Department of the Treasury Internal Revenue Service Instructions for Form 940 Irs

Understanding the Department Of The Treasury Internal Revenue Service Instructions For Form 940

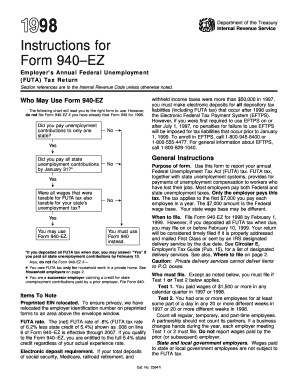

The Department Of The Treasury Internal Revenue Service Instructions For Form 940 provide essential guidelines for employers to report their annual Federal Unemployment Tax Act (FUTA) tax liability. This form is crucial for businesses that pay unemployment taxes, as it helps ensure compliance with federal regulations. Understanding these instructions is vital for accurate reporting and avoiding potential penalties.

Steps to Complete the Department Of The Treasury Internal Revenue Service Instructions For Form 940

Completing Form 940 involves several key steps to ensure accuracy and compliance. First, gather all necessary information about your business, including employee wages and the total amount of unemployment tax paid. Next, follow the instructions carefully, filling out each section of the form based on your business's specific circumstances. It is important to double-check all entries for accuracy before submission. Finally, submit the completed form by the designated deadline to avoid penalties.

Filing Deadlines and Important Dates for Form 940

Filing deadlines for Form 940 are crucial for compliance. Typically, the form must be filed by January 31 of the following year for the previous tax year. If you have deposited all FUTA tax when due, you may file by February 10. It is essential to keep track of these dates to avoid late fees and penalties, which can significantly impact your business finances.

Required Documents for Form 940 Submission

When preparing to submit Form 940, certain documents are necessary to ensure a smooth filing process. These include payroll records that detail employee wages, any previous tax payments made, and information on any state unemployment tax credits claimed. Having these documents readily available will facilitate accurate completion of the form and help in case of any audits or inquiries from the IRS.

Legal Use of the Department Of The Treasury Internal Revenue Service Instructions For Form 940

The legal use of the Department Of The Treasury Internal Revenue Service Instructions For Form 940 is essential for employers to fulfill their tax obligations. Adhering to these instructions ensures that businesses report their unemployment taxes correctly, thereby avoiding legal issues with the IRS. Understanding the legal implications of misreporting or failing to file can help businesses maintain compliance and protect their interests.

Examples of Using the Department Of The Treasury Internal Revenue Service Instructions For Form 940

Using the Department Of The Treasury Internal Revenue Service Instructions For Form 940 can vary based on different business scenarios. For instance, a small business owner with a few employees may follow the instructions to calculate their annual unemployment tax based on total wages paid. Conversely, a larger corporation may need to account for multiple state unemployment tax credits. These examples illustrate the versatility of the instructions in catering to various business types and sizes.

Quick guide on how to complete department of the treasury internal revenue service instructions for form 940 irs

Effortlessly Prepare [SKS] on Any Device

Digital document management has become increasingly favored by organizations and individuals alike. It offers a superb environmentally friendly substitute for conventional printed and signed paperwork, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents quickly and without hassle. Manage [SKS] on any device using airSlate SignNow’s Android or iOS applications and simplify any document-related process today.

Edit and Electronically Sign [SKS] with Ease

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize pertinent sections of your documents or conceal confidential information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Verify the details and press the Done button to save your changes.

- Choose your preferred method to send your form—via email, text message (SMS), an invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, the frustration of searching for forms, or the errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Edit and electronically sign [SKS] to ensure effective communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Department Of The Treasury Internal Revenue Service Instructions For Form 940 Irs

Create this form in 5 minutes!

How to create an eSignature for the department of the treasury internal revenue service instructions for form 940 irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the Department Of The Treasury Internal Revenue Service Instructions For Form 940 Irs?

The Department Of The Treasury Internal Revenue Service Instructions For Form 940 Irs provides essential guidance for employers on how to correctly complete Form 940, which reports annual Federal Unemployment Tax Act (FUTA) taxes. Understanding these instructions is crucial for compliance with federal regulations and to avoid costly penalties.

-

How can airSlate SignNow assist with the Department Of The Treasury Internal Revenue Service Instructions For Form 940 Irs?

airSlate SignNow simplifies the process of signing and managing documents related to the Department Of The Treasury Internal Revenue Service Instructions For Form 940 Irs. Our platform allows users to easily eSign forms, ensuring that your submission is compliant and securely stored for future reference.

-

What are the pricing options for using airSlate SignNow for IRS-related documents?

airSlate SignNow offers flexible pricing plans tailored to businesses of all sizes, starting from an affordable monthly subscription. Each plan includes access to features that facilitate handling the Department Of The Treasury Internal Revenue Service Instructions For Form 940 Irs and other important IRS documentation efficiently.

-

Does airSlate SignNow provide templates for the Department Of The Treasury Internal Revenue Service Instructions For Form 940 Irs?

Yes, airSlate SignNow provides a library of templates designed specifically for IRS forms, including those that comply with the Department Of The Treasury Internal Revenue Service Instructions For Form 940 Irs. These templates can be customized to speed up the document preparation process while ensuring accuracy.

-

Can I integrate airSlate SignNow with other accounting software to handle IRS forms?

Absolutely! airSlate SignNow offers seamless integration with various accounting and tax software applications. This integration enhances your ability to manage and eSign documents related to the Department Of The Treasury Internal Revenue Service Instructions For Form 940 Irs directly from your preferred financial management platform.

-

What benefits does airSlate SignNow offer for handling IRS submissions?

airSlate SignNow enhances efficiency and compliance when dealing with the Department Of The Treasury Internal Revenue Service Instructions For Form 940 Irs. Users benefit from a user-friendly interface, secure document storage, and quick sharing capabilities, ensuring that your IRS forms are submitted accurately and on time.

-

Is airSlate SignNow compliant with IRS regulations for electronic signatures?

Yes, airSlate SignNow complies with all necessary IRS regulations for electronic signatures, including eSign Act requirements. This compliance ensures that documents related to the Department Of The Treasury Internal Revenue Service Instructions For Form 940 Irs are legally binding and accepted by the IRS.

Get more for Department Of The Treasury Internal Revenue Service Instructions For Form 940 Irs

Find out other Department Of The Treasury Internal Revenue Service Instructions For Form 940 Irs

- How Do I Sign Idaho Banking Limited Power Of Attorney

- Sign Iowa Banking Quitclaim Deed Safe

- How Do I Sign Iowa Banking Rental Lease Agreement

- Sign Iowa Banking Residential Lease Agreement Myself

- Sign Kansas Banking Living Will Now

- Sign Kansas Banking Last Will And Testament Mobile

- Sign Kentucky Banking Quitclaim Deed Online

- Sign Kentucky Banking Quitclaim Deed Later

- How Do I Sign Maine Banking Resignation Letter

- Sign Maine Banking Resignation Letter Free

- Sign Louisiana Banking Separation Agreement Now

- Sign Maryland Banking Quitclaim Deed Mobile

- Sign Massachusetts Banking Purchase Order Template Myself

- Sign Maine Banking Operating Agreement Computer

- Sign Banking PPT Minnesota Computer

- How To Sign Michigan Banking Living Will

- Sign Michigan Banking Moving Checklist Mobile

- Sign Maine Banking Limited Power Of Attorney Simple

- Sign Michigan Banking Moving Checklist Free

- Sign Montana Banking RFP Easy