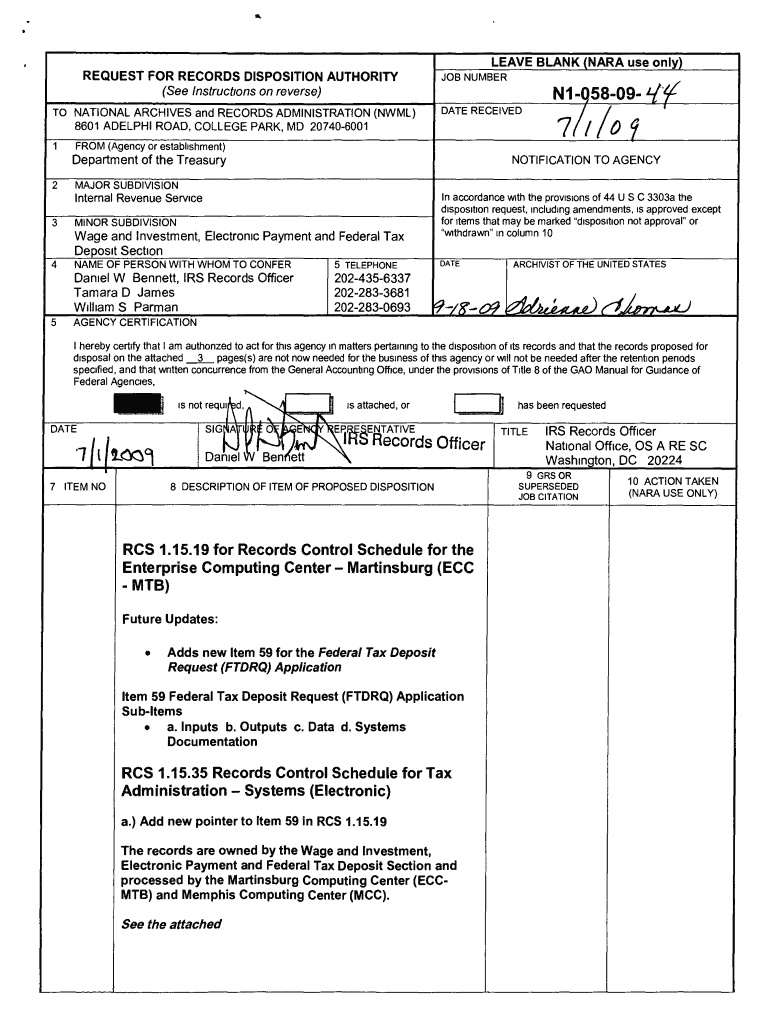

Federal Tax Deposite Request FTDRQ Application Archives Form

What is the Federal Tax Deposite Request FTDRQ Application Archives

The Federal Tax Deposite Request FTDRQ Application Archives is a crucial document used by businesses and individuals to request federal tax deposits. This application serves as a formal request for the Internal Revenue Service (IRS) to process tax payments electronically. It is essential for ensuring compliance with federal tax obligations and maintaining accurate financial records. The archives contain historical data related to these applications, which can be beneficial for audits, financial planning, and tax preparation.

Steps to Complete the Federal Tax Deposite Request FTDRQ Application Archives

Completing the Federal Tax Deposite Request FTDRQ Application Archives involves several key steps:

- Gather necessary information, including your Employer Identification Number (EIN) and tax payment details.

- Access the FTDRQ application form through the IRS website or authorized platforms.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the information for accuracy to prevent any errors that could delay processing.

- Submit the application electronically or print it for mailing, depending on your preference.

Legal Use of the Federal Tax Deposite Request FTDRQ Application Archives

The legal use of the Federal Tax Deposite Request FTDRQ Application Archives is governed by IRS regulations. Businesses must utilize this application to comply with federal tax payment requirements. Failure to submit the FTDRQ application correctly can result in penalties, interest on unpaid taxes, and potential audits. It is essential to understand the legal implications of this form and to maintain accurate records for all submitted applications.

Required Documents for the Federal Tax Deposite Request FTDRQ Application Archives

To successfully complete the Federal Tax Deposite Request FTDRQ Application Archives, certain documents are required:

- Employer Identification Number (EIN) or Social Security Number (SSN) if applicable.

- Financial records that detail the amounts to be deposited.

- Previous tax returns for reference, if necessary.

- Any correspondence from the IRS regarding tax obligations.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Federal Tax Deposite Request FTDRQ Application Archives is essential for compliance. Typically, federal tax deposits are due on a semi-weekly or monthly basis, depending on the taxpayer's classification. It is crucial to stay informed about specific deadlines to avoid penalties. The IRS provides a calendar of due dates that can help taxpayers plan their submissions accordingly.

IRS Guidelines for the Federal Tax Deposite Request FTDRQ Application Archives

The IRS guidelines for the Federal Tax Deposite Request FTDRQ Application Archives outline the procedures and requirements for submitting tax deposits. These guidelines include details on acceptable payment methods, electronic filing procedures, and record-keeping practices. Familiarizing oneself with these guidelines ensures that taxpayers can navigate the application process smoothly and meet all compliance obligations.

Quick guide on how to complete federal tax deposite request ftdrq application archives

Complete [SKS] effortlessly on any device

Digital document management has gained traction among both businesses and individuals. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents swiftly without delays. Manage [SKS] on any platform with airSlate SignNow’s Android or iOS applications and simplify any document-related task today.

How to edit and eSign [SKS] with ease

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Mark important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method of sending your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, the hassle of tedious form searches, or errors that require reprinting new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] to ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Federal Tax Deposite Request FTDRQ Application Archives

Create this form in 5 minutes!

How to create an eSignature for the federal tax deposite request ftdrq application archives

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Federal Tax Deposite Request FTDRQ Application Archives?

The Federal Tax Deposite Request FTDRQ Application Archives is a comprehensive document management solution that allows businesses to easily manage their tax deposit requests. With airSlate SignNow, users can seamlessly access, complete, and track these applications, ensuring that they comply with federal requirements.

-

How can airSlate SignNow improve my experience with the Federal Tax Deposite Request FTDRQ Application Archives?

airSlate SignNow enhances your experience with the Federal Tax Deposite Request FTDRQ Application Archives by providing an intuitive interface for eSigning and managing documents. This improves efficiency and saves time, allowing you to focus on your core business operations.

-

Is there a cost associated with using airSlate SignNow for the Federal Tax Deposite Request FTDRQ Application Archives?

Yes, airSlate SignNow offers tiered pricing plans to accommodate different business needs. The pricing is competitive and provides excellent value for the features included in the Federal Tax Deposite Request FTDRQ Application Archives management solution.

-

Can I integrate other applications with the airSlate SignNow Federal Tax Deposite Request FTDRQ Application Archives?

Absolutely! airSlate SignNow supports various integrations with popular apps, allowing you to streamline your workflows related to the Federal Tax Deposite Request FTDRQ Application Archives. This interconnectivity helps you manage documents more efficiently across platforms.

-

What are the benefits of using airSlate SignNow for the Federal Tax Deposite Request FTDRQ Application Archives?

Using airSlate SignNow for the Federal Tax Deposite Request FTDRQ Application Archives offers multiple benefits, including enhanced document security, quick access to forms, and an improved signing experience. This increases productivity and helps meet regulatory compliance effortlessly.

-

How secure is the airSlate SignNow platform when handling the Federal Tax Deposite Request FTDRQ Application Archives?

airSlate SignNow prioritizes security with industry-standard encryption and compliance measures. You can confidently manage the Federal Tax Deposite Request FTDRQ Application Archives, knowing that your sensitive information is protected at all times.

-

Can multiple users collaborate on the Federal Tax Deposite Request FTDRQ Application Archives using airSlate SignNow?

Yes, airSlate SignNow allows multiple users to collaborate on the Federal Tax Deposite Request FTDRQ Application Archives efficiently. This collaborative feature enhances teamwork, ensuring that all comments and revisions are managed in one unified platform.

Get more for Federal Tax Deposite Request FTDRQ Application Archives

- Vermont dmv form vg 168

- Patients name date of birth dob ct gov form

- Gd11 excavations checklist citb form

- How to fill beneficiary nomination form

- Venue challenge letter file lacounty form

- The ocp field guide operation college promise form

- Safety task assignment 418827865 form

- A 5accommodations interventions strategies worksheetdoc form

Find out other Federal Tax Deposite Request FTDRQ Application Archives

- How Do I Implement eSignature in Plumbing

- How To Use Electronic signature in Banking

- How To Integrate Electronic signature in Banking

- How To Install Electronic signature in Banking

- How To Add Electronic signature in Banking

- How To Set Up Electronic signature in Banking

- How To Save Electronic signature in Banking

- How To Implement Electronic signature in Banking

- Can I Implement Electronic signature in Car Dealer

- How To Install Electronic signature in Charity

- How To Add Electronic signature in Charity

- How To Set Up Electronic signature in Charity

- How To Save Electronic signature in Charity

- How To Use Electronic signature in Construction

- How To Implement Electronic signature in Charity

- How To Set Up Electronic signature in Construction

- How To Integrate Electronic signature in Doctors

- How To Use Electronic signature in Doctors

- How To Install Electronic signature in Doctors

- How To Add Electronic signature in Doctors