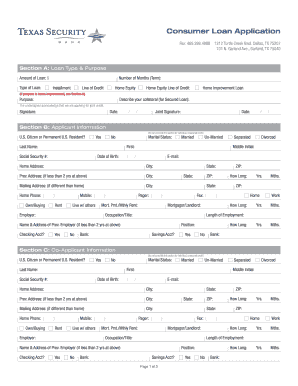

Consumer Loan Application Texas Security Bank Form

Understanding the Consumer Loan Application at Texas Security Bank

The Consumer Loan Application at Texas Security Bank is a formal document used by individuals seeking to obtain a loan for personal use. This application collects essential information about the applicant, including personal identification details, financial history, and the purpose of the loan. The form is designed to assess the applicant's creditworthiness and ability to repay the loan. Understanding the structure and requirements of this application can help streamline the process and improve the chances of approval.

Steps to Complete the Consumer Loan Application

Completing the Consumer Loan Application involves several key steps to ensure accuracy and completeness. First, gather all necessary personal and financial information, including Social Security numbers, income details, and employment history. Next, fill out the application form carefully, ensuring that all sections are completed. It is crucial to review the information for any errors or omissions before submission. Finally, submit the application either online or in person at a Texas Security Bank branch, depending on your preference and the options available.

Required Documents for the Consumer Loan Application

When applying for a consumer loan at Texas Security Bank, certain documents are typically required to support your application. These may include:

- Proof of identity, such as a government-issued ID or driver's license

- Proof of income, like recent pay stubs or tax returns

- Bank statements to demonstrate financial stability

- Information regarding any existing debts or financial obligations

Having these documents ready can expedite the application process and help the bank make a timely decision.

Eligibility Criteria for the Consumer Loan Application

Eligibility for a consumer loan at Texas Security Bank typically depends on several factors. Applicants must be at least eighteen years old and a resident of Texas. Additionally, the bank will assess credit history, income level, and debt-to-income ratio to determine eligibility. Meeting these criteria does not guarantee approval, but it is essential for applicants to understand these requirements before submitting their application.

Application Process and Approval Time

The application process for a consumer loan at Texas Security Bank generally follows a straightforward path. After submitting the completed application and required documents, the bank will review the information provided. This review process usually takes a few business days, during which the bank may contact the applicant for additional information or clarification. Once the review is complete, the bank will notify the applicant of the decision regarding loan approval, including any terms and conditions associated with the loan.

Digital Submission of the Consumer Loan Application

Texas Security Bank offers a digital submission option for the Consumer Loan Application, allowing applicants to fill out and submit their forms online. This method enhances convenience and speeds up the application process. To use this option, applicants must access the bank's secure online portal, complete the application form, and upload any required documents. Digital submission is designed to be user-friendly, ensuring that applicants can easily navigate the process from the comfort of their own homes.

Quick guide on how to complete consumer loan application texas security bank

Complete [SKS] effortlessly on any device

Online document management has gained popularity among enterprises and individuals. It serves as an excellent environmentally friendly alternative to traditional printed and signed paperwork, enabling you to obtain the correct form and securely save it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents quickly and without delays. Manage [SKS] on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The optimal method to modify and eSign [SKS] easily

- Find [SKS] and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Select key parts of the documents or obscure confidential information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you would like to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require new document copies to be printed. airSlate SignNow addresses your requirements in document management with just a few clicks from any device of your choice. Modify and eSign [SKS] and ensure exceptional clarity at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Consumer Loan Application Texas Security Bank

Create this form in 5 minutes!

How to create an eSignature for the consumer loan application texas security bank

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Consumer Loan Application Texas Security Bank?

The Consumer Loan Application Texas Security Bank is a streamlined process to apply for various consumer loans offered by Texas Security Bank. This application provides an efficient way for borrowers to submit their financial information and receive quick approvals, making the loan application experience simple and accessible.

-

How can I apply for a Consumer Loan at Texas Security Bank?

To apply for a Consumer Loan at Texas Security Bank, simply visit our website and fill out the online Consumer Loan Application Texas Security Bank form. The application guides you through the necessary steps, allowing you to securely submit your information and upload any required documents.

-

What types of consumer loans does Texas Security Bank offer?

Texas Security Bank offers a variety of consumer loans including personal loans, auto loans, and home improvement loans. Each loan type is designed to meet specific financial needs, providing potential borrowers with flexible options to choose from when completing the Consumer Loan Application Texas Security Bank.

-

What are the eligibility requirements for the Consumer Loan Application Texas Security Bank?

Eligibility requirements for the Consumer Loan Application Texas Security Bank may vary based on the type of loan you are applying for. Generally, you need to provide proof of income, a credit report, and other relevant financial information, ensuring a fair assessment of your application.

-

How long does it take to process the Consumer Loan Application Texas Security Bank?

Processing times for the Consumer Loan Application Texas Security Bank can vary, but most applications are reviewed within a few business days. Once approved, funds are typically disbursed quickly, allowing you to access your loan funds as soon as possible.

-

Are there any fees associated with the Consumer Loan Application Texas Security Bank?

Texas Security Bank aims to be transparent with borrowers regarding any fees associated with the Consumer Loan Application. While some loans may have nominal processing fees, there are no hidden charges, and our team will clarify all applicable fees at the time of application.

-

Can I manage my loans online after submitting the Consumer Loan Application Texas Security Bank?

Yes, Texas Security Bank offers robust online banking features, allowing you to manage your loans effectively after submitting the Consumer Loan Application Texas Security Bank. You can view balances, make payments, and access statements all through our secure online portal.

Get more for Consumer Loan Application Texas Security Bank

Find out other Consumer Loan Application Texas Security Bank

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later