Irs Form 1041 Schedule D 1

What is the IRS Form 1041 Schedule D 1

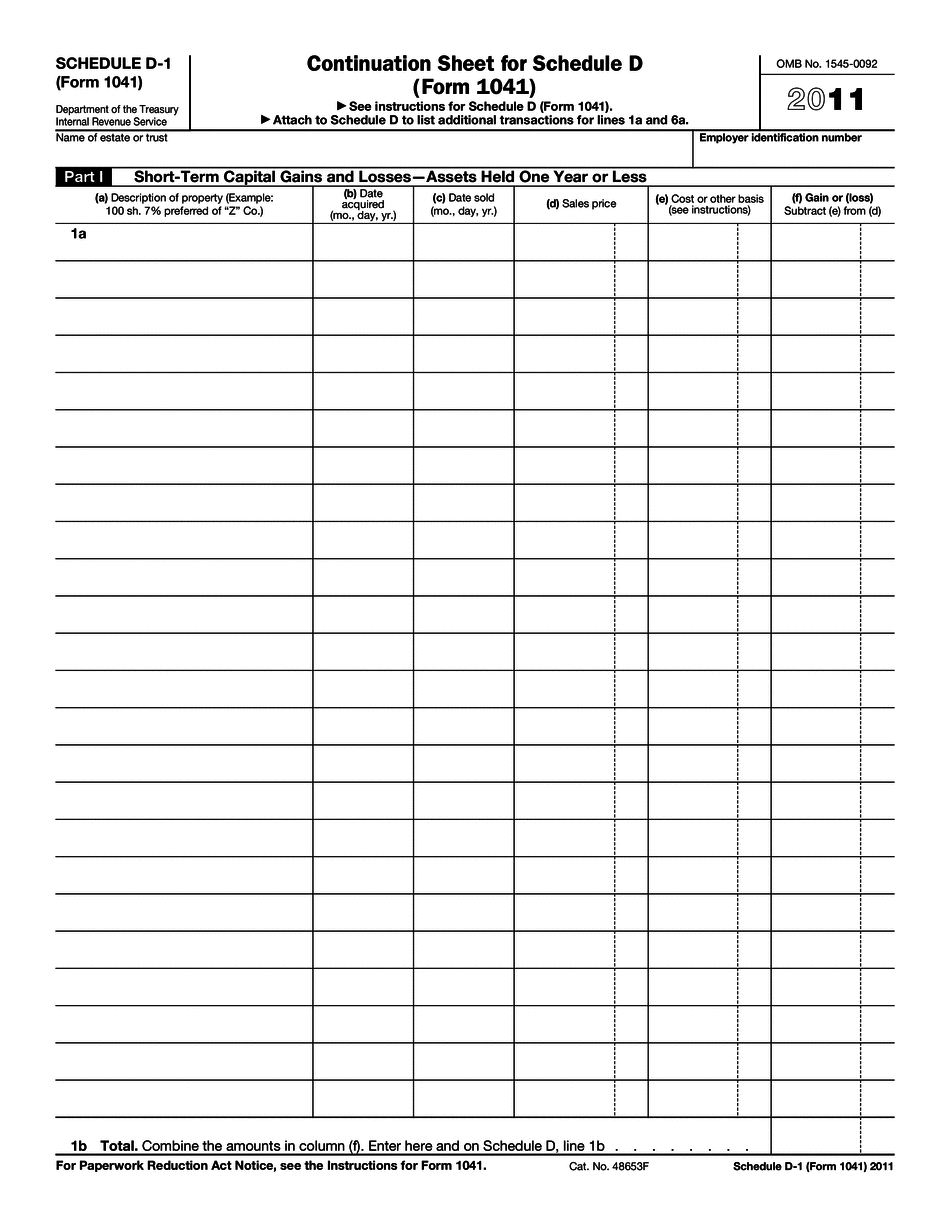

The IRS Form 1041 Schedule D 1 is a tax form used by estates and trusts to report capital gains and losses. This form is essential for accurately calculating the taxable income of an estate or trust, particularly when it involves the sale of assets. It allows the fiduciary to detail transactions involving capital assets, ensuring compliance with federal tax regulations. Understanding this form is crucial for proper tax reporting and can help in minimizing tax liabilities for beneficiaries.

How to use the IRS Form 1041 Schedule D 1

Using the IRS Form 1041 Schedule D 1 involves several steps to ensure accurate reporting of capital gains and losses. First, gather all necessary documentation related to the estate's or trust's capital assets. This includes purchase and sale records, along with any relevant financial statements. Next, complete the form by entering details about each transaction, including dates, amounts, and asset descriptions. Finally, ensure that the completed form is submitted along with the main Form 1041 by the designated filing deadline.

Steps to complete the IRS Form 1041 Schedule D 1

Completing the IRS Form 1041 Schedule D 1 requires careful attention to detail. Here are the steps to follow:

- Gather all documentation related to capital transactions.

- List each asset sold during the tax year, including the date of sale and sale price.

- Calculate the cost basis for each asset, which includes the purchase price and any associated costs.

- Determine the gain or loss for each transaction by subtracting the cost basis from the sale price.

- Complete the form by entering the total gains and losses in the appropriate sections.

- Review the completed form for accuracy before submission.

Legal use of the IRS Form 1041 Schedule D 1

The legal use of the IRS Form 1041 Schedule D 1 is governed by federal tax laws. It is essential for fiduciaries to use this form to report capital gains and losses accurately. Failure to do so can result in penalties and interest on unpaid taxes. Additionally, the form must be filed in accordance with the IRS guidelines to ensure that the estate or trust remains compliant with tax obligations. Proper use of this form not only fulfills legal requirements but also helps in maintaining transparency for beneficiaries.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form 1041 Schedule D 1 are critical for compliance. Generally, the form is due on the 15th day of the fourth month following the close of the tax year. For estates and trusts operating on a calendar year, this typically means the deadline is April 15. If the deadline falls on a weekend or holiday, it is extended to the next business day. It is important to keep track of these dates to avoid late filing penalties and ensure timely processing of tax returns.

Form Submission Methods (Online / Mail / In-Person)

The IRS Form 1041 Schedule D 1 can be submitted through various methods. Taxpayers have the option to file electronically through approved e-filing software, which can streamline the process and reduce errors. Alternatively, the form can be printed and mailed to the IRS at the address specified in the form instructions. Some taxpayers may also choose to deliver their forms in person to a local IRS office, although this is less common. Each method has its benefits, and choosing the right one depends on individual preferences and circumstances.

Quick guide on how to complete 2011 irs form 1041 schedule d 1

Effortlessly Prepare Irs Form 1041 Schedule D 1 on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers a superb eco-friendly substitute for conventional printed and signed documents, allowing you to locate the correct form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage Irs Form 1041 Schedule D 1 on any device using airSlate SignNow’s Android or iOS applications and simplify any document-related process today.

How to Edit and eSign Irs Form 1041 Schedule D 1 with Ease

- Obtain Irs Form 1041 Schedule D 1 and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), an invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign Irs Form 1041 Schedule D 1 and guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How can I deduct on my Federal income taxes massage therapy for my chronic migraines? Is there some form to fill out to the IRS for permission?

As long as your doctor prescribed this, it is tax deductible under the category for medical expenses. There is no IRS form for permission.

-

According to instructions, if you earn less than $1,500, say $15 in interest, you don't have to fill out a Schedule B--if it's ordinary income, where do you put it on the new forms? (I know the government won't give up a penny in tax.)

If you have less than $1500 in interest income, and do not attach Schedule B, you should report your total taxable interest directly on Form 1040, Line 2b.

Create this form in 5 minutes!

How to create an eSignature for the 2011 irs form 1041 schedule d 1

How to make an eSignature for your 2011 Irs Form 1041 Schedule D 1 online

How to create an eSignature for your 2011 Irs Form 1041 Schedule D 1 in Google Chrome

How to create an eSignature for putting it on the 2011 Irs Form 1041 Schedule D 1 in Gmail

How to make an electronic signature for the 2011 Irs Form 1041 Schedule D 1 straight from your mobile device

How to make an eSignature for the 2011 Irs Form 1041 Schedule D 1 on iOS devices

How to make an eSignature for the 2011 Irs Form 1041 Schedule D 1 on Android devices

People also ask

-

What is the Irs Form 1041 Schedule D 1 and why is it important?

The Irs Form 1041 Schedule D 1 is a tax form used for reporting capital gains and losses for estates and trusts. It is important for ensuring accurate tax filings and compliance with IRS regulations. By utilizing airSlate SignNow, you can effortlessly eSign and send your Irs Form 1041 Schedule D 1, ensuring a smooth and efficient process.

-

How can airSlate SignNow help me with my Irs Form 1041 Schedule D 1?

airSlate SignNow provides an easy-to-use platform for preparing and eSigning documents like the Irs Form 1041 Schedule D 1. You can streamline your workflow by sending this form for signature with just a few clicks, saving time and hassle in the tax filing process.

-

Is there a cost associated with using airSlate SignNow for the Irs Form 1041 Schedule D 1?

Yes, airSlate SignNow offers a variety of pricing plans to cater to different needs, including options for individuals and businesses. Pricing is competitive and provides access to features that simplify the management of documents like the Irs Form 1041 Schedule D 1, making it a cost-effective solution.

-

What features does airSlate SignNow offer for managing the Irs Form 1041 Schedule D 1?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking to enhance your experience with the Irs Form 1041 Schedule D 1. These features help you manage your forms efficiently while ensuring compliance and security.

-

Can I integrate airSlate SignNow with other software for my Irs Form 1041 Schedule D 1?

Yes, airSlate SignNow offers integrations with popular software applications, making it easy to connect your workflow for the Irs Form 1041 Schedule D 1. This allows you to sync data and streamline processes across platforms, enhancing your overall efficiency.

-

What benefits can I expect from using airSlate SignNow for the Irs Form 1041 Schedule D 1?

Using airSlate SignNow for the Irs Form 1041 Schedule D 1 provides numerous benefits, including increased efficiency, reduced paperwork, and faster turnaround times. The platform's user-friendly interface simplifies the eSigning process, making tax preparation less stressful.

-

Is airSlate SignNow secure for handling sensitive documents like the Irs Form 1041 Schedule D 1?

Absolutely! airSlate SignNow employs advanced security measures, including encryption and secure cloud storage, to protect sensitive documents such as the Irs Form 1041 Schedule D 1. You can trust that your information is safe while utilizing our eSigning services.

Get more for Irs Form 1041 Schedule D 1

Find out other Irs Form 1041 Schedule D 1

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free