Form 1120 for Calendar Year or Tax Year Beginning , , Ending , 19

Understanding Form 1120 for Calendar Year or Tax Year

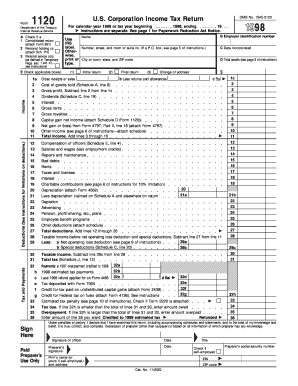

Form 1120 is the U.S. Corporation Income Tax Return, used by corporations to report their income, gains, losses, deductions, and credits. This form is essential for corporations operating on a calendar year or a specific tax year. It provides the IRS with a comprehensive overview of a corporation's financial activities during the year, ensuring compliance with federal tax regulations. Understanding the purpose and requirements of Form 1120 is crucial for corporations to maintain proper tax records and avoid penalties.

Steps to Complete Form 1120

Completing Form 1120 involves several key steps. First, gather all necessary financial documents, including income statements, balance sheets, and records of deductions. Next, fill out the form by entering your corporation's identifying information, such as the name, address, and employer identification number (EIN). Then, report your corporation's income and expenses in the appropriate sections, ensuring accuracy in calculations. Finally, review the form for completeness and correctness before submission.

Filing Deadlines and Important Dates

Corporations must adhere to specific deadlines when filing Form 1120. Generally, the form is due on the fifteenth day of the fourth month following the end of the corporation's tax year. For calendar year filers, this means the deadline is April 15. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. Understanding these deadlines is vital to avoid late fees and penalties.

Obtaining Form 1120

Form 1120 can be obtained directly from the IRS website or through authorized tax preparation software. The form is available in a downloadable format, allowing corporations to print and complete it manually. Additionally, many tax professionals can assist in obtaining and filing the form, ensuring that all necessary information is accurately reported.

Key Elements of Form 1120

Form 1120 consists of several key sections that require detailed information. These include the corporation's income, deductions, tax credits, and tax computation. Important elements include the total income, cost of goods sold, and various deductions that can significantly impact the corporation's taxable income. Accurate reporting of these elements is essential for compliance and to minimize tax liability.

Legal Use of Form 1120

Form 1120 serves a legal purpose by ensuring that corporations report their income and pay the appropriate taxes. Filing this form is a legal requirement under U.S. tax law for all corporations, including C corporations. Failure to file or inaccuracies in the form can lead to legal repercussions, including fines and audits by the IRS. Understanding the legal implications of Form 1120 is crucial for corporate compliance.

Quick guide on how to complete form 1120 for calendar year or tax year beginning ending 19

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained traction among organizations and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The Easiest Method to Edit and Electronically Sign [SKS] with Ease

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing additional document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Edit and electronically sign [SKS] and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 1120 For Calendar Year Or Tax Year Beginning , , Ending , 19

Create this form in 5 minutes!

How to create an eSignature for the form 1120 for calendar year or tax year beginning ending 19

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 1120 For Calendar Year Or Tax Year Beginning , , Ending , 19?

Form 1120 is the U.S. Income Tax Return for Corporations, which includes details about a corporation's income, gains, losses, deductions, and credits. Understanding how to complete Form 1120 for Calendar Year Or Tax Year Beginning , , Ending , 19 is essential for accurate tax reporting and compliance.

-

How can airSlate SignNow assist with Form 1120 For Calendar Year Or Tax Year Beginning , , Ending , 19?

airSlate SignNow provides an efficient platform for businesses to send and electronically sign Form 1120 for Calendar Year Or Tax Year Beginning , , Ending , 19. Our easy-to-use interface streamlines document management, ensuring that your tax forms are signed and submitted promptly.

-

What are the pricing options for using airSlate SignNow for Form 1120?

airSlate SignNow offers flexible pricing plans that cater to different business sizes and needs. You can choose a plan that fits your budget while ensuring effective management of documents, including the timely processing of Form 1120 for Calendar Year Or Tax Year Beginning , , Ending , 19.

-

What features does airSlate SignNow offer for managing Form 1120 documents?

With airSlate SignNow, you can easily create, send, and track documents, including Form 1120 for Calendar Year Or Tax Year Beginning , , Ending , 19. Features like real-time notifications and advanced security options ensure your documents are managed safely and efficiently.

-

Are there integrations available for airSlate SignNow with other platforms?

Yes, airSlate SignNow seamlessly integrates with various accounting and productivity platforms. This makes it easier to manage Form 1120 for Calendar Year Or Tax Year Beginning , , Ending , 19 alongside your existing workflows and systems.

-

What benefits can businesses expect from using airSlate SignNow for tax forms?

Businesses can expect faster processing times, reduced paperwork, and enhanced security when using airSlate SignNow to manage forms like Form 1120 for Calendar Year Or Tax Year Beginning , , Ending , 19. This leads to improved efficiency and compliance with tax requirements.

-

How does airSlate SignNow ensure security for documents like Form 1120?

airSlate SignNow prioritizes document security with robust encryption, secure signatures, and compliant storage solutions. When handling Form 1120 for Calendar Year Or Tax Year Beginning , , Ending , 19, you can trust that your sensitive information is protected.

Get more for Form 1120 For Calendar Year Or Tax Year Beginning , , Ending , 19

- Instructions for completing the restated articles of organization form

- Texas irp apportioned registration application form

- Licensee nameaddress change request form

- Pers 282 pdf texas department of criminal justice form

- Building code enforcement addressname form

- Haz holdings inc annual report form10

- Reference check form vcu department of human resources hr vcu

- Dah clearance form

Find out other Form 1120 For Calendar Year Or Tax Year Beginning , , Ending , 19

- Electronic signature Connecticut Award Nomination Form Fast

- eSignature South Dakota Apartment lease agreement template Free

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy

- How Do I eSignature Idaho Landlord tenant lease agreement

- eSignature Washington Landlord tenant lease agreement Free

- eSignature Wisconsin Landlord tenant lease agreement Online

- eSignature Wyoming Landlord tenant lease agreement Online

- How Can I eSignature Oregon lease agreement

- eSignature Washington Lease agreement form Easy

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement