Credit for Idaho Research Activities Idaho State Tax Commission Form

What is the Credit For Idaho Research Activities Idaho State Tax Commission

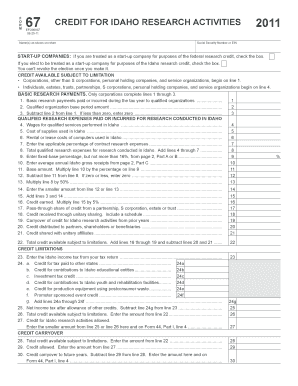

The Credit For Idaho Research Activities is a tax incentive designed to encourage businesses engaged in qualified research and development activities within the state of Idaho. This credit allows eligible taxpayers to reduce their state tax liability based on their qualified research expenses. The Idaho State Tax Commission administers this credit, ensuring that businesses can benefit from their investments in innovation and development.

Eligibility Criteria

To qualify for the Credit For Idaho Research Activities, businesses must meet specific criteria set by the Idaho State Tax Commission. Eligible taxpayers include corporations, partnerships, and sole proprietorships that conduct qualified research activities. These activities must aim to develop or improve products, processes, or software and must meet the definition of qualified research as outlined in the tax code. Additionally, the expenses claimed must be incurred within Idaho.

Steps to complete the Credit For Idaho Research Activities Idaho State Tax Commission

Completing the Credit For Idaho Research Activities involves several steps:

- Gather documentation of all qualified research expenses incurred during the tax year.

- Complete the appropriate forms provided by the Idaho State Tax Commission, detailing the nature of the research activities.

- Calculate the amount of credit based on the eligible expenses and any applicable limits.

- Submit the completed forms along with your state tax return to the Idaho State Tax Commission.

Required Documents

When applying for the Credit For Idaho Research Activities, taxpayers must provide specific documentation to substantiate their claims. This includes:

- Records of qualified research expenses, such as payroll records for research staff, materials costs, and contract research expenses.

- A detailed description of the research activities conducted, demonstrating how they meet the criteria for qualified research.

- Any additional forms or schedules required by the Idaho State Tax Commission for proper filing.

Filing Deadlines / Important Dates

Taxpayers must adhere to specific deadlines when filing for the Credit For Idaho Research Activities. Generally, the credit must be claimed on the Idaho state tax return for the year in which the qualified expenses were incurred. It is important to check the Idaho State Tax Commission’s website for the latest filing deadlines, as these can vary each tax year.

Application Process & Approval Time

The application process for the Credit For Idaho Research Activities involves submitting the required documentation along with the state tax return. Once submitted, the Idaho State Tax Commission will review the application for completeness and compliance with eligibility requirements. The approval time can vary, but taxpayers can typically expect to receive confirmation of their credit status within a few weeks of filing.

Quick guide on how to complete credit for idaho research activities idaho state tax commission

Complete [SKS] effortlessly on any device

Digital document management has become increasingly popular among organizations and individuals alike. It serves as an excellent eco-friendly alternative to conventional printed and signed papers, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Manage [SKS] on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The simplest way to modify and electronically sign [SKS] seamlessly

- Locate [SKS] and click Get Form to initiate the process.

- Use the tools we provide to complete your document.

- Highlight relevant parts of your documents or obscure sensitive data with tools specifically designed by airSlate SignNow for this purpose.

- Create your electronic signature using the Sign feature, which takes seconds and carries the same legal significance as a traditional handwritten signature.

- Review all the information and click the Done button to save your changes.

- Choose your preferred method of submitting your form, whether it be via email, text message (SMS), invitation link, or downloading it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form navigation, or errors that necessitate reprinting new document copies. airSlate SignNow takes care of your document management needs in just a few clicks from any device. Revise and electronically sign [SKS] to ensure effective communication at every step of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Credit For Idaho Research Activities Idaho State Tax Commission

Create this form in 5 minutes!

How to create an eSignature for the credit for idaho research activities idaho state tax commission

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Credit For Idaho Research Activities offered by the Idaho State Tax Commission?

The Credit For Idaho Research Activities is a tax incentive program designed to encourage research and development in Idaho. This program allows eligible businesses to receive tax credits based on their qualified research expenses. By participating, businesses can lower their tax liability, thus fostering innovation within the state.

-

How can I apply for the Credit For Idaho Research Activities through the Idaho State Tax Commission?

To apply for the Credit For Idaho Research Activities, businesses must complete the necessary forms provided by the Idaho State Tax Commission. It involves documenting eligible research expenses and submitting these along with your tax return. Make sure to review the guidelines carefully to ensure compliance and maximize your potential credits.

-

What types of research activities qualify for the Credit For Idaho Research Activities?

Qualifying research activities for the Credit For Idaho Research Activities generally include experimental or laboratory work aimed at developing or improving products or processes. Specific criteria may apply, so it's essential to consult the official guidelines provided by the Idaho State Tax Commission for detailed eligibility requirements.

-

Is there a limit to how much credit I can receive for the Credit For Idaho Research Activities?

Yes, there are limits on the amount of credit you can claim under the Credit For Idaho Research Activities. The specific cap depends on your total qualified research expenditures and may vary year to year. It's advisable to review the Idaho State Tax Commission's official documentation for the most up-to-date information on credit limits.

-

How does airSlate SignNow support the documentation process for the Credit For Idaho Research Activities?

airSlate SignNow provides an efficient platform for managing the documentation process required for the Credit For Idaho Research Activities. Our eSigning features ensure that all necessary documents can be prepared and signed quickly, streamlining the submission process for the Idaho State Tax Commission. This helps businesses save time and increase accuracy in their documentation.

-

What benefits do I gain by utilizing airSlate SignNow while applying for the Credit For Idaho Research Activities?

Utilizing airSlate SignNow when applying for the Credit For Idaho Research Activities can signNowly enhance efficiency. Our platform allows for easy document management, eSigning, and secure storage, facilitating a smoother application process. Businesses can focus more on their research activities rather than getting bogged down by paperwork.

-

Are there any integrations available with airSlate SignNow that help manage documents for the Credit For Idaho Research Activities?

Yes, airSlate SignNow offers various integrations that can help manage your documents related to the Credit For Idaho Research Activities. These integrations enhance collaboration and streamline workflows by connecting with platforms your business already uses. This integration capability ensures that you can efficiently track and manage your research documentation.

Get more for Credit For Idaho Research Activities Idaho State Tax Commission

- Carer payment andor carer allowance medical report sa332a for a person 16 years or over form

- This may help reduce the time it takes for your application to form

- As you work through the steps check form

- Family details fill online printable fillable blankpdffiller form

- Pdf adult general passport application form pptc 140

- Cross border currency or monetary instruments report individual form

- Notice of resignation or retirement vl156 department for form

- Pdf application form wd deogcca

Find out other Credit For Idaho Research Activities Idaho State Tax Commission

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application