp 6704 C2718joint Statement Of School Tax Levy For The on Android

People also ask

-

What is the Form RP 6704 C2718 Joint Statement Of School Tax Levy For The?

The Form RP 6704 C2718 Joint Statement Of School Tax Levy For The is a document used by school districts to report and signNow their tax levy. It is essential for ensuring that the correct funding is allocated for educational institutions. Completing this form accurately is crucial for compliance with local regulations.

-

How can airSlate SignNow help me with the Form RP 6704 C2718 Joint Statement Of School Tax Levy For The?

airSlate SignNow provides an easy-to-use platform for eSigning and sending the Form RP 6704 C2718 Joint Statement Of School Tax Levy For The. With our solution, you can automate document workflows, ensuring timely submissions and compliance. You'll improve efficiency and reduce errors in your tax levy documentation.

-

Is there a cost associated with using airSlate SignNow for the Form RP 6704 C2718 Joint Statement Of School Tax Levy For The?

Yes, airSlate SignNow offers a variety of pricing plans based on your organization's needs. These plans are designed to be cost-effective while providing all the essential features for managing documents like the Form RP 6704 C2718 Joint Statement Of School Tax Levy For The. You can select a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the Form RP 6704 C2718 Joint Statement Of School Tax Levy For The?

airSlate SignNow offers features such as intuitive eSigning, templates for the Form RP 6704 C2718 Joint Statement Of School Tax Levy For The, automated reminders, and tracking for document status. These features streamline the process and ensure that all parties are properly informed on the progress of the tax levy statement submission.

-

Can I integrate airSlate SignNow with other tools I use for the Form RP 6704 C2718 Joint Statement Of School Tax Levy For The?

Absolutely! airSlate SignNow offers integrations with various tools and platforms, enhancing your workflow efficiency when dealing with the Form RP 6704 C2718 Joint Statement Of School Tax Levy For The. You can easily connect with CRM systems, cloud storage services, and more to simplify documentation management.

-

What are the benefits of using airSlate SignNow for the Form RP 6704 C2718 Joint Statement Of School Tax Levy For The?

Using airSlate SignNow for the Form RP 6704 C2718 Joint Statement Of School Tax Levy For The offers numerous benefits, including time-saving eSigning, enhanced security features, and easy access through any device. Our platform helps you streamline your tax levy processes and ensures you remain compliant with local regulations.

-

How secure is airSlate SignNow when processing the Form RP 6704 C2718 Joint Statement Of School Tax Levy For The?

airSlate SignNow prioritizes security and compliance, employing advanced encryption and authentication measures. When processing the Form RP 6704 C2718 Joint Statement Of School Tax Levy For The, your sensitive data is protected at all times. Feel confident knowing that your documents are secure with us.

Get more for Form RP 6704 C2718Joint Statement Of School Tax Levy For The

Find out other Form RP 6704 C2718Joint Statement Of School Tax Levy For The

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy