8582 K Kentucky Passive Activity Loss Limitations Form

What is the 8582 K Kentucky Passive Activity Loss Limitations Form

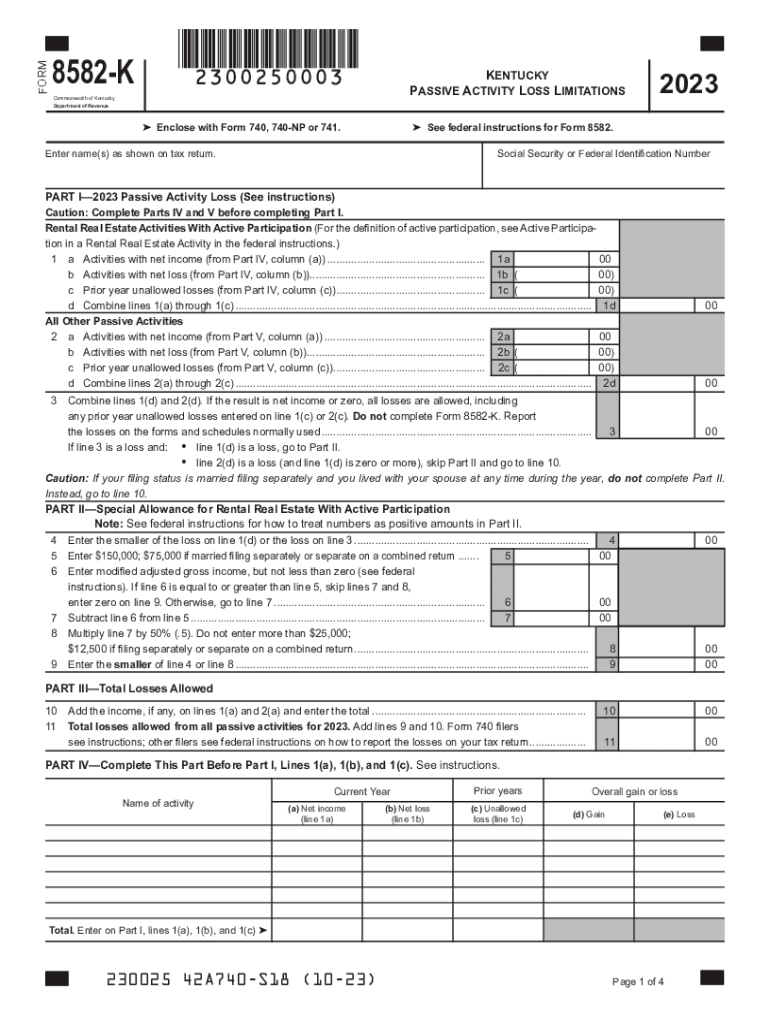

The 8582 K Kentucky Passive Activity Loss Limitations Form is a tax document used by individuals and businesses in Kentucky to report passive activity losses. Passive activities typically include rental properties and businesses in which the taxpayer does not materially participate. This form helps taxpayers determine the amount of passive losses that can be deducted from their taxable income, adhering to both federal and state tax regulations.

How to use the 8582 K Kentucky Passive Activity Loss Limitations Form

To effectively use the 8582 K form, taxpayers must first gather relevant financial information regarding their passive activities. This includes income and expenses related to rental properties or other passive investments. The form requires details about each activity, including the type of activity, income generated, and losses incurred. Once completed, the form is submitted alongside the taxpayer's annual income tax return, ensuring that all passive losses are accurately reported and accounted for.

Steps to complete the 8582 K Kentucky Passive Activity Loss Limitations Form

Completing the 8582 K form involves several key steps:

- Gather all necessary financial documents related to passive activities.

- Identify each passive activity and categorize them appropriately.

- Calculate total income and losses for each activity.

- Fill out the form, ensuring all fields are completed accurately.

- Review the form for any errors or omissions before submission.

Key elements of the 8582 K Kentucky Passive Activity Loss Limitations Form

The key elements of the 8582 K form include sections for reporting income, losses, and the specific activities involved. Taxpayers must provide detailed information about each passive activity, including:

- Type of activity (e.g., rental, limited partnership)

- Total income generated

- Total expenses incurred

- Net passive activity loss

These elements are crucial for determining the allowable deductions for the tax year.

Filing Deadlines / Important Dates

It is important for taxpayers to be aware of the filing deadlines for the 8582 K form. Typically, this form must be submitted by the same deadline as the federal income tax return, which is usually April fifteenth. If additional time is needed, taxpayers may file for an extension, but they should ensure that any taxes owed are paid by the original deadline to avoid penalties.

Eligibility Criteria

Eligibility to use the 8582 K form generally applies to individuals and entities that have passive activities resulting in losses. Taxpayers must meet specific criteria, such as not materially participating in the activity and having a certain level of income. Understanding these eligibility requirements is essential for accurately reporting passive losses and maximizing potential deductions.

Quick guide on how to complete 8582 k kentucky passive activity loss limitations form

Finalize 8582 K Kentucky Passive Activity Loss Limitations Form effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the proper form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents swiftly without any hold-ups. Manage 8582 K Kentucky Passive Activity Loss Limitations Form across any platform using airSlate SignNow apps available for Android or iOS and simplify any document-based task today.

How to edit and eSign 8582 K Kentucky Passive Activity Loss Limitations Form with ease

- Find 8582 K Kentucky Passive Activity Loss Limitations Form and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information using tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management requirements in just a few clicks from your chosen device. Edit and eSign 8582 K Kentucky Passive Activity Loss Limitations Form and maintain excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 8582 k kentucky passive activity loss limitations form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 8582 K Kentucky Passive Activity Loss Limitations Form?

The 8582 K Kentucky Passive Activity Loss Limitations Form is a tax form used to report and track passive losses, ensuring compliance with state tax regulations. It helps taxpayers calculate limitations based on income and losses from passive activities, facilitating accurate tax reporting.

-

How can airSlate SignNow assist with the 8582 K Kentucky Passive Activity Loss Limitations Form?

airSlate SignNow offers an efficient eSignature solution that simplifies the signing and submission process for the 8582 K Kentucky Passive Activity Loss Limitations Form. With our user-friendly interface, you can quickly prepare the form for signatures, ensuring timely compliance with tax deadlines.

-

What features does airSlate SignNow offer for managing tax forms like the 8582 K Kentucky Passive Activity Loss Limitations Form?

airSlate SignNow includes features like customizable document templates, secure cloud storage, and real-time tracking of document status that are particularly beneficial for managing the 8582 K Kentucky Passive Activity Loss Limitations Form. These features streamline the workflow, making compliance easier than ever.

-

Is airSlate SignNow cost-effective for managing forms like the 8582 K Kentucky Passive Activity Loss Limitations Form?

Yes, airSlate SignNow provides a cost-effective solution for managing tax forms, including the 8582 K Kentucky Passive Activity Loss Limitations Form. Our pricing plans are designed to fit the needs of businesses of all sizes, offering excellent value for streamlining document workflows.

-

Can airSlate SignNow integrate with accounting software for the 8582 K Kentucky Passive Activity Loss Limitations Form?

Absolutely! airSlate SignNow can seamlessly integrate with various accounting software, which makes managing the 8582 K Kentucky Passive Activity Loss Limitations Form even more efficient. This integration allows for easy importing of data, ensuring accuracy while saving time.

-

What benefits does using airSlate SignNow provide for the 8582 K Kentucky Passive Activity Loss Limitations Form?

By utilizing airSlate SignNow for the 8582 K Kentucky Passive Activity Loss Limitations Form, you can enhance efficiency with quicker document processing and reduce errors through automatic calculations. The platform's secure compliance features help ensure your sensitive tax information is protected.

-

How secure is airSlate SignNow for handling sensitive documents like the 8582 K Kentucky Passive Activity Loss Limitations Form?

Security is a top priority for airSlate SignNow. Our platform employs advanced encryption and security protocols to protect sensitive documents such as the 8582 K Kentucky Passive Activity Loss Limitations Form, giving you peace of mind while handling tax information.

Get more for 8582 K Kentucky Passive Activity Loss Limitations Form

Find out other 8582 K Kentucky Passive Activity Loss Limitations Form

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF