Missouri State Taxes DBBS Student Advisory Committee 2023-2026

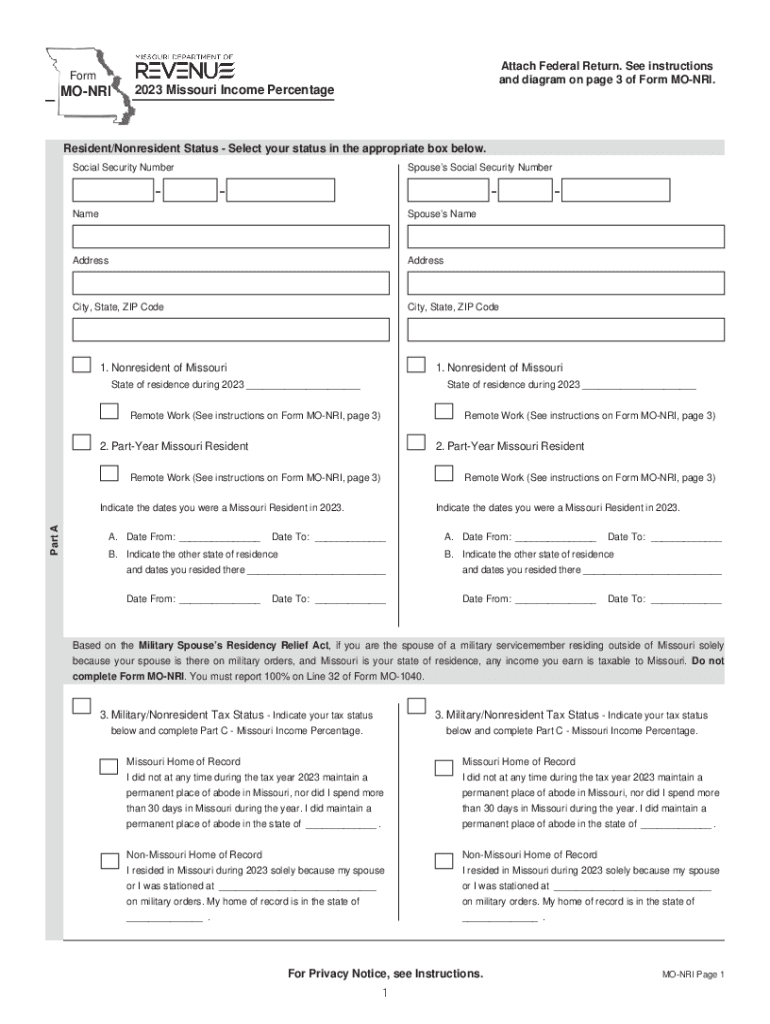

What is the Missouri NRI Instructions?

The Missouri Non-Resident Income (NRI) instructions provide essential guidance for individuals who earn income in Missouri but reside outside the state. This form is crucial for accurately reporting income and ensuring compliance with Missouri tax laws. Understanding the NRI instructions helps taxpayers navigate their obligations and avoid potential penalties.

Key Elements of the Missouri NRI Instructions

Several key elements are included in the Missouri NRI instructions. These elements detail the necessary information required to complete the form accurately, including:

- Identification of income sources

- Calculation of Missouri income percentage

- Applicable deductions and credits

- Filing requirements and deadlines

Familiarizing yourself with these components can streamline the filing process and enhance accuracy.

Steps to Complete the Missouri NRI Instructions

Completing the Missouri NRI form involves several steps. Start by gathering all relevant financial documents, such as W-2s and 1099s. Next, follow these steps:

- Fill in your personal information, including your name and address.

- Report all income earned in Missouri.

- Calculate your Missouri income percentage based on your total income.

- Apply any eligible deductions.

- Review your completed form for accuracy.

Taking these steps ensures that you meet all requirements and file your taxes correctly.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Missouri NRI form is essential for compliance. Typically, the deadline for submitting the form aligns with the federal tax deadline, which is April 15 each year. If April 15 falls on a weekend or holiday, the deadline may be extended. It is important to stay informed about any changes to these dates to avoid late penalties.

Required Documents for Missouri NRI Filing

When preparing to file the Missouri NRI form, certain documents are required to ensure accurate reporting. These documents include:

- W-2 forms from employers

- 1099 forms for other income sources

- Records of any deductions claimed

- Previous year’s tax returns for reference

Having these documents readily available can simplify the completion of the form and facilitate a smoother filing process.

Penalties for Non-Compliance

Failure to comply with Missouri tax regulations can result in penalties. Common penalties for not filing the NRI form or for filing it late include:

- Monetary fines based on the amount owed

- Interest on unpaid taxes

- Potential legal action for persistent non-compliance

Being aware of these penalties underscores the importance of timely and accurate filing.

Quick guide on how to complete missouri state taxes dbbs student advisory committee

Complete Missouri State Taxes DBBS Student Advisory Committee effortlessly on any device

Online document handling has become popular among organizations and individuals alike. It serves as an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents quickly and without delays. Manage Missouri State Taxes DBBS Student Advisory Committee on any device with the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to modify and electronically sign Missouri State Taxes DBBS Student Advisory Committee without hassle

- Obtain Missouri State Taxes DBBS Student Advisory Committee and click Get Form to begin.

- Make use of the tools we offer to fill out your form.

- Select important sections of the documents or conceal confidential information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Put aside concerns about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and electronically sign Missouri State Taxes DBBS Student Advisory Committee and ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct missouri state taxes dbbs student advisory committee

Create this form in 5 minutes!

How to create an eSignature for the missouri state taxes dbbs student advisory committee

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are mo nri instructions for electronic signatures?

Mo nri instructions refer to the guidelines and procedures provided for creating and managing electronic signatures using airSlate SignNow. These instructions help ensure that your documents comply with legal standards and can be seamlessly signed online. Understanding these instructions is crucial for businesses looking to streamline their signing processes.

-

How does airSlate SignNow simplify the mo nri instructions process?

airSlate SignNow simplifies the mo nri instructions process by offering a user-friendly interface that guides you through each step of electronic signing. With intuitive tools, you can quickly learn how to prepare documents, set up signatures, and ensure compliance. This efficiency saves time and reduces the complexities often found in traditional signing methods.

-

What pricing plans are available for airSlate SignNow?

airSlate SignNow provides various pricing plans tailored to meet different business needs, including options that align with the mo nri instructions requirements. Each plan offers features such as unlimited signatures and document templates, ensuring businesses have the tools necessary for effective document management. Check our website for detailed pricing information.

-

What features does airSlate SignNow offer related to mo nri instructions?

airSlate SignNow offers features such as document templates, real-time collaboration, and mobile access, all designed to work seamlessly with mo nri instructions. These tools ensure that the entire signing process is efficient and compliant, helping businesses maintain a smooth workflow. Additionally, users can track document status and receive notifications when actions are needed.

-

Can airSlate SignNow integrate with other software to enhance mo nri instructions?

Yes, airSlate SignNow integrates with various third-party applications, enhancing the mo nri instructions process. Seamless integration with CRM systems, cloud storage, and productivity tools allows businesses to streamline their operations and maintain all documents in one accessible location. This connectivity improves efficiency and data organization.

-

What benefits does using airSlate SignNow offer for managing mo nri instructions?

Using airSlate SignNow for managing mo nri instructions offers numerous benefits, including improved turnaround times and simplified compliance with legal requirements. By digitizing the signing process, businesses can signNowly reduce paper usage and enhance overall efficiency. This not only saves resources but also provides a better experience for signers.

-

Is there a mobile app for airSlate SignNow to help with mo nri instructions?

Absolutely! airSlate SignNow features a mobile app that facilitates handling mo nri instructions on-the-go. With the app, you can create, send, and sign documents from anywhere, ensuring you never miss a vital step in your document workflow. This flexibility ensures that your signing process is always accessible and efficient.

Get more for Missouri State Taxes DBBS Student Advisory Committee

Find out other Missouri State Taxes DBBS Student Advisory Committee

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy

- How Can I Electronic signature Arizona Life Sciences Resignation Letter

- Electronic signature Legal PDF Illinois Online

- How Can I Electronic signature Colorado Non-Profit Promissory Note Template