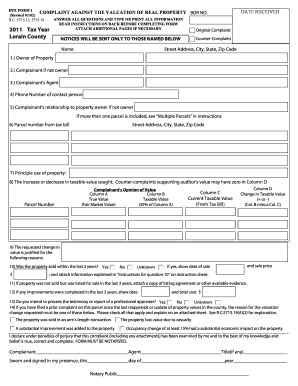

Tax Year Lorain County Form

What is the Tax Year Lorain County

The Tax Year Lorain County refers to the specific period for which tax liabilities are calculated for residents and businesses in Lorain County, Ohio. Typically, the tax year aligns with the calendar year, running from January first to December thirty-first. During this time, individuals and entities must report their income, expenses, and other financial activities to determine their tax obligations. Understanding the tax year is essential for accurate reporting and compliance with local and federal tax regulations.

How to use the Tax Year Lorain County

Utilizing the Tax Year Lorain County involves gathering all relevant financial documents and records for the specified year. Taxpayers should compile income statements, receipts for deductible expenses, and any other pertinent financial information. Once the necessary documents are organized, individuals can begin filling out the appropriate tax forms, ensuring that all information is accurate and complete. This process may also involve consulting with tax professionals or using tax software to ensure compliance with local tax laws.

Steps to complete the Tax Year Lorain County

Completing the Tax Year for Lorain County involves several key steps:

- Gather all financial documents, including W-2s, 1099s, and receipts.

- Determine your filing status, which may impact your tax rate and deductions.

- Fill out the appropriate tax forms, ensuring all information is accurate.

- Calculate your total income, deductions, and credits to determine your tax liability.

- Review your completed forms for accuracy before submission.

- Submit your tax forms by the designated deadline, either electronically or by mail.

Filing Deadlines / Important Dates

Filing deadlines for the Tax Year Lorain County typically coincide with federal tax deadlines. For most individuals, the deadline to file is April fifteenth of the following year. If April fifteenth falls on a weekend or holiday, the deadline may be extended. Businesses may have different deadlines based on their entity type. It is crucial to stay informed about these dates to avoid penalties and ensure timely compliance with tax obligations.

Required Documents

To accurately complete the Tax Year Lorain County, taxpayers need to gather several essential documents, including:

- W-2 forms from employers for wage income.

- 1099 forms for other income sources, such as freelance work.

- Receipts for deductible expenses, including medical, educational, and business-related costs.

- Previous year’s tax return for reference.

- Any relevant schedules or additional forms required for specific deductions or credits.

Penalties for Non-Compliance

Failing to comply with the Tax Year Lorain County regulations can result in various penalties. These may include fines for late filing or payment, interest on unpaid taxes, and potential legal action for severe violations. It is important for taxpayers to understand these consequences and strive to meet all filing requirements to avoid unnecessary financial burdens.

Quick guide on how to complete tax year lorain county

Complete [SKS] effortlessly on any device

Digital document management has gained popularity among companies and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without any delays. Manage [SKS] across any platform using airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

The easiest way to modify and eSign [SKS] with ease

- Find [SKS] and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Mark important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you would like to share your form, whether by email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] while ensuring exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Tax Year Lorain County

Create this form in 5 minutes!

How to create an eSignature for the tax year lorain county

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the importance of Tax Year Lorain County for businesses?

Tax Year Lorain County is crucial for businesses since it dictates the time frame for filing taxes and ensures compliance with local regulations. Understanding this timeframe can help businesses avoid penalties and ensure that they take advantage of available deductions and credits. By staying organized and informed, companies in Lorain County can optimize their financial strategies.

-

How can airSlate SignNow help with document management during Tax Year Lorain County?

airSlate SignNow streamlines document management by allowing businesses to easily send and eSign documents essential for Tax Year Lorain County. This efficiency helps in gathering necessary signatures and approvals without the hassle of physical paperwork. Using airSlate SignNow saves time and ensures all your tax-related documents are securely organized and accessible.

-

Are there any cost-effective solutions for tax filing in Tax Year Lorain County?

Yes, airSlate SignNow offers a cost-effective solution for document management that simplifies the tax filing process during Tax Year Lorain County. With various pricing plans, businesses can choose an option that fits their budget while still accessing powerful features. This allows companies of any size to manage their documents efficiently without overspending.

-

What features does airSlate SignNow offer for Tax Year Lorain County?

airSlate SignNow provides a range of features designed to assist businesses during Tax Year Lorain County, including eSigning, document templates, and secure cloud storage. These tools enhance collaboration and ensure that all necessary documents are properly signed and archived. The user-friendly interface makes it easy for any team member to manage their tax documents effectively.

-

How does airSlate SignNow ensure the security of documents related to Tax Year Lorain County?

Security is a top priority for airSlate SignNow, especially for sensitive documents related to Tax Year Lorain County. The platform uses encryption and complies with industry standards to protect your data from unauthorized access. This means that businesses can confidently manage their tax documentation without worrying about data bsignNowes.

-

Can I integrate airSlate SignNow with other software for Tax Year Lorain County?

Absolutely! airSlate SignNow supports various integrations with popular accounting and tax software which can streamline your workflow for Tax Year Lorain County. These integrations enable seamless data transfer and improve efficiency during the preparation for tax filing. By using airSlate SignNow alongside your existing tools, you can enhance productivity and accuracy.

-

What benefits can businesses expect from using airSlate SignNow during Tax Year Lorain County?

Businesses can expect numerous benefits when using airSlate SignNow during Tax Year Lorain County, including time savings, improved accuracy, and easier collaboration. The ability to quickly eSign documents reduces delays and helps teams stay on top of deadlines. Furthermore, the structured environment assists businesses in ensuring compliance with tax regulations.

Get more for Tax Year Lorain County

- Concept paper example form

- Sasol bursary application forms

- Saratoga lashes amp skincare eyelash extension agreement consent and waiver form

- Pmkvy registration form

- Pwpds form

- The rainier valleyamp39s diversity myth city of seattle seattle form

- Residential duct seal bcertificationb city of virginia beach form

- Cd 429 fillable form

Find out other Tax Year Lorain County

- How Do I Electronic signature West Virginia Banking Document

- How To Electronic signature Washington Car Dealer Document

- Can I Electronic signature West Virginia Car Dealer Document

- How Do I Electronic signature West Virginia Car Dealer Form

- How Can I Electronic signature Wisconsin Car Dealer PDF

- How Can I Electronic signature Wisconsin Car Dealer Form

- How Do I Electronic signature Montana Business Operations Presentation

- How To Electronic signature Alabama Charity Form

- How To Electronic signature Arkansas Construction Word

- How Do I Electronic signature Arkansas Construction Document

- Can I Electronic signature Delaware Construction PDF

- How Can I Electronic signature Ohio Business Operations Document

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF