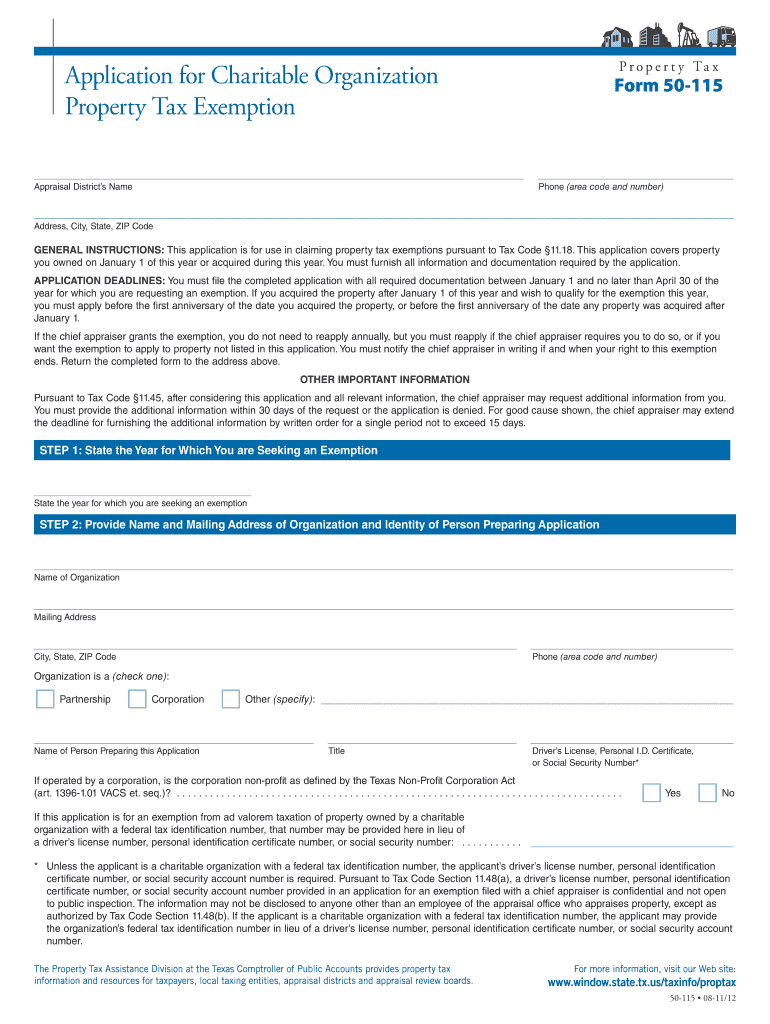

Application for Charitable Organization Form

What is the Application For Charitable Organization

The Application For Charitable Organization is a formal request that organizations must submit to obtain tax-exempt status under Section 501(c)(3) of the Internal Revenue Code. This application is essential for non-profit entities seeking to operate as charitable organizations in the United States. By completing this application, organizations can gain recognition as tax-exempt, allowing them to receive tax-deductible contributions and potentially qualify for various grants and funding opportunities.

Steps to complete the Application For Charitable Organization

Completing the Application For Charitable Organization involves several critical steps. First, organizations must gather necessary information, including their mission statement, financial data, and details about their governing body. Next, they should select the appropriate form, typically Form 1023 or Form 1023-EZ, depending on their size and complexity. After filling out the form, organizations must review their application for accuracy, ensuring all required documents are included. Finally, the completed application can be submitted to the IRS either electronically or via mail, along with the applicable filing fee.

Required Documents

When submitting the Application For Charitable Organization, specific documents are required to support the application. These documents typically include:

- Articles of incorporation or organization

- Bylaws that govern the organization

- Financial statements for the past three years, if applicable

- A detailed description of the organization's activities

- Conflict of interest policy

Having these documents prepared in advance can streamline the application process and help avoid delays in approval.

Eligibility Criteria

To qualify for tax-exempt status through the Application For Charitable Organization, an organization must meet specific eligibility criteria. Primarily, it must be organized and operated exclusively for charitable, educational, religious, or scientific purposes. Additionally, the organization must not engage in substantial lobbying or political activities. It should also ensure that its earnings do not benefit any private individual or shareholder. Understanding these criteria is essential for organizations to ensure they align with IRS requirements before applying.

Form Submission Methods

Organizations have multiple options for submitting the Application For Charitable Organization. They can file the application online through the IRS website, which often provides a quicker processing time. Alternatively, organizations may choose to submit their application via mail, sending the completed forms and required documents to the appropriate IRS address. In-person submissions are generally not accepted, making electronic and mail submissions the primary methods for application delivery.

IRS Guidelines

The IRS provides specific guidelines that organizations must follow when completing the Application For Charitable Organization. These guidelines cover various aspects, including the types of organizations eligible for tax-exempt status, the information required in the application, and the standards for maintaining compliance after approval. Organizations are encouraged to review these guidelines thoroughly to ensure they meet all requirements and understand their obligations as tax-exempt entities.

Quick guide on how to complete application for charitable organization

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained traction among companies and individuals alike. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to access the correct format and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents promptly without any hold-ups. Manage [SKS] on any device with airSlate SignNow’s Android or iOS applications and streamline any document-related task today.

How to Edit and eSign [SKS] with Ease

- Obtain [SKS] and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or obscure sensitive details with features that airSlate SignNow provides specifically for that task.

- Create your eSignature using the Sign tool, which only takes a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, invitation link, or by downloading it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searching, or errors that require reprinting new copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Modify and eSign [SKS] and guarantee outstanding communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Application For Charitable Organization

Create this form in 5 minutes!

How to create an eSignature for the application for charitable organization

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Application For Charitable Organization in airSlate SignNow?

The Application For Charitable Organization within airSlate SignNow allows nonprofits to collect signatures and streamline document management efficiently. This feature ensures that organizations can meet compliance requirements while simplifying the process of securing donations and grants.

-

How does airSlate SignNow enhance the Application For Charitable Organization process?

airSlate SignNow enhances the Application For Charitable Organization process by providing an intuitive platform for eSignature and document tracking. Users can easily create, send, and manage applications, ensuring that all stakeholders can sign documents remotely, saving both time and effort.

-

Are there any costs associated with using the Application For Charitable Organization feature?

While airSlate SignNow offers a range of pricing plans, many features, including the Application For Charitable Organization, provide excellent value for nonprofits. Users can choose from various subscription options that suit their budget and organizational needs, ensuring affordability.

-

Can I integrate the Application For Charitable Organization with other tools?

Yes, airSlate SignNow supports integrations with various applications that are commonly used by charitable organizations. By integrating the Application For Charitable Organization with tools like CRM systems or donor management software, organizations can enhance their workflow and improve efficiency.

-

What are the benefits of using airSlate SignNow for my charitable organization's application process?

Using airSlate SignNow for your charitable organization's application process brings several benefits, including increased efficiency, reduced paper usage, and improved compliance. This digital transformation allows your team to focus more on your mission rather than administrative tasks.

-

How secure is the Application For Charitable Organization with airSlate SignNow?

Security is a top priority for airSlate SignNow, especially regarding the Application For Charitable Organization. The platform ensures that all documents are encrypted and complies with industry-standard regulations, providing peace of mind when handling sensitive information.

-

Is training or support available for the Application For Charitable Organization feature?

Absolutely! airSlate SignNow offers extensive training resources and customer support for users of the Application For Charitable Organization. Whether you're a newcomer or an experienced user, help is available to enhance your understanding and use of the platform.

Get more for Application For Charitable Organization

Find out other Application For Charitable Organization

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online