Form CT 184 R November Foreign Bus and Taxicab Tax Ny

What is the Form CT 184 R November Foreign Bus And Taxicab Tax Ny

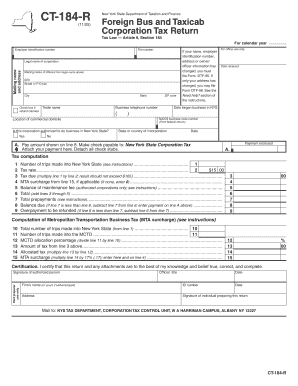

The Form CT 184 R is a tax form specifically designed for foreign businesses and taxicab operators in New York. This form is utilized to report the tax obligations of foreign entities operating within the state. It ensures compliance with New York state tax laws and provides necessary information for tax assessment and collection purposes. Understanding this form is crucial for foreign businesses to avoid penalties and ensure proper tax reporting.

How to use the Form CT 184 R November Foreign Bus And Taxicab Tax Ny

Using the Form CT 184 R involves several steps to ensure accurate completion. First, gather all necessary financial documents related to your business operations in New York. Next, fill out the form by providing detailed information about your business activities, including income generated from taxicab services. It is important to review the instructions carefully to ensure all sections are completed accurately. Once filled, the form must be submitted to the appropriate tax authority by the specified deadline.

Steps to complete the Form CT 184 R November Foreign Bus And Taxicab Tax Ny

Completing the Form CT 184 R requires a methodical approach:

- Gather relevant financial records, including income statements and expense reports.

- Access the form from the New York State Department of Taxation and Finance website or through authorized sources.

- Fill in your business information, including the entity's name, address, and tax identification number.

- Detail your income from taxicab services, ensuring accuracy in reporting.

- Review the completed form for any errors or omissions.

- Submit the form by the due date, either electronically or via mail.

Filing Deadlines / Important Dates

Filing deadlines for the Form CT 184 R are critical to avoid penalties. Typically, the form must be filed annually, with specific due dates set by the New York State Department of Taxation and Finance. It is essential to stay informed about these dates to ensure timely submission. Late filings may incur additional fees or interest on unpaid taxes, so adhering to the deadlines is crucial for compliance.

Required Documents

To complete the Form CT 184 R, several documents are necessary:

- Financial statements detailing income and expenses related to taxicab operations.

- Tax identification number for the business entity.

- Any prior tax returns that may be relevant for reference.

- Documentation of any deductions or credits being claimed.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the Form CT 184 R can lead to significant penalties. These may include fines for late filing, interest on unpaid taxes, and potential legal action for persistent non-compliance. Understanding these risks emphasizes the importance of timely and accurate submission of the form to avoid financial repercussions.

Quick guide on how to complete form ct 184 r november foreign bus and taxicab tax ny

Complete [SKS] effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a fantastic eco-friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and store it securely online. airSlate SignNow provides you with all the essential tools to create, modify, and eSign your documents swiftly without delays. Handle [SKS] on any platform using airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

How to edit and eSign [SKS] without any hassle

- Find [SKS] and click Get Form to commence.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your preference. Edit and eSign [SKS] and ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form CT 184 R November Foreign Bus And Taxicab Tax Ny

Create this form in 5 minutes!

How to create an eSignature for the form ct 184 r november foreign bus and taxicab tax ny

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form CT 184 R November Foreign Bus And Taxicab Tax NY?

The Form CT 184 R November Foreign Bus And Taxicab Tax NY is a tax form used by foreign businesses operating taxis or buses in New York. It helps these businesses report their income and ensure compliance with state tax regulations. Understanding this form is essential for maintaining legal operations in the New York transport market.

-

How can airSlate SignNow assist with the Form CT 184 R November Foreign Bus And Taxicab Tax NY?

airSlate SignNow provides an efficient way to manage and eSign the Form CT 184 R November Foreign Bus And Taxicab Tax NY. With our platform, you can streamline the signing process, making it easy to fill out and submit tax forms quickly and securely. This saves time and reduces the risk of errors in your tax documentation.

-

What are the pricing options for using airSlate SignNow for Form CT 184 R November Foreign Bus And Taxicab Tax NY?

airSlate SignNow offers flexible pricing plans that cater to different business sizes and needs. Whether you’re a small taxi service or a larger bus company, you can choose a plan that fits your budget while effectively handling the Form CT 184 R November Foreign Bus And Taxicab Tax NY. Get started with a free trial to explore our features.

-

What features does airSlate SignNow offer for managing the Form CT 184 R November Foreign Bus And Taxicab Tax NY?

airSlate SignNow offers a variety of features to simplify the management of the Form CT 184 R November Foreign Bus And Taxicab Tax NY. These include customizable templates, easy eSigning, document tracking, and collaboration tools. These functionalities make it easier to handle tax forms and stay organized.

-

How does eSigning the Form CT 184 R November Foreign Bus And Taxicab Tax NY enhance the process?

eSigning the Form CT 184 R November Foreign Bus And Taxicab Tax NY with airSlate SignNow enhances the process by making it faster and more secure. Electronic signatures are legally binding and save you from delays associated with traditional paper methods. This efficiency ensures you meet tax deadlines and maintain compliance.

-

Can I integrate airSlate SignNow with other software while managing Form CT 184 R November Foreign Bus And Taxicab Tax NY?

Yes, airSlate SignNow can be integrated with various software tools essential for your operations, making it easy to manage the Form CT 184 R November Foreign Bus And Taxicab Tax NY along with your other business processes. Integrations with accounting and CRM systems allow for seamless data sharing and improved workflow efficiency.

-

What are the benefits of using airSlate SignNow for my Form CT 184 R November Foreign Bus And Taxicab Tax NY submissions?

Using airSlate SignNow for your Form CT 184 R November Foreign Bus And Taxicab Tax NY submissions offers numerous benefits, including increased compliance, reduced processing time, and enhanced security. The platform's user-friendly interface allows for easy navigation, ensuring you can quickly orient yourself with the tax submission process.

Get more for Form CT 184 R November Foreign Bus And Taxicab Tax Ny

- Form lll affidavit us 7 2 of the private security agency

- Northern california laborers jatc apprenticeship norcalaborers form

- Spelling menu form

- Jammer referee wftda referee performance evaluation

- Full plans application 30334864 form

- Netflix svod license agreement for animated pictures wikileaks form

- Paediatric respiratory assessment woscor scot nhs form

- Glass cleaner formulation pdf file

Find out other Form CT 184 R November Foreign Bus And Taxicab Tax Ny

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure