TRS 6 Application for Refund Special IRS Tax Notice Regarding TRS Payments Form TRS 6 Application for Refund Special IR 2017

What is the TRS 6 Application For Refund Special IRS Tax Notice Regarding TRS Payments?

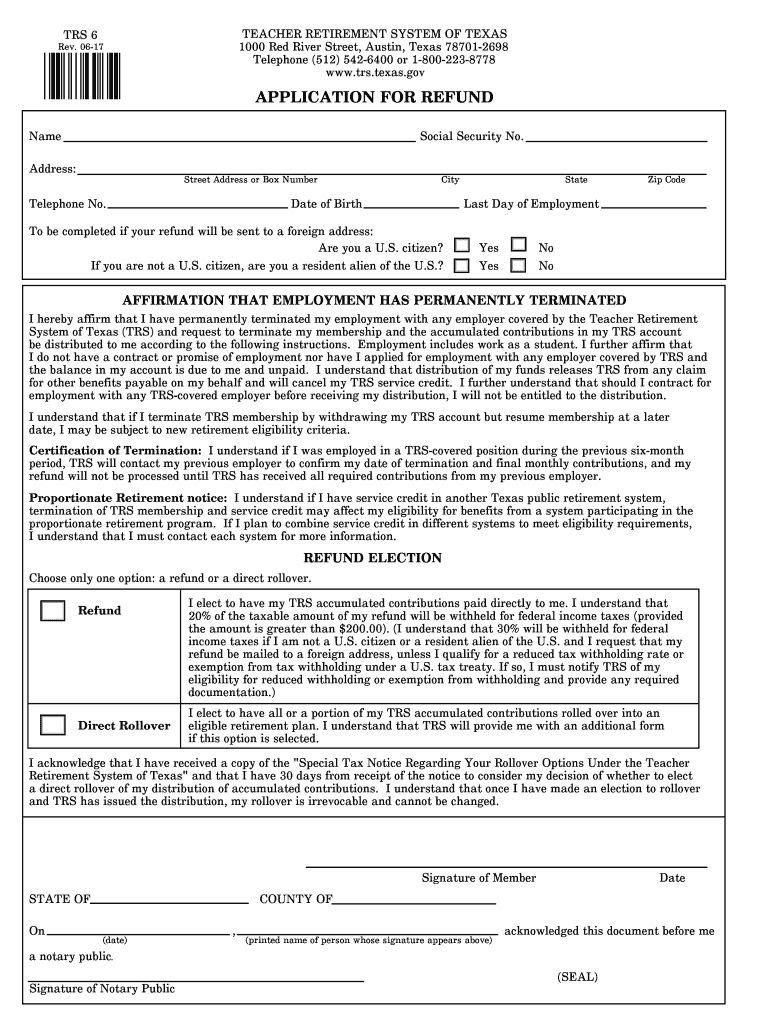

The TRS 6 Application For Refund Special IRS Tax Notice Regarding TRS Payments is a specific form designed for taxpayers seeking refunds related to TRS payments. This form is essential for individuals who have overpaid or are eligible for a refund due to adjustments in their tax situation. It serves as a formal request to the IRS, detailing the reasons for the refund and providing necessary information to process the claim efficiently. Understanding the purpose of this form is crucial for ensuring compliance with IRS regulations and facilitating a smooth refund process.

Steps to Complete the TRS 6 Application For Refund Special IRS Tax Notice

Completing the TRS 6 Application For Refund involves several important steps to ensure accuracy and compliance. First, gather all necessary documentation, including previous tax returns and any relevant TRS payment records. Next, accurately fill out the form, ensuring that all information is complete and correct. Pay special attention to the sections that require detailed explanations of the refund request. After completing the form, review it thoroughly for any errors or omissions. Finally, sign the form electronically using a secure eSignature solution to ensure it meets IRS requirements.

Legal Use of the TRS 6 Application For Refund Special IRS Tax Notice

The TRS 6 Application For Refund is legally recognized by the IRS as a valid document for requesting refunds. It is important to ensure that the form is completed in accordance with IRS guidelines to maintain its legal standing. Submitting this form electronically with a compliant eSignature enhances its validity and expedites processing. Taxpayers must also retain copies of the completed form and any supporting documents for their records, as this may be necessary for future reference or in case of an audit.

IRS Guidelines for the TRS 6 Application For Refund

The IRS has established specific guidelines for completing and submitting the TRS 6 Application For Refund. These guidelines include requirements for the information to be provided, the format of submission, and acceptable methods of signature. It is essential for taxpayers to familiarize themselves with these guidelines to avoid delays in processing. The IRS encourages the use of electronic signatures for efficiency and security, which aligns with their efforts to streamline tax processes and reduce the need for physical paperwork.

Filing Deadlines for the TRS 6 Application For Refund

Filing deadlines for the TRS 6 Application For Refund are critical to ensure timely processing of refund requests. Taxpayers should be aware of the specific dates set by the IRS for submission, which may vary based on individual circumstances. Generally, it is advisable to submit the form as soon as the need for a refund is identified to avoid missing any deadlines. Keeping track of these important dates helps taxpayers manage their tax obligations effectively and ensures compliance with IRS regulations.

Required Documents for the TRS 6 Application For Refund

When submitting the TRS 6 Application For Refund, taxpayers must include certain required documents to support their request. These documents typically include proof of TRS payments, previous tax returns, and any correspondence related to the refund. Providing comprehensive documentation helps the IRS verify the claim and expedites the refund process. It is advisable to organize these documents carefully and ensure they are readily available when completing the application.

Quick guide on how to complete trs 6 application for refund special irs tax notice regarding trs payments form trs 6 application for refund special irs tax

Your assistance manual on preparing your TRS 6 Application For Refund Special IRS Tax Notice Regarding TRS Payments Form TRS 6 Application For Refund Special IR

If you are looking to learn how to create and submit your TRS 6 Application For Refund Special IRS Tax Notice Regarding TRS Payments Form TRS 6 Application For Refund Special IR, here are some brief instructions to simplify tax filing.

To begin, simply sign up for your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an exceptionally intuitive and effective document solution that enables you to edit, generate, and complete your income tax forms with ease. With its editor, you can toggle between text, checkboxes, and electronic signatures, and revisit to modify details as necessary. Enhance your tax handling with advanced PDF editing, eSigning, and straightforward sharing.

Follow the instructions below to complete your TRS 6 Application For Refund Special IRS Tax Notice Regarding TRS Payments Form TRS 6 Application For Refund Special IR in just a few minutes:

- Create your account and start editing PDFs in no time.

- Utilize our directory to locate any IRS tax form; browse through updates and schedules.

- Click Retrieve form to access your TRS 6 Application For Refund Special IRS Tax Notice Regarding TRS Payments Form TRS 6 Application For Refund Special IR in our editor.

- Populate the required fields with your information (text, figures, checkmarks).

- Employ the Signature Tool to add your legally recognized eSignature (if required).

- Examine your document and amend any errors.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Use this manual to file your taxes electronically with airSlate SignNow. Be aware that paper filing may lead to increased errors and delayed refunds. Certainly, before e-filing your taxes, verify the IRS website for submission guidelines specific to your state.

Create this form in 5 minutes or less

Find and fill out the correct trs 6 application for refund special irs tax notice regarding trs payments form trs 6 application for refund special irs tax

Create this form in 5 minutes!

How to create an eSignature for the trs 6 application for refund special irs tax notice regarding trs payments form trs 6 application for refund special irs tax

How to make an eSignature for the Trs 6 Application For Refund Special Irs Tax Notice Regarding Trs Payments Form Trs 6 Application For Refund Special Irs Tax online

How to create an electronic signature for the Trs 6 Application For Refund Special Irs Tax Notice Regarding Trs Payments Form Trs 6 Application For Refund Special Irs Tax in Google Chrome

How to create an electronic signature for putting it on the Trs 6 Application For Refund Special Irs Tax Notice Regarding Trs Payments Form Trs 6 Application For Refund Special Irs Tax in Gmail

How to generate an eSignature for the Trs 6 Application For Refund Special Irs Tax Notice Regarding Trs Payments Form Trs 6 Application For Refund Special Irs Tax straight from your smartphone

How to create an eSignature for the Trs 6 Application For Refund Special Irs Tax Notice Regarding Trs Payments Form Trs 6 Application For Refund Special Irs Tax on iOS

How to generate an eSignature for the Trs 6 Application For Refund Special Irs Tax Notice Regarding Trs Payments Form Trs 6 Application For Refund Special Irs Tax on Android devices

People also ask

-

What is the TRS 6 Application For Refund Special IRS Tax Notice Regarding TRS Payments?

The TRS 6 Application For Refund Special IRS Tax Notice Regarding TRS Payments is a specific form used for requesting refunds from the IRS concerning TRS payments. It outlines the eligibility and the necessary documentation required for processing your refund efficiently.

-

How do I complete the TRS 6 Application For Refund Special IRS Tax Notice Regarding TRS Payments form?

Completing the TRS 6 Application For Refund Special IRS Tax Notice Regarding TRS Payments form requires gathering relevant financial documentation and filling out personal and payment details accurately. For guidance, refer to the instructions provided on the IRS website or consult a tax professional.

-

What are the benefits of using the airSlate SignNow platform for the TRS 6 Application For Refund process?

Using airSlate SignNow for the TRS 6 Application For Refund process simplifies document management with easy eSigning and tracking features. It's a cost-effective solution that contributes to a seamless and efficient refund request experience.

-

Are there any costs associated with filing the TRS 6 Application For Refund Special IRS Tax Notice?

While there is no fee to file the TRS 6 Application For Refund Special IRS Tax Notice, using airSlate SignNow may involve subscription costs. However, the value it provides through document management and eSigning capabilities can save time and resources.

-

Can I integrate airSlate SignNow with other applications for processing my TRS 6 Application For Refund?

Yes, airSlate SignNow offers integrations with various platforms such as Google Drive, Dropbox, and CRM systems. This allows you to manage your TRS 6 Application For Refund Special IRS Tax Notice effectively alongside your other business applications.

-

How secure is my information when using airSlate SignNow for the TRS 6 Application For Refund?

airSlate SignNow prioritizes user security by implementing advanced encryption protocols and secure login processes. This ensures that your sensitive information related to the TRS 6 Application For Refund Special IRS Tax Notice remains protected.

-

What features does airSlate SignNow provide that can enhance the TRS 6 Application For Refund experience?

airSlate SignNow features include customizable templates, in-app notifications, and robust audit trails. These functionalities streamline the TRS 6 Application For Refund Special IRS Tax Notice process, improving efficiency and organization.

Get more for TRS 6 Application For Refund Special IRS Tax Notice Regarding TRS Payments Form TRS 6 Application For Refund Special IR

- Icsa crematorium form

- Peacehealth financial assistance income guidelines form

- Ogle donna m kwl in action secondary teachers find applications that work form

- Wender utah rating scale pdf form

- Epa 190 f 04 001 form

- Download the questionnaire landmark spirituality and health survey form

- Costume measurement sheet male form

- Scrum working agreement template form

Find out other TRS 6 Application For Refund Special IRS Tax Notice Regarding TRS Payments Form TRS 6 Application For Refund Special IR

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors