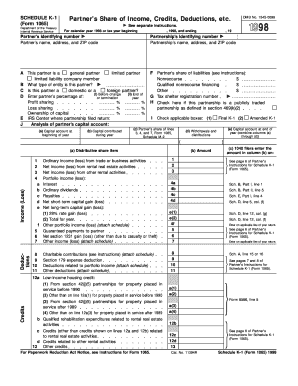

SCHEDULE K 1 Form 1065 Department of the Treasury Internal Revenue Service Partner S Share of Income, Credits, Deductions, Etc

What is the SCHEDULE K-1 Form 1065?

The SCHEDULE K-1 Form 1065 is a tax document used by partnerships to report each partner's share of income, credits, deductions, and other tax-related information. This form is issued by the Department of the Treasury Internal Revenue Service and is essential for partners to accurately report their earnings on their individual tax returns. Each partner receives a K-1 that details their specific share of the partnership's income, losses, and other tax attributes.

How to Use the SCHEDULE K-1 Form 1065

To effectively use the SCHEDULE K-1 Form 1065, partners should first review the information provided on the form. This includes details such as the partner's share of income, deductions, and credits. Partners must then transfer this information to their individual tax returns, typically on Form 1040. It is important to ensure that all amounts are accurately reported to avoid discrepancies with the IRS.

Steps to Complete the SCHEDULE K-1 Form 1065

Completing the SCHEDULE K-1 Form 1065 involves several key steps:

- Gather all necessary financial information related to the partnership.

- Fill out the partner's identifying information, including name, address, and taxpayer identification number.

- Report the partner's share of income, deductions, and credits as outlined in the partnership agreement.

- Ensure all calculations are accurate and reflect the partnership's financial activities for the tax year.

- Distribute copies of the completed K-1 to each partner by the required deadline.

Key Elements of the SCHEDULE K-1 Form 1065

The SCHEDULE K-1 Form 1065 includes several key elements that are crucial for accurate reporting:

- Partner Information: This section includes the partner's name, address, and taxpayer identification number.

- Partnership Information: Details about the partnership, including its name and EIN (Employer Identification Number).

- Income and Deductions: A breakdown of the partner's share of the partnership's income, losses, and deductions.

- Credits: Any tax credits that the partner is entitled to based on their share of the partnership.

IRS Guidelines for the SCHEDULE K-1 Form 1065

The IRS provides specific guidelines for the use and submission of the SCHEDULE K-1 Form 1065. Partnerships must ensure that the form is completed accurately and submitted by the deadline to avoid penalties. The IRS requires that all partners receive their K-1 forms by the due date of the partnership's tax return, which is typically March 15 for calendar year partnerships. Partners should keep a copy of the K-1 for their records and ensure that the information is correctly reported on their individual tax returns.

Penalties for Non-Compliance with the SCHEDULE K-1 Form 1065

Failure to comply with the requirements of the SCHEDULE K-1 Form 1065 can result in significant penalties for both the partnership and individual partners. The IRS may impose fines for late filing or inaccuracies on the form. Additionally, partners may face challenges during audits if the information reported does not align with the partnership's filings. It is essential for partnerships to maintain accurate records and ensure timely distribution of K-1 forms to mitigate these risks.

Quick guide on how to complete schedule k 1 form 1065 department of the treasury internal revenue service partner s share of income credits deductions etc

Accomplish [SKS] effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any platform utilizing airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The simplest way to modify and eSign [SKS] with ease

- Locate [SKS] and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or conceal sensitive data with the tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review the details and then click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, laborious form hunting, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Modify and eSign [SKS] to ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to SCHEDULE K 1 Form 1065 Department Of The Treasury Internal Revenue Service Partner S Share Of Income, Credits, Deductions, Etc

Create this form in 5 minutes!

How to create an eSignature for the schedule k 1 form 1065 department of the treasury internal revenue service partner s share of income credits deductions etc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the SCHEDULE K 1 Form 1065 Department Of The Treasury Internal Revenue Service Partner S Share Of Income, Credits, Deductions, Etc.?

The SCHEDULE K 1 Form 1065 is a tax document used by partnerships to report each partner's share of income, deductions, and credits. This form is essential for accurate tax reporting and helps partners understand their tax obligations based on their partnership income.

-

How does airSlate SignNow facilitate the completion of the SCHEDULE K 1 Form 1065?

airSlate SignNow provides a streamlined platform that allows users to easily fill out, sign, and send the SCHEDULE K 1 Form 1065. With intuitive templates and automated workflows, businesses can ensure that all necessary information is correctly filled out, reducing errors and saving time.

-

What features does airSlate SignNow offer for managing the SCHEDULE K 1 Form 1065?

airSlate SignNow offers features like eSigning, secure document storage, and customizable templates for the SCHEDULE K 1 Form 1065. These tools enhance collaboration among partners, ensuring everyone can access, edit, and finalize the form efficiently.

-

Is there a cost associated with using airSlate SignNow for the SCHEDULE K 1 Form 1065?

AirSlate SignNow offers various pricing plans, allowing businesses to choose a solution that fits their budget while managing the SCHEDULE K 1 Form 1065. More cost-effective solutions are available for small businesses that need to simplify their document management without compromising on quality.

-

Can I integrate airSlate SignNow with other software for handling the SCHEDULE K 1 Form 1065?

Yes, airSlate SignNow seamlessly integrates with various tools and software such as accounting programs and CRMs to streamline the process of managing the SCHEDULE K 1 Form 1065. This integration allows users to automate data entry and enhance efficiency.

-

What are the benefits of using airSlate SignNow for the SCHEDULE K 1 Form 1065?

Using airSlate SignNow for the SCHEDULE K 1 Form 1065 ensures a fast, efficient, and secure method of document management. Users benefit from electronic signatures, reducing turnaround time, and enhanced security features that protect sensitive financial information.

-

How secure is the information submitted in the SCHEDULE K 1 Form 1065 when using airSlate SignNow?

AirSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your data when submitting the SCHEDULE K 1 Form 1065. This guarantees that sensitive information regarding income, credits, and deductions remains confidential and secure.

Get more for SCHEDULE K 1 Form 1065 Department Of The Treasury Internal Revenue Service Partner S Share Of Income, Credits, Deductions, Etc

- Sipt test pdf form

- Interstate agreement on detainers forms 1232228

- No interest letter for motor vehicle form

- Revocation of power of attorney form pdf california

- Bank statement bd form

- 2307 bir form

- Certification form for induced abortion or induced miscarriage i certify that on the basis of physician s name my professional

- Department of taxation application for transient vendoramp039s form

Find out other SCHEDULE K 1 Form 1065 Department Of The Treasury Internal Revenue Service Partner S Share Of Income, Credits, Deductions, Etc

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile