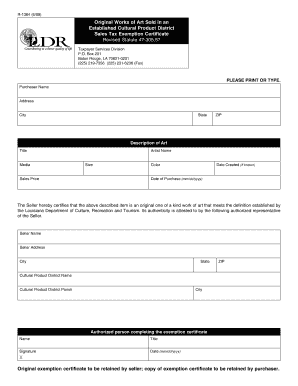

Original Works of Art Sold in an Established Cultural Product District Sales Tax Exemption Certificate Revised Statute 47305 Rev Form

Understanding the Sales Tax Exemption Certificate

The Original Works Of Art Sold In An Established Cultural Product District Sales Tax Exemption Certificate, as outlined in Revised Statute 47305 in Louisiana, is a specific document that allows for the exemption of sales tax on original works of art sold within designated cultural districts. This statute is designed to promote the arts and support local artists by reducing the financial burden associated with sales tax on their creations. The certificate is applicable to original works of art, which include paintings, sculptures, and other artistic expressions that are sold in these cultural districts.

How to Obtain the Sales Tax Exemption Certificate

To obtain the Original Works Of Art Sold In An Established Cultural Product District Sales Tax Exemption Certificate, individuals or businesses must first ensure they are located within an established cultural product district in Louisiana. The process typically involves contacting the local tax authority or cultural district office to request the certificate. Applicants may need to provide documentation that verifies their status as an artist or a business selling original works of art. It is important to keep in mind that the certificate is specific to the cultural district and may not be valid outside of this designated area.

Steps to Complete the Exemption Certificate

Completing the Original Works Of Art Sold In An Established Cultural Product District Sales Tax Exemption Certificate involves several key steps:

- Verify eligibility by confirming the location within a cultural product district.

- Gather necessary documentation, including proof of art sales and artist status.

- Obtain the exemption certificate form from the local tax authority.

- Fill out the form accurately, ensuring all required fields are completed.

- Submit the completed form to the appropriate tax authority for processing.

Legal Use of the Exemption Certificate

The Original Works Of Art Sold In An Established Cultural Product District Sales Tax Exemption Certificate is legally binding and must be used in accordance with Louisiana tax laws. It is essential for artists and sellers to understand that misuse of the certificate, such as applying it to non-qualifying items or outside the designated district, can result in penalties. The certificate serves as proof that the seller is entitled to the sales tax exemption and should be kept on file for audit purposes.

Eligibility Criteria for the Exemption Certificate

To qualify for the Original Works Of Art Sold In An Established Cultural Product District Sales Tax Exemption Certificate, applicants must meet specific eligibility criteria. These include:

- Being an artist or a business that sells original works of art.

- Operating within a designated cultural product district in Louisiana.

- Providing documentation that verifies the nature of the artwork and the sales process.

Examples of Using the Exemption Certificate

Practical examples of using the Original Works Of Art Sold In An Established Cultural Product District Sales Tax Exemption Certificate include:

- An artist selling paintings at a gallery located within a cultural district can use the certificate to exempt sales tax on those transactions.

- A local art fair featuring multiple artists can facilitate the use of the exemption certificate for all sales made during the event, provided it is held within the cultural district.

Quick guide on how to complete original works of art sold in an established cultural product district sales tax exemption certificate revised statute 47305

Complete [SKS] effortlessly on any device

Digital document management has gained traction with businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without complications. Manage [SKS] on any platform using the airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

The easiest way to alter and eSign [SKS] without any hassle

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools provided to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and eSign [SKS] and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the original works of art sold in an established cultural product district sales tax exemption certificate revised statute 47305

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the Original Works Of Art Sold In An Established Cultural Product District Sales Tax Exemption Certificate Revised Statute 47305 Revenue Louisiana?

The Original Works Of Art Sold In An Established Cultural Product District Sales Tax Exemption Certificate Revised Statute 47305 Revenue Louisiana is designed to encourage the sale of original artwork. This certificate allows qualified sellers to exempt certain sales from state sales tax, making art more accessible to both artists and buyers. Understanding this statute can help you benefit from potential tax savings.

-

How can I apply for the sales tax exemption certificate in Louisiana?

To apply for the Original Works Of Art Sold In An Established Cultural Product District Sales Tax Exemption Certificate Revised Statute 47305 Revenue Louisiana, you need to fill out the required application form provided by the Louisiana Department of Revenue. Ensure you meet all eligibility criteria, such as the type of artwork sold and its location within the cultural product district. For detailed guidance, refer to the official state website.

-

Are there any fees associated with obtaining the sales tax exemption certificate?

Typically, there is no fee required to obtain the Original Works Of Art Sold In An Established Cultural Product District Sales Tax Exemption Certificate Revised Statute 47305 Revenue Louisiana. However, you may need to ensure you have the necessary documentation to support your application. It's advisable to check with the Louisiana Department of Revenue for any updates on fees or submission processes.

-

What types of art are eligible for this sales tax exemption in Louisiana?

Eligible artworks under the Original Works Of Art Sold In An Established Cultural Product District Sales Tax Exemption Certificate Revised Statute 47305 Revenue Louisiana generally include original paintings, sculptures, and other unique artistic creations. Reproductions or mass-produced artworks typically do not qualify for this exemption. Make sure to review the specific criteria listed by the state.

-

How does this tax exemption benefit artists and buyers?

The Original Works Of Art Sold In An Established Cultural Product District Sales Tax Exemption Certificate Revised Statute 47305 Revenue Louisiana benefits artists by enhancing their marketability through reduced purchase costs for buyers. This exemption encourages more art sales, helping local artists thrive. Additionally, it provides buyers with a financial incentive to invest in original works of art.

-

Can businesses also apply for this sales tax exemption certificate?

Yes, businesses that deal with original works of art can apply for the Original Works Of Art Sold In An Established Cultural Product District Sales Tax Exemption Certificate Revised Statute 47305 Revenue Louisiana. This allows them to take advantage of tax savings while promoting local art. Ensure your business operations align with the requirements outlined by the Louisiana Department of Revenue.

-

How does airSlate SignNow assist with managing this process?

airSlate SignNow offers a user-friendly platform that helps businesses create, send, and manage eSign documents efficiently, including applications for the Original Works Of Art Sold In An Established Cultural Product District Sales Tax Exemption Certificate Revised Statute 47305 Revenue Louisiana. By streamlining the documentation process, SignNow makes it easier for artists and businesses to handle necessary paperwork without delays.

Get more for Original Works Of Art Sold In An Established Cultural Product District Sales Tax Exemption Certificate Revised Statute 47305 Rev

- Pld c 001 1 form

- Esg due diligence checklist pdf form

- Tbi form bi 0162

- Asrs retiree return to work form azdema

- Information retrieval implementing and evaluating search engines

- Ready made employment contracts letters ampampampampampampampampampamp forms sample chapter find out more about lawpacks ready

- Swift mt103 swift form

- Soil site evaluation sheet for permit form

Find out other Original Works Of Art Sold In An Established Cultural Product District Sales Tax Exemption Certificate Revised Statute 47305 Rev

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney