8300 SP Informe De Pagos En Efectivo En Exceso De $10000

What is the 8300 SP Informe De Pagos En Efectivo En Exceso De $10000

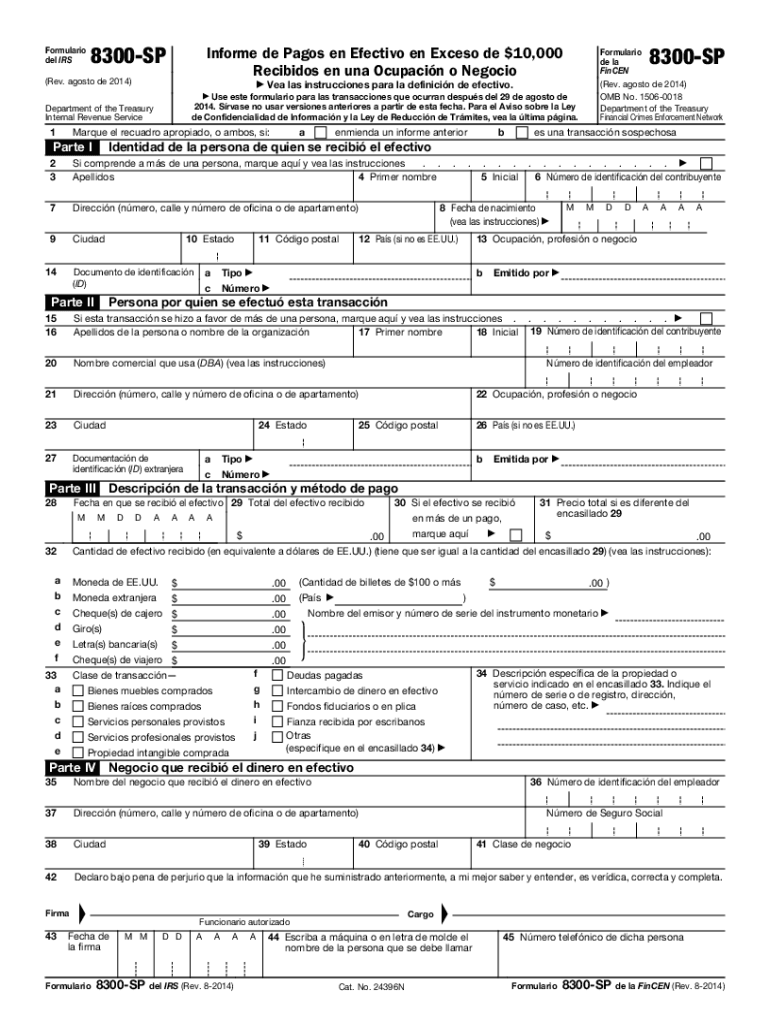

The 8300 SP Informe De Pagos En Efectivo En Exceso De $10000 is a form used by businesses in the United States to report cash payments exceeding ten thousand dollars. This form is essential for compliance with the Bank Secrecy Act, which aims to prevent money laundering and other financial crimes. By filing this form, businesses provide the Internal Revenue Service (IRS) with information about large cash transactions, helping to maintain transparency in financial activities.

Steps to complete the 8300 SP Informe De Pagos En Efectivo En Exceso De $10000

Completing the 8300 SP Informe De Pagos En Efectivo En Exceso De $10000 involves several steps:

- Gather necessary information about the transaction, including the payer's name, address, and Social Security number or taxpayer identification number.

- Document the amount of cash received and the date of the transaction.

- Fill out the form accurately, ensuring all required fields are completed.

- Submit the form to the IRS within the required timeframe, typically within fifteen days of the transaction.

Key elements of the 8300 SP Informe De Pagos En Efectivo En Exceso De $10000

Understanding the key elements of the 8300 SP Informe De Pagos En Efectivo En Exceso De $10000 is crucial for accurate reporting. The form requires:

- Payer's identification details, including name and address.

- Transaction details, such as the date and amount of cash received.

- Information about the business receiving the payment.

- Signature of the individual completing the form to certify its accuracy.

Legal use of the 8300 SP Informe De Pagos En Efectivo En Exceso De $10000

The legal use of the 8300 SP Informe De Pagos En Efectivo En Exceso De $10000 is mandated by federal law. Businesses are required to file this form when they receive cash payments of more than ten thousand dollars in a single transaction or related transactions. Failing to comply with this requirement can lead to significant penalties, including fines and potential legal action. It is crucial for businesses to understand their obligations under the law to avoid non-compliance.

Filing Deadlines / Important Dates

Filing deadlines for the 8300 SP Informe De Pagos En Efectivo En Exceso De $10000 are critical for compliance. The form must be submitted to the IRS within fifteen days of the cash transaction. Additionally, businesses should keep a copy of the form for their records. It is advisable to mark the calendar for these deadlines to ensure timely submission and avoid penalties.

Penalties for Non-Compliance

Non-compliance with the filing requirements of the 8300 SP Informe De Pagos En Efectivo En Exceso De $10000 can result in severe penalties. Businesses may face fines for failing to file the form or for filing it late. The IRS can impose penalties ranging from hundreds to thousands of dollars, depending on the severity of the violation. It is important for businesses to prioritize compliance to avoid these financial repercussions.

Quick guide on how to complete 8300 sp informe de pagos en efectivo en exceso de 10000

Complete 8300 SP Informe De Pagos En Efectivo En Exceso De $10000 seamlessly on any device

Managing documents online has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct format and securely keep it online. airSlate SignNow supplies you with all the tools necessary to create, alter, and electronically sign your documents quickly without delays. Handle 8300 SP Informe De Pagos En Efectivo En Exceso De $10000 on any device using airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

How to alter and electronically sign 8300 SP Informe De Pagos En Efectivo En Exceso De $10000 effortlessly

- Locate 8300 SP Informe De Pagos En Efectivo En Exceso De $10000 and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose your preferred method to submit your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign 8300 SP Informe De Pagos En Efectivo En Exceso De $10000 to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 8300 sp informe de pagos en efectivo en exceso de 10000

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 8300 SP Informe De Pagos En Efectivo En Exceso De $10000?

The 8300 SP Informe De Pagos En Efectivo En Exceso De $10000 is a form used to report cash transactions over $10,000 to the IRS. This form is essential for businesses to maintain compliance and avoid penalties. By using airSlate SignNow, you can streamline the eSigning process of these documents efficiently.

-

How does airSlate SignNow help with the 8300 SP Informe De Pagos En Efectivo En Exceso De $10000?

airSlate SignNow simplifies the process of signing and sending the 8300 SP Informe De Pagos En Efectivo En Exceso De $10000. Our platform offers easy document management, allowing you to quickly gather signatures, track statuses, and ensure timely compliance. This saves you time and increases productivity.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to fit the needs of any business. Each plan includes features to help you manage the 8300 SP Informe De Pagos En Efectivo En Exceso De $10000 and other important documents efficiently. You can choose a plan based on your user volume and required features.

-

Can I integrate airSlate SignNow with other tools for tax compliance?

Yes, airSlate SignNow seamlessly integrates with popular accounting and tax software, making the management of the 8300 SP Informe De Pagos En Efectivo En Exceso De $10000 easier. This integration allows data to flow smoothly between systems, reducing data entry errors and improving accuracy.

-

What are the benefits of using airSlate SignNow for tax reporting?

Using airSlate SignNow for tax reporting, including the 8300 SP Informe De Pagos En Efectivo En Exceso De $10000, allows for greater efficiency and accuracy. Our platform enables automated workflows, reduces paperwork, and provides real-time tracking for document statuses. This streamlines your tax compliance efforts.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Absolutely! airSlate SignNow employs advanced security measures to protect sensitive information associated with the 8300 SP Informe De Pagos En Efectivo En Exceso De $10000. Our platform is compliant with industry standards and ensures that your data remains confidential and secure during transmission and storage.

-

How quickly can I complete the 8300 SP Informe De Pagos En Efectivo En Exceso De $10000 using airSlate SignNow?

With airSlate SignNow, you can complete the 8300 SP Informe De Pagos En Efectivo En Exceso De $10000 in minutes instead of hours. Our intuitive interface allows you to send documents for signature quickly, and real-time notifications help you track their progress. This quick turnaround supports timely compliance with IRS requirements.

Get more for 8300 SP Informe De Pagos En Efectivo En Exceso De $10000

- Ltcc transcript form

- Eastern form health

- Gary finkas scholarship application toutle lake school district form

- Ramapo college transcript form

- Thank a teacher written form print and mail tenafly public sites tenafly k12 nj

- Iusb housing application form

- Kirklin clinic authorization form

- Cleaning checklist printable form

Find out other 8300 SP Informe De Pagos En Efectivo En Exceso De $10000

- Can I eSign Oklahoma Online Donation Form

- How Can I Electronic signature North Dakota Claim

- How Do I eSignature Virginia Notice to Stop Credit Charge

- How Do I eSignature Michigan Expense Statement

- How Can I Electronic signature North Dakota Profit Sharing Agreement Template

- Electronic signature Ohio Profit Sharing Agreement Template Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Secure

- Electronic signature Florida Amendment to an LLC Operating Agreement Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Simple

- Electronic signature Florida Amendment to an LLC Operating Agreement Safe

- How Can I eSignature South Carolina Exchange of Shares Agreement

- Electronic signature Michigan Amendment to an LLC Operating Agreement Computer

- Can I Electronic signature North Carolina Amendment to an LLC Operating Agreement

- Electronic signature South Carolina Amendment to an LLC Operating Agreement Safe

- Can I Electronic signature Delaware Stock Certificate

- Electronic signature Massachusetts Stock Certificate Simple

- eSignature West Virginia Sale of Shares Agreement Later

- Electronic signature Kentucky Affidavit of Service Mobile

- How To Electronic signature Connecticut Affidavit of Identity

- Can I Electronic signature Florida Affidavit of Title