NEVADA BANK & TRUST CONSUMER LOAN APPLICATION Form

What is the NEVADA BANK & TRUST CONSUMER LOAN APPLICATION

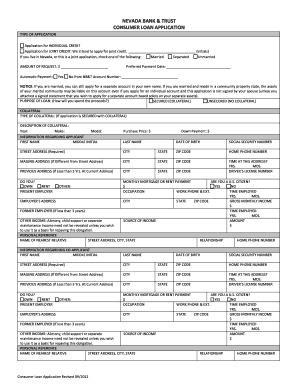

The NEVADA BANK & TRUST CONSUMER LOAN APPLICATION is a formal document used by individuals seeking to apply for a consumer loan from Nevada Bank & Trust. This application collects essential information about the applicant's financial status, employment history, and personal details to assess their eligibility for a loan. It serves as the primary tool for initiating the loan approval process, allowing the bank to evaluate the creditworthiness of potential borrowers.

Key elements of the NEVADA BANK & TRUST CONSUMER LOAN APPLICATION

This application includes several critical components necessary for processing a loan request. Key elements typically consist of:

- Personal Information: Name, address, Social Security number, and contact details.

- Employment Details: Current employer, job title, and income information.

- Financial Information: Monthly expenses, existing debts, and assets.

- Loan Details: Desired loan amount, purpose of the loan, and repayment terms.

Providing accurate and complete information in these sections is crucial for a smooth application process.

Steps to complete the NEVADA BANK & TRUST CONSUMER LOAN APPLICATION

Completing the NEVADA BANK & TRUST CONSUMER LOAN APPLICATION involves several straightforward steps:

- Gather Documentation: Collect necessary documents such as proof of income, identification, and credit history.

- Fill Out the Application: Provide all required information accurately in the application form.

- Review Your Application: Double-check all entries to ensure accuracy and completeness.

- Submit the Application: Send the completed application to Nevada Bank & Trust through the preferred submission method.

Following these steps can help facilitate a timely review and approval of your loan application.

Eligibility Criteria

To qualify for a loan through the NEVADA BANK & TRUST CONSUMER LOAN APPLICATION, applicants must meet specific eligibility criteria. Common requirements include:

- Being at least eighteen years old.

- Having a steady source of income.

- Maintaining a satisfactory credit history.

- Providing valid identification and residency proof.

Understanding these criteria can help applicants prepare effectively before submitting their application.

Application Process & Approval Time

The application process for the NEVADA BANK & TRUST CONSUMER LOAN APPLICATION typically involves several stages:

- Submission: After completing the form, it is submitted for review.

- Review: The bank evaluates the application based on the provided information and creditworthiness.

- Approval: If approved, the applicant receives a notification detailing the loan terms.

- Funding: Upon acceptance of the loan terms, funds are disbursed to the applicant.

The approval time can vary based on the bank's processing speed and the completeness of the application, typically ranging from a few days to a couple of weeks.

How to use the NEVADA BANK & TRUST CONSUMER LOAN APPLICATION

Using the NEVADA BANK & TRUST CONSUMER LOAN APPLICATION is a straightforward process. Applicants should begin by accessing the application form, which can often be found on the bank's official website or obtained directly from a branch. Once the form is in hand, applicants should:

- Read all instructions carefully to understand the requirements.

- Fill in the form with accurate and truthful information.

- Attach any required documentation to support the application.

- Submit the application through the designated method, whether online, by mail, or in person.

Following these guidelines ensures that the application is completed effectively and increases the chances of approval.

Quick guide on how to complete nevada bank amp trust consumer loan application

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to access the required form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications, and streamline any document-related process today.

How to Modify and eSign [SKS] with Ease

- Locate [SKS] and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Craft your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, SMS, invitation link, or download to your computer.

Eliminate concerns over lost or disorganized documents, tedious form hunts, or mistakes that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Modify and eSign [SKS] and ensure excellent communication throughout the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to NEVADA BANK & TRUST CONSUMER LOAN APPLICATION

Create this form in 5 minutes!

How to create an eSignature for the nevada bank amp trust consumer loan application

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the NEVADA BANK & TRUST CONSUMER LOAN APPLICATION process?

The NEVADA BANK & TRUST CONSUMER LOAN APPLICATION process is designed to be straightforward and user-friendly. Applicants can fill out the necessary forms online, ensuring a faster turnaround time for approval. After submitting the application, you can track its status directly from your airSlate SignNow account.

-

What documents are required for the NEVADA BANK & TRUST CONSUMER LOAN APPLICATION?

For the NEVADA BANK & TRUST CONSUMER LOAN APPLICATION, you'll typically need to provide proof of income, personal identification, and details regarding your financial history. Specific requirements may vary, so we recommend checking with Nevada Bank & Trust for the latest documentation needs. This ensures you have everything ready for a smooth application process.

-

How long does it take to receive approval for the NEVADA BANK & TRUST CONSUMER LOAN APPLICATION?

Approval times for the NEVADA BANK & TRUST CONSUMER LOAN APPLICATION can vary based on individual circumstances. Generally, you can expect a decision within a few business days. Factors affecting this timeline include the completeness of your application and verification of submitted documents.

-

Are there any fees associated with the NEVADA BANK & TRUST CONSUMER LOAN APPLICATION?

Yes, there may be fees associated with the NEVADA BANK & TRUST CONSUMER LOAN APPLICATION, including application processing fees and possible service charges. It’s essential to review the specific terms and conditions provided by Nevada Bank & Trust to understand any associated costs before applying. Transparency in pricing helps you make an informed decision.

-

What are the benefits of using airSlate SignNow for the NEVADA BANK & TRUST CONSUMER LOAN APPLICATION?

Using airSlate SignNow for the NEVADA BANK & TRUST CONSUMER LOAN APPLICATION provides a streamlined eSigning experience. Our platform enhances efficiency by allowing you to complete applications electronically, making the review process faster. Additionally, the user-friendly interface ensures that both applicants and institutions can manage their documents effortlessly.

-

Can I access my NEVADA BANK & TRUST CONSUMER LOAN APPLICATION on mobile devices?

Yes, airSlate SignNow supports mobile accessibility for the NEVADA BANK & TRUST CONSUMER LOAN APPLICATION. You can complete and eSign your application from any smartphone or tablet, allowing for convenience and flexibility. This means you can manage your financial documents on-the-go without hassle.

-

Is the NEVADA BANK & TRUST CONSUMER LOAN APPLICATION secure?

Absolutely! The NEVADA BANK & TRUST CONSUMER LOAN APPLICATION process through airSlate SignNow is designed with security in mind. We utilize encryption and other advanced security measures to protect sensitive information, ensuring that your personal data remains safe throughout the application process.

Get more for NEVADA BANK & TRUST CONSUMER LOAN APPLICATION

Find out other NEVADA BANK & TRUST CONSUMER LOAN APPLICATION

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation