Life Dividend Withdrawal Form Catholic Financial Life

What is the Life Dividend Withdrawal Form Catholic Financial Life

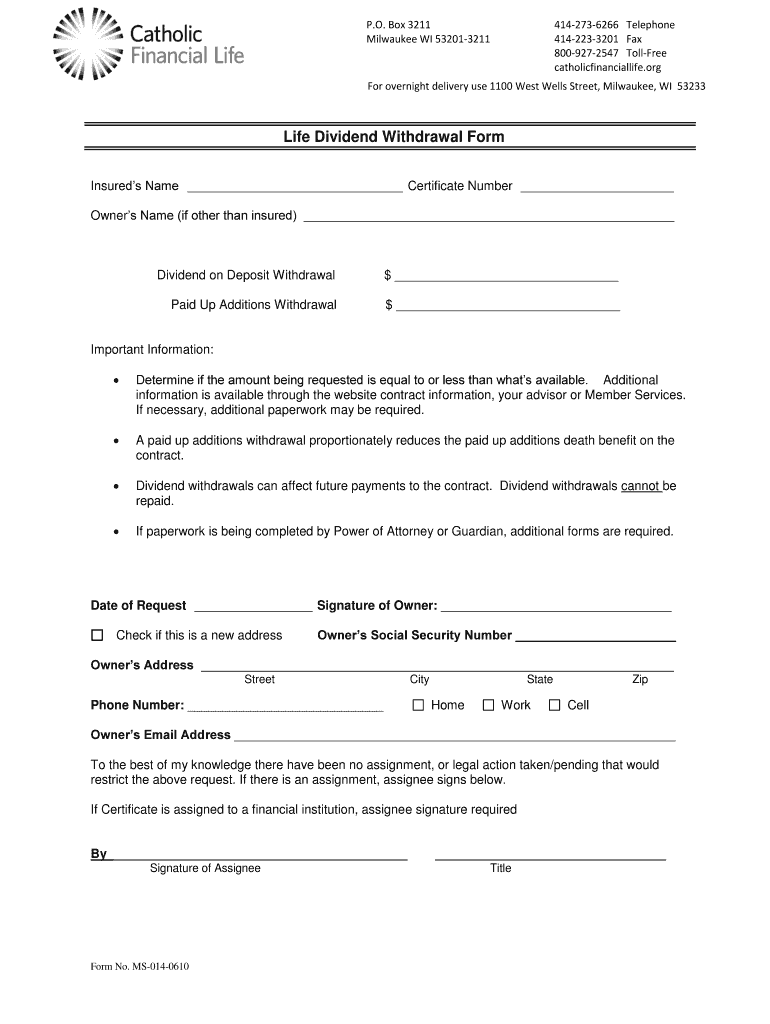

The Life Dividend Withdrawal Form from Catholic Financial Life is a specific document used by policyholders to request the withdrawal of dividends earned on their life insurance policies. This form is essential for individuals looking to access their accumulated dividends, which can be used for various purposes, such as premium payments or cash withdrawals. Understanding this form is crucial for ensuring that policyholders can effectively manage their benefits and make informed financial decisions.

How to use the Life Dividend Withdrawal Form Catholic Financial Life

Using the Life Dividend Withdrawal Form involves several steps to ensure that the request is processed smoothly. Policyholders should first obtain the form, which can typically be accessed through Catholic Financial Life's official channels. After filling out the required information, including personal details and the amount to be withdrawn, the form must be submitted according to the specified guidelines. It is important to review the completed form for accuracy before submission to avoid any delays in processing.

Steps to complete the Life Dividend Withdrawal Form Catholic Financial Life

Completing the Life Dividend Withdrawal Form requires careful attention to detail. Follow these steps:

- Download or request the form from Catholic Financial Life.

- Fill in your personal information, including your policy number and contact details.

- Indicate the amount of dividend you wish to withdraw.

- Sign and date the form to authenticate your request.

- Submit the form via the method outlined by Catholic Financial Life, ensuring you keep a copy for your records.

Key elements of the Life Dividend Withdrawal Form Catholic Financial Life

The Life Dividend Withdrawal Form includes several key elements that are vital for processing your request. These elements typically consist of:

- Your personal identification information, including name, address, and policy number.

- The specific amount of dividends you wish to withdraw.

- Signature and date to confirm your request.

- Instructions for submission, including any required documentation.

Eligibility Criteria

To successfully use the Life Dividend Withdrawal Form, policyholders must meet certain eligibility criteria. Generally, individuals must have an active life insurance policy with Catholic Financial Life that has accumulated dividends. Additionally, the request for withdrawal must comply with the terms and conditions set forth in the policy. It is advisable to review your policy details or consult with a representative to ensure eligibility before submitting the form.

Form Submission Methods

The Life Dividend Withdrawal Form can be submitted through various methods, depending on the preferences of the policyholder. Common submission methods include:

- Online submission through the Catholic Financial Life portal.

- Mailing the completed form to the designated address provided by Catholic Financial Life.

- In-person submission at a local Catholic Financial Life office, if available.

Who Issues the Form

The Life Dividend Withdrawal Form is issued by Catholic Financial Life, a not-for-profit financial services organization that provides insurance and investment products to its members. The organization is dedicated to serving its policyholders and ensuring they have the necessary tools to manage their financial needs effectively. For any questions regarding the form or its usage, policyholders can contact Catholic Financial Life directly for assistance.

Quick guide on how to complete life dividend withdrawal form catholic financial life

Easily Prepare [SKS] on Any Device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents promptly without interruptions. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to Edit and eSign [SKS] Effortlessly

- Find [SKS] and then click Get Form to get started.

- Utilize the tools we provide to finish your document.

- Emphasize key sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for this purpose.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you want to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or mislaid documents, tedious searching for forms, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and eSign [SKS] to ensure excellent communication at every step of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Life Dividend Withdrawal Form Catholic Financial Life

Create this form in 5 minutes!

How to create an eSignature for the life dividend withdrawal form catholic financial life

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Life Dividend Withdrawal Form Catholic Financial Life?

The Life Dividend Withdrawal Form Catholic Financial Life is a document designed for policyholders to request the withdrawal of dividends from their life insurance policies. This form ensures that your request is processed efficiently and accurately, allowing you to access the funds you are entitled to.

-

How do I complete the Life Dividend Withdrawal Form Catholic Financial Life?

To complete the Life Dividend Withdrawal Form Catholic Financial Life, you will need to provide your policy number, personal details, and specify the amount you wish to withdraw. Make sure to review the form carefully before submitting to avoid any delays in processing.

-

What are the benefits of using the Life Dividend Withdrawal Form Catholic Financial Life?

The Life Dividend Withdrawal Form Catholic Financial Life allows policyholders to easily access their earned dividends, providing financial flexibility. By using this form, you can manage your benefits promptly and streamline the withdrawal process, ensuring you receive your funds without unnecessary complications.

-

Are there any fees associated with the Life Dividend Withdrawal Form Catholic Financial Life?

There are typically no fees associated with submitting the Life Dividend Withdrawal Form Catholic Financial Life. However, it's always best to confirm with Catholic Financial Life directly regarding any potential charges that may apply to specific withdrawals or transactions.

-

How long does it take to process the Life Dividend Withdrawal Form Catholic Financial Life?

Processing times for the Life Dividend Withdrawal Form Catholic Financial Life can vary. Generally, you can expect to receive a confirmation and your requested funds within a few business days after the form is submitted, providing all information is accurate and complete.

-

Can I submit the Life Dividend Withdrawal Form Catholic Financial Life online?

Many policyholders prefer submitting the Life Dividend Withdrawal Form Catholic Financial Life through online portals for convenience. Check with Catholic Financial Life to see if online submissions are available, as this method can expedite processing and reduce paperwork.

-

What should I do if I encounter issues with the Life Dividend Withdrawal Form Catholic Financial Life?

If you encounter any issues with the Life Dividend Withdrawal Form Catholic Financial Life, it’s best to signNow out to Catholic Financial Life's customer service. They can provide assistance, clarify any points of confusion, and ensure that your withdrawal request is handled appropriately.

Get more for Life Dividend Withdrawal Form Catholic Financial Life

Find out other Life Dividend Withdrawal Form Catholic Financial Life

- Can I eSign Minnesota Legal Document

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form