ST 9 Sales and Use Tax Return Mass 2016-2026

What is the ST 9 Sales And Use Tax Return in Massachusetts?

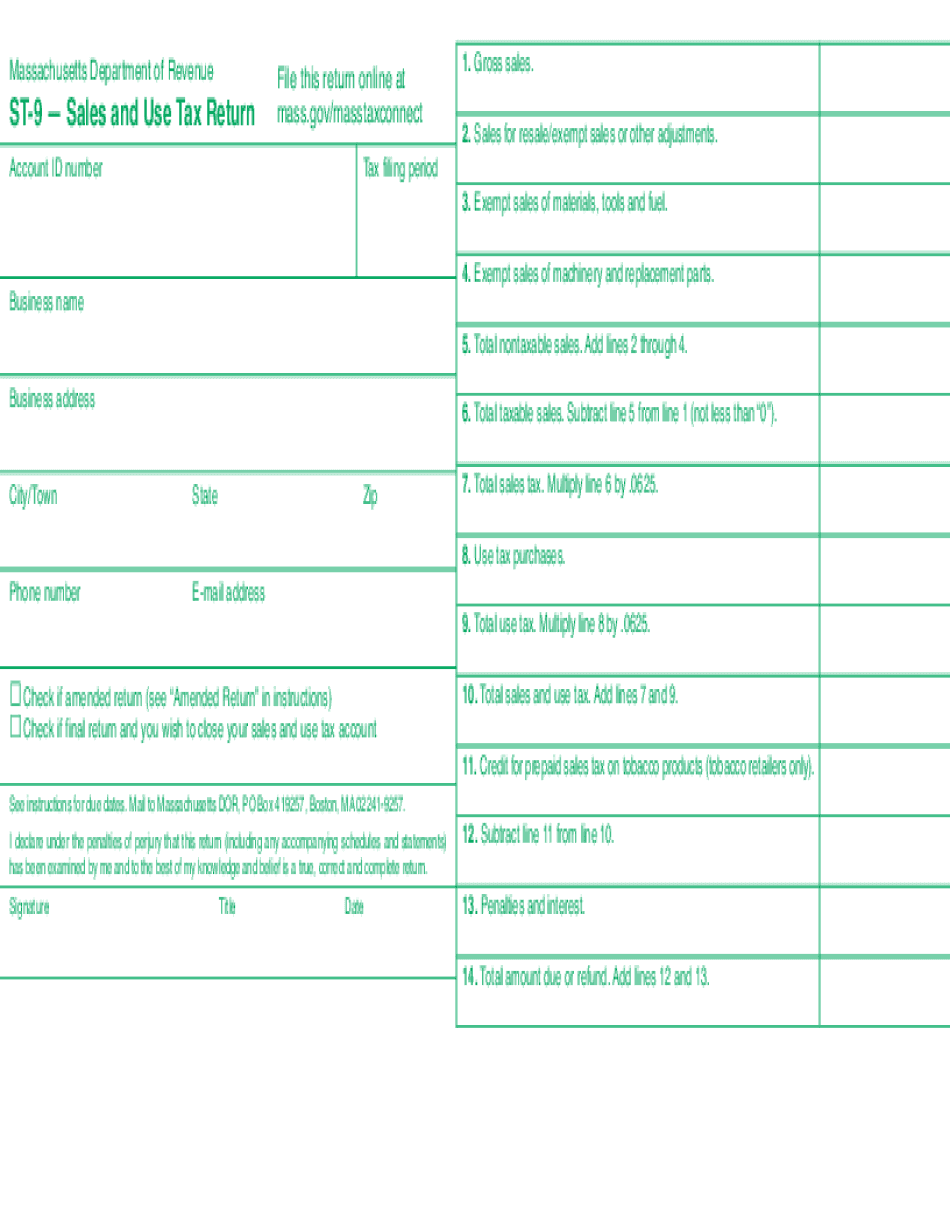

The ST 9 form is a critical document used in Massachusetts for reporting sales and use tax. This form is primarily utilized by businesses to report the tax collected on sales of tangible personal property and certain services. The Massachusetts Department of Revenue requires this form to ensure compliance with state tax laws. The ST 9 form helps businesses accurately calculate the amount of tax owed and facilitates the proper remittance to the state.

How to Use the ST 9 Sales And Use Tax Return in Massachusetts

To effectively use the ST 9 form, businesses must first gather all relevant sales data for the reporting period. This includes total sales, exempt sales, and any applicable deductions. Once the data is compiled, businesses can fill out the form, detailing the total sales tax collected. It is essential to ensure that all information is accurate and complete, as errors can lead to penalties or delays in processing.

Steps to Complete the ST 9 Sales And Use Tax Return in Massachusetts

Completing the ST 9 form involves several key steps:

- Gather sales records and receipts for the reporting period.

- Calculate the total sales subject to tax.

- Determine any exempt sales and deductions.

- Fill out the ST 9 form, ensuring all fields are completed accurately.

- Review the completed form for errors or omissions.

- Submit the form to the Massachusetts Department of Revenue by the specified deadline.

Legal Use of the ST 9 Sales And Use Tax Return in Massachusetts

The ST 9 form is legally required for businesses that collect sales tax in Massachusetts. Its proper use ensures compliance with state tax regulations, helping to avoid potential legal issues. Businesses must file this form accurately and on time to maintain good standing with the Massachusetts Department of Revenue. Failure to submit the ST 9 form can result in penalties, interest on unpaid taxes, and other legal repercussions.

Key Elements of the ST 9 Sales And Use Tax Return in Massachusetts

Several key elements are essential when completing the ST 9 form:

- Business Information: Include the business name, address, and tax identification number.

- Sales Data: Report total sales and any exempt sales clearly.

- Tax Calculation: Accurately calculate the total sales tax owed based on the reported sales.

- Signature: The form must be signed by an authorized representative of the business.

Form Submission Methods for the ST 9 Sales And Use Tax Return in Massachusetts

The ST 9 form can be submitted in various ways to the Massachusetts Department of Revenue. Businesses may choose to file the form online through the department's website, which offers a streamlined process. Alternatively, the form can be mailed to the appropriate address provided by the department. In-person submissions may also be possible at designated locations, ensuring that businesses have multiple options for compliance.

Quick guide on how to complete st 9 sales and use tax return mass

Easily prepare ST 9 Sales And Use Tax Return Mass on any device

Digital document management has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary for you to create, alter, and electronically sign your documents promptly without delays. Manage ST 9 Sales And Use Tax Return Mass on any platform using the airSlate SignNow applications for Android or iOS and simplify any document-related task today.

The simplest method to modify and electronically sign ST 9 Sales And Use Tax Return Mass effortlessly

- Locate ST 9 Sales And Use Tax Return Mass and click Get Form to begin.

- Make use of the tools available to finalize your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or mistakes that require printing new copies. airSlate SignNow fulfills all your document management requirements in a few clicks from any device you choose. Edit and electronically sign ST 9 Sales And Use Tax Return Mass and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct st 9 sales and use tax return mass

Create this form in 5 minutes!

How to create an eSignature for the st 9 sales and use tax return mass

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the st9 form and why is it important?

The st9 form is a crucial document used for various tax and compliance purposes. Understanding its use can help businesses ensure they meet necessary legal requirements and avoid potential penalties.

-

How does airSlate SignNow simplify the st9 form process?

airSlate SignNow streamlines the completion and signing of the st9 form by allowing users to fill out, sign, and send documents electronically. This eliminates the hassle of paper forms and speeds up the process signNowly.

-

Are there any costs associated with using the st9 form on airSlate SignNow?

While airSlate SignNow offers a range of pricing plans, there are no additional costs for using the st9 form. Customers can choose a plan that fits their needs, ensuring affordability and flexibility.

-

What features does airSlate SignNow offer for managing the st9 form?

AirSlate SignNow provides various features for the st9 form, including document templates, eSignature capabilities, and secure storage. These features enable users to manage their forms efficiently and safely.

-

Can I integrate the st9 form with other software using airSlate SignNow?

Yes, airSlate SignNow allows easy integration with various applications, enabling users to connect their st9 form with accounting and management software. This integration streamlines workflows and improves data management.

-

What are the benefits of using airSlate SignNow for the st9 form?

Using airSlate SignNow for the st9 form offers signNow time savings, enhanced security, and ease of collaboration. Businesses can complete forms quickly and securely, improving overall productivity.

-

Is airSlate SignNow user-friendly for filling out the st9 form?

Absolutely! airSlate SignNow has an intuitive interface designed for users of all technical backgrounds. This makes filling out and managing the st9 form a straightforward experience.

Get more for ST 9 Sales And Use Tax Return Mass

- Vip vendor information pages

- Single family dwelling lease 3132017web form

- Date of birth form

- Fillable online inventory and condition of leased premises form

- After we have provided tenant with 60 day move out notice form

- Improvements or additions form

- Other than discussed herein the terms and conditions of the operative lease form

- Within five 5 days of lessor placing written notice in the united states mail postage pre paid form

Find out other ST 9 Sales And Use Tax Return Mass

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now