LOUISIANA Nonresident and Part Year Resident Revenue Louisiana Form

What is the LOUISIANA Nonresident And Part year Resident Revenue Louisiana

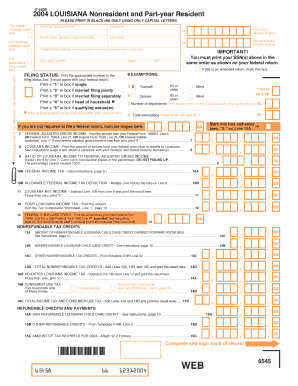

The LOUISIANA Nonresident And Part year Resident Revenue Louisiana form is a tax document specifically designed for individuals who do not reside in Louisiana for the entire tax year but earn income within the state. This form allows nonresidents and part-year residents to report their Louisiana-sourced income and calculate the appropriate tax liability. Understanding this form is essential for compliance with state tax laws and ensuring that individuals pay the correct amount of taxes based on their earnings in Louisiana.

How to use the LOUISIANA Nonresident And Part year Resident Revenue Louisiana

Using the LOUISIANA Nonresident And Part year Resident Revenue Louisiana form involves several steps. First, gather all relevant financial documents, including W-2s and 1099s that reflect income earned in Louisiana. Next, accurately fill out the form by entering personal information, income details, and any applicable deductions. It is crucial to follow the instructions carefully to ensure that all information is reported correctly. After completing the form, review it for accuracy before submitting it to the Louisiana Department of Revenue.

Steps to complete the LOUISIANA Nonresident And Part year Resident Revenue Louisiana

Completing the LOUISIANA Nonresident And Part year Resident Revenue Louisiana form requires a systematic approach:

- Gather necessary documents, such as income statements and previous tax returns.

- Fill in personal identification information, including your name, address, and Social Security number.

- Report all income earned in Louisiana, ensuring to include wages, interest, and dividends.

- Apply any eligible deductions or credits that may reduce your taxable income.

- Calculate the total tax owed based on the provided tax tables or formulas.

- Sign and date the form before submission.

Key elements of the LOUISIANA Nonresident And Part year Resident Revenue Louisiana

Several key elements are essential when filling out the LOUISIANA Nonresident And Part year Resident Revenue Louisiana form:

- Personal Information: Accurate identification details are crucial for processing.

- Income Reporting: All income sourced from Louisiana must be reported, including wages and investment income.

- Deductions: Eligible deductions can significantly impact the total tax liability.

- Filing Status: Indicate whether you are filing as a nonresident or part-year resident.

Required Documents

To successfully complete the LOUISIANA Nonresident And Part year Resident Revenue Louisiana form, individuals must prepare several documents:

- W-2 forms from employers for income earned in Louisiana.

- 1099 forms for any freelance or contract work completed in the state.

- Documentation of any deductions claimed, such as receipts or statements.

- Previous year tax returns, if applicable, for reference.

Filing Deadlines / Important Dates

Filing deadlines for the LOUISIANA Nonresident And Part year Resident Revenue Louisiana form align with standard tax deadlines. Typically, the form must be submitted by April fifteenth of the following year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to stay informed about any changes to deadlines announced by the Louisiana Department of Revenue to avoid late penalties.

Quick guide on how to complete louisiana nonresident and part year resident revenue louisiana

Effortlessly Prepare [SKS] on Any Device

The management of online documents has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to easily locate the right form and securely keep it online. airSlate SignNow provides you with all the necessary tools to swiftly create, modify, and eSign your documents without delays. Handle [SKS] on any platform using the airSlate SignNow Android or iOS applications and simplify your document-based tasks today.

The Easiest Way to Modify and eSign [SKS] with Ease

- Acquire [SKS] and click on Get Form to start.

- Utilize the tools we provide to fill out your form.

- Mark important sections of your documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign feature, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method for sending your form: by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tiresome searches for forms, or errors that require printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you select. Modify and eSign [SKS] to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to LOUISIANA Nonresident And Part year Resident Revenue Louisiana

Create this form in 5 minutes!

How to create an eSignature for the louisiana nonresident and part year resident revenue louisiana

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the LOUISIANA Nonresident And Part year Resident Revenue Louisiana?

The LOUISIANA Nonresident And Part year Resident Revenue Louisiana refers to the tax obligations and responsibilities for individuals who do not reside in Louisiana for the full year. It is essential for these individuals to understand their tax liabilities while utilizing services, such as airSlate SignNow, to manage their documents efficiently.

-

How can airSlate SignNow assist with LOUISIANA Nonresident And Part year Resident Revenue Louisiana tax forms?

airSlate SignNow provides an easy-to-use platform that enables you to complete and eSign any necessary LOUISIANA Nonresident And Part year Resident Revenue Louisiana tax forms. Our intuitive features simplify the process, ensuring you can manage your documentation effectively and meet deadlines.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans designed to fit the needs of different users, whether you're filing LOUISIANA Nonresident And Part year Resident Revenue Louisiana or managing multiple agreements. Each plan includes essential features that help you streamline eSigning and document management.

-

Does airSlate SignNow offer integrations with other software for LOUISIANA Nonresident And Part year Resident Revenue Louisiana?

Yes, airSlate SignNow integrates seamlessly with numerous applications, making it easier to manage your LOUISIANA Nonresident And Part year Resident Revenue Louisiana-related documents. This allows you to connect with your favorite tools and streamline your workflow for efficiency and accuracy.

-

What features make airSlate SignNow effective for handling LOUISIANA Nonresident And Part year Resident Revenue Louisiana documents?

airSlate SignNow includes advanced features like customizable templates, secure eSigning, and automated workflows. These tools are particularly beneficial for managing LOUISIANA Nonresident And Part year Resident Revenue Louisiana documents, ensuring compliance and timely submissions.

-

How secure is airSlate SignNow when dealing with LOUISIANA Nonresident And Part year Resident Revenue Louisiana?

airSlate SignNow prioritizes security, implementing multiple layers of protection for your LOUISIANA Nonresident And Part year Resident Revenue Louisiana documents. Our platform is compliant with industry standards, ensuring that your sensitive information is always kept safe.

-

Can I access airSlate SignNow on mobile devices for LOUISIANA Nonresident And Part year Resident Revenue Louisiana tasks?

Absolutely! airSlate SignNow is mobile-friendly, allowing you to handle your LOUISIANA Nonresident And Part year Resident Revenue Louisiana tasks on the go. This flexibility ensures you can manage documentation whenever and wherever you need.

Get more for LOUISIANA Nonresident And Part year Resident Revenue Louisiana

Find out other LOUISIANA Nonresident And Part year Resident Revenue Louisiana

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile