Form 8621 a Rev December IRS Irs

What is the Form 8621 A Rev December IRS Irs

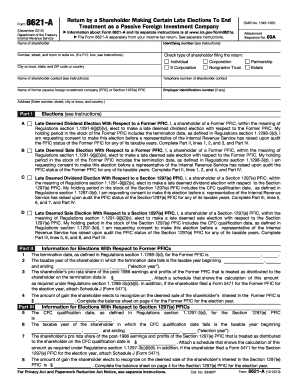

The Form 8621 A Rev December is a tax form used by U.S. taxpayers who hold shares in a Passive Foreign Investment Company (PFIC). This form is essential for reporting income, gains, and distributions from PFICs, ensuring compliance with U.S. tax laws. It provides the IRS with detailed information about the taxpayer's investments in these foreign entities, which may have different tax implications compared to domestic investments.

How to use the Form 8621 A Rev December IRS Irs

To effectively use the Form 8621 A Rev December, taxpayers must first determine whether they have investments in a PFIC. If applicable, the form must be filled out accurately to report any income, gains, and distributions. The information must be submitted along with the taxpayer's annual tax return. It is crucial to follow the IRS guidelines for completing the form to avoid penalties and ensure proper reporting of foreign income.

Steps to complete the Form 8621 A Rev December IRS Irs

Completing the Form 8621 A Rev December involves several key steps:

- Gather necessary financial information regarding your PFIC investments, including income, gains, and distributions.

- Fill out the form by providing accurate details about your investments, ensuring all sections are completed as required.

- Review the form for accuracy, checking for any discrepancies or missing information.

- Submit the completed form with your annual tax return to the IRS by the appropriate deadline.

Legal use of the Form 8621 A Rev December IRS Irs

The legal use of the Form 8621 A Rev December is to report income and gains from PFICs as mandated by U.S. tax law. Failure to file this form when required can lead to significant penalties. Taxpayers must ensure they are compliant with all IRS regulations regarding foreign investments to avoid legal repercussions.

Filing Deadlines / Important Dates

The filing deadline for the Form 8621 A Rev December typically aligns with the annual tax return due date, which is usually April 15. However, if taxpayers file for an extension, they may have until October 15 to submit the form. It is important to stay informed about any changes in deadlines that the IRS may announce each tax year.

Key elements of the Form 8621 A Rev December IRS Irs

Key elements of the Form 8621 A Rev December include sections for reporting:

- Income from PFICs, including ordinary earnings and capital gains.

- Distributions received from PFIC investments.

- Election statements for certain tax treatments, if applicable.

Each section must be filled out with precise information to ensure compliance with IRS reporting requirements.

Quick guide on how to complete form 8621 a rev december irs irs

Easily Prepare [SKS] on Any Gadget

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to easily find the correct form and securely save it online. airSlate SignNow provides all the resources needed to create, edit, and electronically sign your documents quickly and efficiently. Handle [SKS] on any gadget using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

Effortlessly Modify and Electronically Sign [SKS]

- Find [SKS] and click on Get Form to commence.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or mask sensitive information with the tools provided by airSlate SignNow specifically for this task.

- Generate your signature using the Sign tool, which takes just a few seconds and carries the same legal validity as a standard wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select how you want to send your form, via email, SMS, or invite link, or download it to your computer.

Forget the hassle of lost or mislaid files, tedious form hunting, or mistakes that necessitate reprinting new document copies. airSlate SignNow takes care of your document management needs in just a few clicks from any device of your choice. Edit and electronically sign [SKS] to ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 8621 A Rev December IRS Irs

Create this form in 5 minutes!

How to create an eSignature for the form 8621 a rev december irs irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8621 A Rev December IRS Irs?

Form 8621 A Rev December IRS Irs is a tax form used by U.S. persons to report the ownership of a Passive Foreign Investment Company (PFIC). This form plays a critical role in fulfilling IRS requirements for those deriving income from foreign investments. Understanding this form is essential for tax compliance.

-

How can airSlate SignNow assist with Form 8621 A Rev December IRS Irs?

airSlate SignNow simplifies the process of signing and sending your Form 8621 A Rev December IRS Irs documents. With our easy-to-use platform, you can create, eSign, and send documents securely, ensuring timely submission and compliance with IRS regulations.

-

What features does airSlate SignNow offer for managing Form 8621 A Rev December IRS Irs?

Our platform offers customizable templates, automated workflows, and secure cloud storage to manage Form 8621 A Rev December IRS Irs efficiently. These features make it easier to collect signatures and track the status of your documents, streamlining your tax documentation process.

-

Is airSlate SignNow cost-effective for handling Form 8621 A Rev December IRS Irs?

Yes, airSlate SignNow offers a cost-effective solution for managing Form 8621 A Rev December IRS Irs. With various pricing plans, businesses can choose an option that meets their budget while accessing essential features for digital signing and document management.

-

Can I integrate airSlate SignNow with my current software for Form 8621 A Rev December IRS Irs?

Absolutely! airSlate SignNow integrates seamlessly with various software applications to help you manage Form 8621 A Rev December IRS Irs alongside your current workflows. This allows for greater efficiency and reduces the chances of errors during the documentation process.

-

What are the benefits of using airSlate SignNow for tax-related documents like Form 8621 A Rev December IRS Irs?

Using airSlate SignNow for tax-related documents, such as Form 8621 A Rev December IRS Irs, enhances efficiency and security. Our platform signNowly reduces paperwork, expedites the signing process, and provides a legal trail of completed documents, which is vital for compliance.

-

How secure is airSlate SignNow when dealing with Form 8621 A Rev December IRS Irs?

Security is a top priority at airSlate SignNow. We employ industry-standard encryption and comply with necessary regulations to protect sensitive information related to Form 8621 A Rev December IRS Irs, ensuring that your documents are safe and secure throughout the signing process.

Get more for Form 8621 A Rev December IRS Irs

- Pogil ish plate tectonics answer key form

- Labour department haryana form

- Barnetrygd form

- Cupe 4207 application form department of computer science part

- Membership petition prince hall grand lodge of illinois form

- W 4p rol frs state fl us retirement ftp rol frs state fl form

- Printable caregiver forms

- Form ct 1 302413

Find out other Form 8621 A Rev December IRS Irs

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF