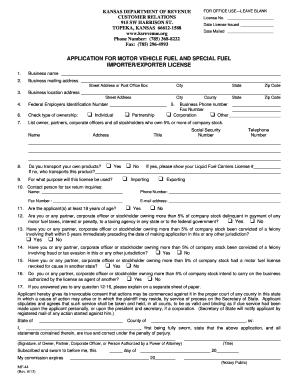

Import Export Application Kansas Department of Revenue Ksrevenue Form

What is the Import Export Application Kansas Department Of Revenue Ksrevenue

The Import Export Application from the Kansas Department of Revenue is a crucial document for businesses engaged in international trade. This application allows companies to register for the necessary permits and licenses required to import and export goods legally within and outside the United States. By completing this application, businesses ensure compliance with state and federal regulations, facilitating smoother trade operations.

Steps to complete the Import Export Application Kansas Department Of Revenue Ksrevenue

Completing the Import Export Application involves several key steps:

- Gather all necessary business information, including your federal Employer Identification Number (EIN).

- Provide details about the types of goods you intend to import or export.

- Complete the application form accurately, ensuring all sections are filled out to avoid delays.

- Review the application for any errors or omissions before submission.

- Submit the application through the designated method, whether online, by mail, or in person.

Required Documents for the Import Export Application Kansas Department Of Revenue Ksrevenue

When applying for the Import Export Application, certain documents are essential to support your application. These typically include:

- A valid federal Employer Identification Number (EIN).

- Proof of business registration, such as articles of incorporation or partnership agreements.

- Details of the products you plan to import or export, including any relevant licenses.

- Financial statements or other documentation that may be required by the Kansas Department of Revenue.

Eligibility Criteria for the Import Export Application Kansas Department Of Revenue Ksrevenue

Eligibility for the Import Export Application is generally based on several factors:

- The applicant must be a registered business entity in Kansas.

- The business must have a valid federal EIN.

- The applicant must comply with all local, state, and federal regulations related to import and export activities.

Form Submission Methods for the Import Export Application Kansas Department Of Revenue Ksrevenue

The Import Export Application can be submitted through various methods to accommodate different preferences:

- Online submission via the Kansas Department of Revenue's official website.

- Mailing the completed application to the appropriate department address.

- In-person submission at designated state offices for direct assistance.

Legal use of the Import Export Application Kansas Department Of Revenue Ksrevenue

The legal use of the Import Export Application is vital for ensuring compliance with trade laws. By utilizing this application, businesses can avoid potential fines and penalties associated with unauthorized import or export activities. It is essential to adhere to the guidelines set forth by the Kansas Department of Revenue and maintain accurate records of all transactions related to the application.

Quick guide on how to complete import export application kansas department of revenue ksrevenue

Complete [SKS] effortlessly on any device

Online document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly and without delays. Manage [SKS] on any platform using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign [SKS] effortlessly

- Obtain [SKS] and click on Get Form to begin.

- Use the tools we provide to complete your form.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Select how you would like to send your form, whether via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Modify and eSign [SKS] to ensure excellent communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Import Export Application Kansas Department Of Revenue Ksrevenue

Create this form in 5 minutes!

How to create an eSignature for the import export application kansas department of revenue ksrevenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Import Export Application Kansas Department Of Revenue Ksrevenue?

The Import Export Application Kansas Department Of Revenue Ksrevenue is a streamlined solution designed for businesses to manage their import and export documentation more efficiently. This application helps ensure compliance with state regulations while simplifying the submission process for exporters and importers.

-

How does airSlate SignNow support the Import Export Application Kansas Department Of Revenue Ksrevenue?

airSlate SignNow provides a user-friendly platform that allows businesses to eSign and send documents related to the Import Export Application Kansas Department Of Revenue Ksrevenue securely. The solution ensures that all necessary paperwork is completed accurately, saving time and reducing the risk of compliance issues.

-

What are the pricing options for airSlate SignNow with the Import Export Application Kansas Department Of Revenue Ksrevenue?

airSlate SignNow offers flexible pricing plans that cater to various business sizes. You can choose a plan that best fits your needs when handling the Import Export Application Kansas Department Of Revenue Ksrevenue, ensuring an affordable solution without compromising on features.

-

Are there any specific features for the Import Export Application Kansas Department Of Revenue Ksrevenue within airSlate SignNow?

Yes, airSlate SignNow includes features specifically designed for the Import Export Application Kansas Department Of Revenue Ksrevenue, such as template creation, bulk sending of documents, and automated reminders. These features help streamline your document workflow and improve efficiency.

-

How can airSlate SignNow benefit my business when dealing with the Import Export Application Kansas Department Of Revenue Ksrevenue?

Utilizing airSlate SignNow for the Import Export Application Kansas Department Of Revenue Ksrevenue can signNowly enhance your operational efficiency. The platform reduces processing times and paper usage, allowing your team to focus on core business activities while ensuring compliance with state regulations.

-

Does airSlate SignNow integrate with other platforms for the Import Export Application Kansas Department Of Revenue Ksrevenue?

Absolutely! airSlate SignNow offers seamless integrations with various business applications, making it easy to manage the Import Export Application Kansas Department Of Revenue Ksrevenue alongside your existing systems. This connectivity helps streamline processes and enhances overall productivity.

-

What security measures are in place for the Import Export Application Kansas Department Of Revenue Ksrevenue when using airSlate SignNow?

airSlate SignNow prioritizes security with advanced encryption and compliance with industry standards. When handling the Import Export Application Kansas Department Of Revenue Ksrevenue, you can trust that your documents and sensitive information are protected at all times.

Get more for Import Export Application Kansas Department Of Revenue Ksrevenue

Find out other Import Export Application Kansas Department Of Revenue Ksrevenue

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document