Certain Independent Power Producers Tax Ny Form

Understanding the certain Independent Power Producers Tax Ny

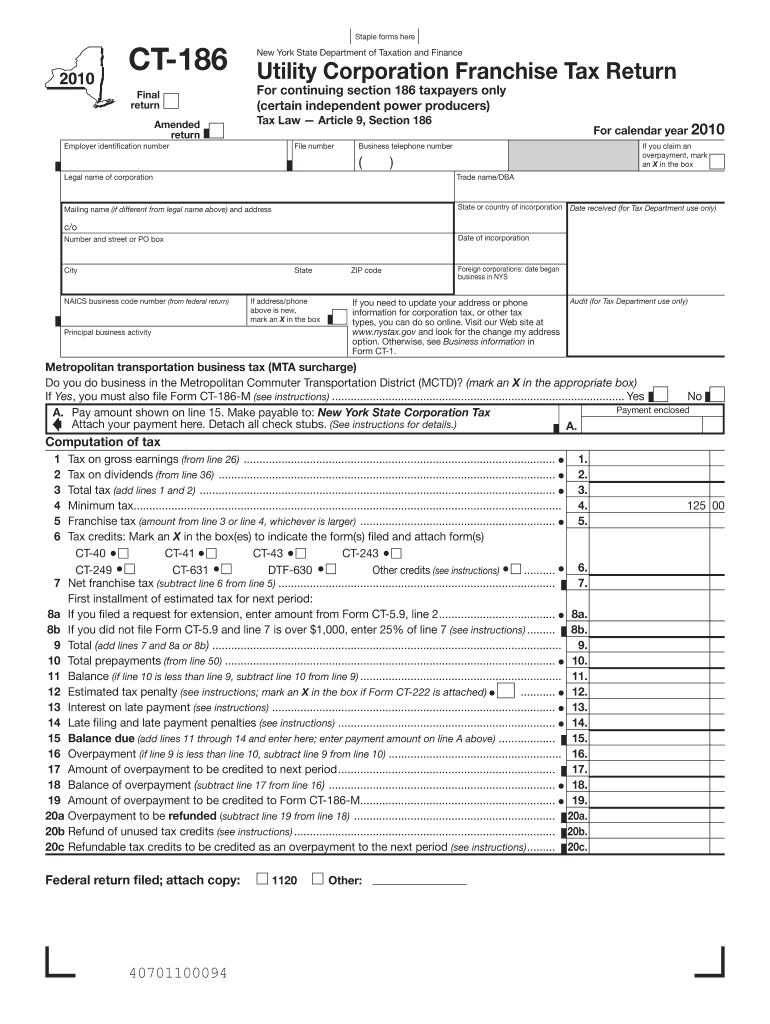

The certain Independent Power Producers Tax Ny is a specific tax regulation that applies to independent power producers operating within New York State. This tax is designed to ensure that these entities contribute fairly to the state's revenue while promoting the development of renewable energy sources. The tax structure may vary based on the type of energy produced, the scale of operations, and the specific regulations set forth by the New York State Department of Taxation and Finance.

Steps to Complete the certain Independent Power Producers Tax Ny

Completing the certain Independent Power Producers Tax Ny involves a series of steps that require careful attention to detail. First, gather all necessary financial records and documentation related to your energy production activities. Next, determine the appropriate tax form to use, which may vary depending on your business structure. Fill out the form accurately, ensuring that all figures are correct and substantiated by your records. Finally, submit the completed form by the designated deadline, either online or via mail, to avoid any penalties.

Required Documents for the certain Independent Power Producers Tax Ny

To successfully file the certain Independent Power Producers Tax Ny, several documents are essential. These include:

- Financial statements detailing revenue from energy production.

- Proof of operational permits and licenses.

- Records of energy output and sales.

- Any applicable tax credits or deductions documentation.

Having these documents ready will streamline the filing process and ensure compliance with state regulations.

Filing Deadlines for the certain Independent Power Producers Tax Ny

It is crucial to be aware of the filing deadlines for the certain Independent Power Producers Tax Ny to avoid late penalties. Typically, the tax return is due on a specific date each year, often aligned with the federal tax filing deadlines. However, it is advisable to check the New York State Department of Taxation and Finance for the most current dates, as they may vary annually or due to legislative changes.

Legal Use of the certain Independent Power Producers Tax Ny

The legal framework surrounding the certain Independent Power Producers Tax Ny is designed to ensure that independent power producers adhere to state laws while benefiting from tax incentives aimed at promoting renewable energy. Understanding these legal stipulations is vital for compliance and can help businesses navigate potential audits or disputes with tax authorities.

Eligibility Criteria for the certain Independent Power Producers Tax Ny

Eligibility for the certain Independent Power Producers Tax Ny typically hinges on several factors, including the type of energy produced, the scale of operations, and compliance with state regulations. Generally, independent power producers engaged in renewable energy generation, such as solar, wind, or hydroelectric power, may qualify for specific tax benefits. It is essential for producers to review the eligibility criteria outlined by the New York State Department of Taxation and Finance to ensure they meet all necessary requirements.

Quick guide on how to complete certain independent power producers tax ny

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, as you can easily obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, edit, and eSign your documents promptly without any hold-ups. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and enhance your document-related processes today.

The easiest way to modify and eSign [SKS] effortlessly

- Find [SKS] and click on Get Form to initiate the process.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or conceal sensitive details with the tools that airSlate SignNow specifically offers for these needs.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method to deliver your form, whether by email, text (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, and errors that necessitate printing new copies. airSlate SignNow meets your document management needs within a few clicks from the device of your choice. Revise and eSign [SKS] while ensuring excellent communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to certain Independent Power Producers Tax Ny

Create this form in 5 minutes!

How to create an eSignature for the certain independent power producers tax ny

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the benefits of utilizing airSlate SignNow for certain Independent Power Producers Tax NY?

Using airSlate SignNow for certain Independent Power Producers Tax NY enables efficient document management and legally binding eSignatures. This leads to faster processing times and reduced errors, which is crucial in tax-related scenarios. Furthermore, our platform ensures compliance with local tax regulations, helping you stay focused on your business.

-

How does airSlate SignNow's pricing structure accommodate businesses focusing on certain Independent Power Producers Tax NY?

We offer flexible pricing plans tailored to the needs of businesses dealing with certain Independent Power Producers Tax NY. Our cost-effective solutions ensure that you only pay for what you need, allowing you to allocate resources effectively. This scalability is perfect for independent power producers at various stages of growth.

-

Can airSlate SignNow integrate with other software used for managing certain Independent Power Producers Tax NY?

Yes, airSlate SignNow seamlessly integrates with various applications commonly used in the industry for certain Independent Power Producers Tax NY. These integrations enhance productivity by streamlining workflows and allowing for easy access to required documents. You can integrate with CRM, ERP, and accounting software for a comprehensive solution.

-

How secure is airSlate SignNow for handling documents related to certain Independent Power Producers Tax NY?

Security is a top priority for airSlate SignNow, especially when dealing with sensitive documents related to certain Independent Power Producers Tax NY. Our platform employs advanced encryption, secure cloud storage, and stringent access controls to ensure that your documents are protected. You can have peace of mind knowing your information is safe.

-

What features does airSlate SignNow offer specifically for certain Independent Power Producers Tax NY?

airSlate SignNow provides several features tailored for certain Independent Power Producers Tax NY, such as customizable templates, multi-party signing, and automated workflows. These features simplify the eSigning process, allowing you to manage multiple contracts and documents efficiently. This streamlining saves time and improves accuracy.

-

How can airSlate SignNow improve workflow efficiency for certain Independent Power Producers Tax NY?

By implementing airSlate SignNow, businesses focusing on certain Independent Power Producers Tax NY can greatly enhance workflow efficiency. The platform automates the document creation and signing process, reducing manual tasks. This leads to quicker turnaround times and allows your team to focus on more strategic initiatives.

-

Is airSlate SignNow user-friendly for businesses dealing with certain Independent Power Producers Tax NY?

Absolutely! airSlate SignNow is designed with user experience in mind, ensuring it is intuitive for users dealing with certain Independent Power Producers Tax NY. The platform offers a straightforward interface, making it easy to create, send, and sign documents without extensive training. This ease of use is essential for teams that need to maintain productivity.

Get more for certain Independent Power Producers Tax Ny

Find out other certain Independent Power Producers Tax Ny

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA