PA 29 PERMANENT APPLICATION for PROPERTY TAX CREDIT Chichesternh Form

What is the PA 29 Permanent Application for Property Tax Credit in Chichester, NH?

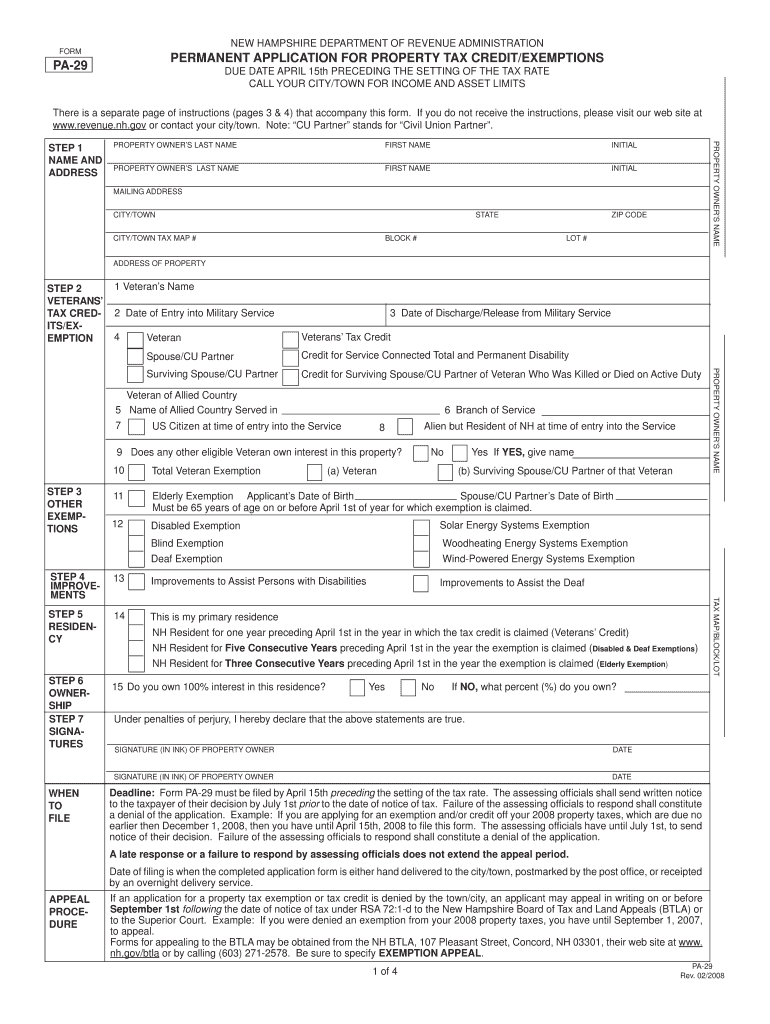

The PA 29 Permanent Application for Property Tax Credit is a form used by residents of Chichester, New Hampshire, to apply for a property tax credit. This credit is designed to reduce the property tax burden for eligible homeowners, particularly those who meet specific criteria related to age, income, or disability status. By submitting this application, residents can potentially lower their annual property taxes, making homeownership more affordable.

Eligibility Criteria for the PA 29 Permanent Application for Property Tax Credit

To qualify for the PA 29 Permanent Application for Property Tax Credit in Chichester, applicants must meet certain eligibility requirements. Generally, these include:

- Being a resident of Chichester and owning property in the town.

- Meeting age requirements, typically being 65 years or older, or being disabled.

- Having an income that falls below a specified threshold set by local regulations.

It is important for applicants to review the specific criteria outlined by the town to ensure they meet all necessary conditions before applying.

Steps to Complete the PA 29 Permanent Application for Property Tax Credit

Completing the PA 29 application involves several key steps:

- Obtain the PA 29 form from the Chichester town office or download it from the official website.

- Fill out the application form with accurate information, including personal details, property information, and income data.

- Gather any required documentation, such as proof of age, disability, or income.

- Submit the completed application and supporting documents to the appropriate town office by the specified deadline.

Following these steps carefully can help ensure a smooth application process.

Required Documents for the PA 29 Permanent Application for Property Tax Credit

When applying for the PA 29 Permanent Application for Property Tax Credit, applicants must provide several key documents to support their application:

- Proof of age or disability, such as a birth certificate or disability award letter.

- Income verification documents, which may include tax returns, Social Security statements, or other financial records.

- Property ownership documentation, such as a deed or property tax bill.

Having these documents ready can facilitate the application process and help ensure that all necessary information is submitted.

Form Submission Methods for the PA 29 Permanent Application for Property Tax Credit

Applicants can submit the PA 29 form through various methods, depending on their preference and local regulations:

- In-person submission at the Chichester town office during business hours.

- Mailing the completed form and supporting documents to the designated town office address.

- Some towns may offer online submission options through their official websites.

It is advisable to confirm the preferred submission method with the town office to ensure compliance with local procedures.

Application Process & Approval Time for the PA 29 Permanent Application for Property Tax Credit

The application process for the PA 29 Permanent Application for Property Tax Credit typically involves several stages:

- Submission of the completed application and required documents.

- Review of the application by town officials to verify eligibility and completeness.

- Notification of approval or denial, usually within a few weeks to a couple of months, depending on the volume of applications received.

Applicants should keep track of their submission and follow up with the town office if they do not receive a response within the expected timeframe.

Quick guide on how to complete pa 29 permanent application for property tax credit chichesternh

Complete [SKS] effortlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It offers an ideal environmentally friendly substitute to traditional printed and signed documents, allowing you to obtain the correct form and securely save it online. airSlate SignNow provides you with all the resources necessary to create, edit, and eSign your documents swiftly without any delays. Manage [SKS] on any platform using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to edit and eSign [SKS] seamlessly

- Find [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or conceal sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your modifications.

- Select your preferred method of delivering your form: by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form hunting, or errors that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Edit and eSign [SKS] to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to PA 29 PERMANENT APPLICATION FOR PROPERTY TAX CREDIT Chichesternh

Create this form in 5 minutes!

How to create an eSignature for the pa 29 permanent application for property tax credit chichesternh

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the PA 29 PERMANENT APPLICATION FOR PROPERTY TAX CREDIT Chichesternh?

The PA 29 PERMANENT APPLICATION FOR PROPERTY TAX CREDIT Chichesternh is a form that residents in Chichester, NH need to complete to apply for property tax relief. This application helps qualifying homeowners receive a credit on their property taxes, making it essential for those eligible to save money.

-

How can airSlate SignNow help with the PA 29 PERMANENT APPLICATION FOR PROPERTY TAX CREDIT Chichesternh?

airSlate SignNow streamlines the process of completing and submitting the PA 29 PERMANENT APPLICATION FOR PROPERTY TAX CREDIT Chichesternh by providing electronic forms. You can easily fill out the application, eSign it, and send it directly to the required agency without any hassle.

-

Are there any fees associated with using airSlate SignNow for the PA 29 PERMANENT APPLICATION FOR PROPERTY TAX CREDIT Chichesternh?

airSlate SignNow offers a cost-effective solution that varies based on the plan you choose. There may be subscription fees, but the investment is often outweighed by the convenience and efficiency gained when handling forms like the PA 29 PERMANENT APPLICATION FOR PROPERTY TAX CREDIT Chichesternh.

-

What features does airSlate SignNow provide for eSigning the PA 29 PERMANENT APPLICATION FOR PROPERTY TAX CREDIT Chichesternh?

With airSlate SignNow, you can enjoy features such as secure electronic signatures, automated workflows, and template management specifically for forms like the PA 29 PERMANENT APPLICATION FOR PROPERTY TAX CREDIT Chichesternh. These tools ensure the application process is both compliant and streamlined.

-

Can I integrate airSlate SignNow with other tools while submitting the PA 29 PERMANENT APPLICATION FOR PROPERTY TAX CREDIT Chichesternh?

Yes, airSlate SignNow integrates seamlessly with various applications including Google Drive, Dropbox, and others, which makes it convenient to manage documents related to the PA 29 PERMANENT APPLICATION FOR PROPERTY TAX CREDIT Chichesternh. This integration capability enhances your workflow and document management.

-

What are the benefits of using airSlate SignNow for the PA 29 PERMANENT APPLICATION FOR PROPERTY TAX CREDIT Chichesternh?

The benefits of using airSlate SignNow for the PA 29 PERMANENT APPLICATION FOR PROPERTY TAX CREDIT Chichesternh include faster processing times, reduced paperwork, and the ability to track your application status electronically. This ensures that you remain updated on your property tax credit application effortlessly.

-

Is it safe to send the PA 29 PERMANENT APPLICATION FOR PROPERTY TAX CREDIT Chichesternh through airSlate SignNow?

Absolutely, airSlate SignNow employs top-notch security measures such as encryption and secure storage to protect your data while sending the PA 29 PERMANENT APPLICATION FOR PROPERTY TAX CREDIT Chichesternh. You can trust that your sensitive information is kept safe throughout the submission process.

Get more for PA 29 PERMANENT APPLICATION FOR PROPERTY TAX CREDIT Chichesternh

- Parking permit westminster high school form

- Ahrr word form

- Oklahoma vintage decal application form

- Nps form s4

- Patient information sheet primary health medical group

- Cfs 444 2 s appointment of short term guardian spanish illinois form

- Professional wrestling license application form

- Authorization letter from home owners form

Find out other PA 29 PERMANENT APPLICATION FOR PROPERTY TAX CREDIT Chichesternh

- Can I Electronic signature South Carolina Home lease agreement

- Can I Electronic signature Wisconsin Home lease agreement

- How To Electronic signature Rhode Island Generic lease agreement

- How Can I eSignature Florida Car Lease Agreement Template

- How To eSignature Indiana Car Lease Agreement Template

- How Can I eSignature Wisconsin Car Lease Agreement Template

- Electronic signature Tennessee House rent agreement format Myself

- How To Electronic signature Florida House rental agreement

- eSignature Connecticut Retainer Agreement Template Myself

- How To Electronic signature Alaska House rental lease agreement

- eSignature Illinois Retainer Agreement Template Free

- How Do I Electronic signature Idaho Land lease agreement

- Electronic signature Illinois Land lease agreement Fast

- eSignature Minnesota Retainer Agreement Template Fast

- Electronic signature Louisiana Land lease agreement Fast

- How Do I eSignature Arizona Attorney Approval

- How Can I eSignature North Carolina Retainer Agreement Template

- Electronic signature New York Land lease agreement Secure

- eSignature Ohio Attorney Approval Now

- eSignature Pennsylvania Retainer Agreement Template Secure