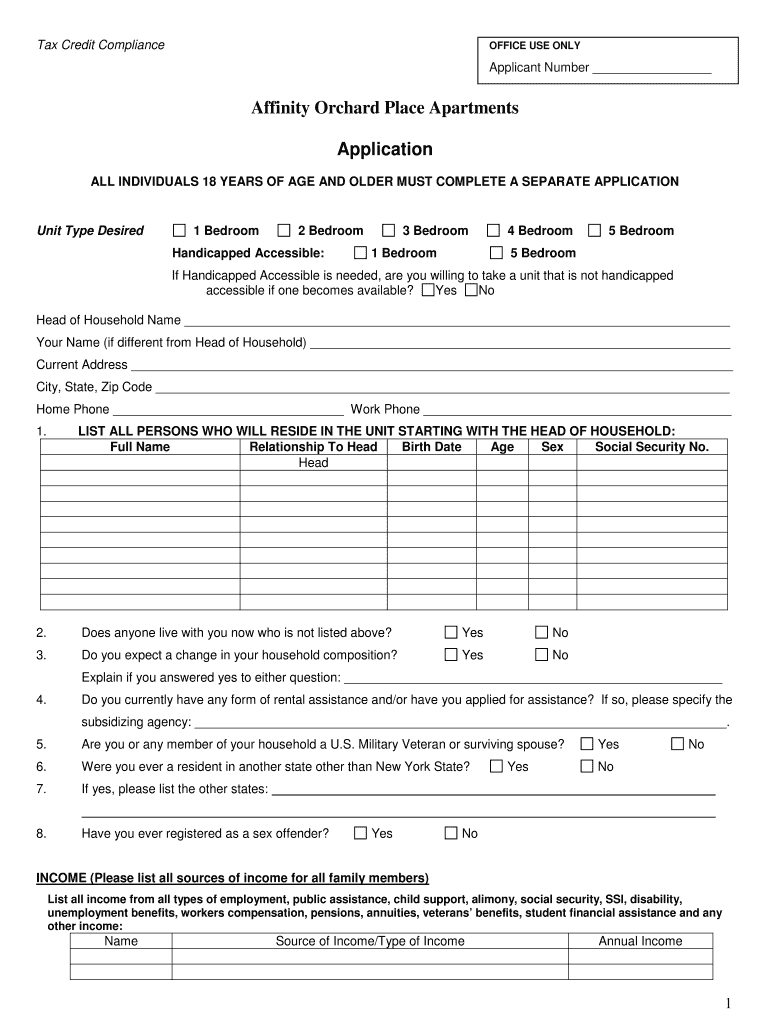

Tax Credit Compliance Form

What is the Tax Credit Compliance

Tax Credit Compliance refers to the adherence to regulations and guidelines set forth by the Internal Revenue Service (IRS) and state authorities regarding the eligibility and application of various tax credits. These credits can significantly reduce a taxpayer's overall tax liability, making compliance essential for both individuals and businesses. Understanding the specific requirements for each type of tax credit is crucial to ensure that taxpayers receive the benefits they are entitled to while avoiding potential penalties.

Steps to complete the Tax Credit Compliance

Completing Tax Credit Compliance involves several key steps:

- Identify the specific tax credits applicable to your situation, such as the Earned Income Tax Credit or Child Tax Credit.

- Gather necessary documentation, including income statements, tax returns, and any other required forms.

- Complete the relevant forms accurately, ensuring all information is correct and up-to-date.

- Submit the forms to the IRS or state tax authority by the designated deadlines.

- Keep copies of all submitted documents for your records in case of future audits.

Eligibility Criteria

Eligibility for tax credits varies based on the type of credit. Generally, factors such as income level, filing status, and number of dependents play a significant role. For example, the Earned Income Tax Credit has specific income thresholds that must be met, while the Child Tax Credit requires proof of dependent status. It is important to review the eligibility criteria for each credit to ensure compliance and maximize potential benefits.

Filing Deadlines / Important Dates

Filing deadlines for tax credits are crucial to ensure compliance and avoid penalties. Typically, the deadline for filing individual tax returns is April fifteenth of each year. However, extensions may be available, and specific credits may have additional deadlines. It is important to stay informed about these dates to ensure timely submission of all necessary documents.

Required Documents

To successfully complete Tax Credit Compliance, several documents are typically required. These may include:

- W-2 forms from employers

- 1099 forms for other income sources

- Proof of residency and dependent status

- Previous year’s tax return for reference

Having these documents ready can streamline the application process and help ensure accuracy in reporting.

Penalties for Non-Compliance

Failure to comply with Tax Credit Compliance can result in various penalties, including fines, interest on unpaid taxes, and disqualification from receiving certain credits in the future. It is essential for taxpayers to understand these potential consequences and take the necessary steps to comply with all regulations to avoid financial repercussions.

Quick guide on how to complete tax credit compliance

Effortlessly Prepare [SKS] on Any Device

Online document management has gained traction among businesses and individuals alike. It offers a superb eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents quickly without delays. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to edit and electronically sign [SKS] with ease

- Find [SKS] and click on Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize relevant sections of your documents or redact sensitive information using the tools provided by airSlate SignNow specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate the worry of lost or misfiled documents, tedious form searches, or errors that require new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and electronically sign [SKS] and ensure seamless communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Tax Credit Compliance

Create this form in 5 minutes!

How to create an eSignature for the tax credit compliance

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Tax Credit Compliance and why is it important?

Tax Credit Compliance refers to the adherence to regulations and requirements necessary to qualify for tax credits. It is crucial for businesses to understand these regulations to avoid penalties and ensure they maximize available credits, ultimately boosting their financial health.

-

How can airSlate SignNow help with Tax Credit Compliance?

airSlate SignNow streamlines the process of managing documents required for Tax Credit Compliance. Our platform allows you to easily send, sign, and store important compliance documents, ensuring that you maintain accurate records and stay audit-ready.

-

What features of airSlate SignNow assist with Tax Credit Compliance documentation?

Key features of airSlate SignNow that assist with Tax Credit Compliance include customizable templates, advanced eSignature capabilities, and secure cloud storage. These tools simplify the documentation process, ensuring that all necessary forms are completed accurately and stored safely for future reference.

-

Is airSlate SignNow cost-effective for small businesses handling Tax Credit Compliance?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes. Our pricing plans are tailored to accommodate small businesses, ensuring they have access to robust features that facilitate Tax Credit Compliance without straining their budgets.

-

Can I integrate airSlate SignNow with other software for better Tax Credit Compliance?

Absolutely! airSlate SignNow offers seamless integrations with various accounting and tax software to enhance your Tax Credit Compliance process. This functionality enables you to transfer data effortlessly, reducing the risk of errors and ensuring compliance with regulatory requirements.

-

What are the benefits of using airSlate SignNow for Tax Credit Compliance?

Using airSlate SignNow for Tax Credit Compliance offers numerous benefits, including improved efficiency in document processing, increased accuracy in compliance management, and enhanced audit readiness. Our platform simplifies the workflow, allowing businesses to focus more on their core operations.

-

How does airSlate SignNow ensure the security of Tax Credit Compliance documents?

Security is a top priority at airSlate SignNow. We utilize advanced encryption protocols and secure cloud storage to protect your Tax Credit Compliance documents, ensuring that sensitive information is safeguarded against unauthorized access and data bsignNowes.

Get more for Tax Credit Compliance

- Microsoft word developmental history formdoc 2793

- Instructions dhs 1139d 0408 acute hospital attachment purpose form dhs 1139d shall be used by health care facilities who

- Ultrasound consent form

- Implant patient information consent form

- Nutrition therapy introductory questionnaire nmg nm form

- Hepatitis declination form

- American general life insurance company the company to form

- Dental laboratory work order form date laboratory

Find out other Tax Credit Compliance

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT