Form it 602Claim for EZ Capital Tax CreditIT602

What is the Form IT-602 Claim for EZ Capital Tax Credit?

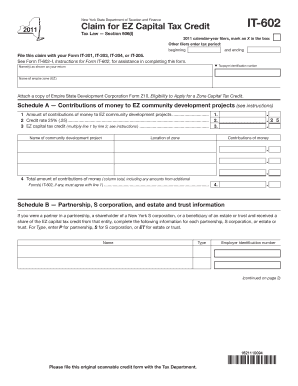

The Form IT-602, known as the Claim for EZ Capital Tax Credit, is a tax form used by businesses in the United States to claim credits for investments made in certain qualified capital assets. This form is specifically designed to facilitate the application for tax credits available under state regulations aimed at encouraging business growth and investment. The EZ Capital Tax Credit is particularly beneficial for small businesses and startups, as it can significantly reduce their overall tax liability.

How to Use the Form IT-602 Claim for EZ Capital Tax Credit

Using the Form IT-602 involves several straightforward steps. First, ensure that your business qualifies for the EZ Capital Tax Credit by reviewing the eligibility criteria set by your state. Next, gather all necessary documentation that supports your claim, including proof of capital investments and any relevant financial statements. Once you have completed the form, it can be submitted either electronically or via mail, depending on your state's submission guidelines.

Steps to Complete the Form IT-602 Claim for EZ Capital Tax Credit

Completing the Form IT-602 requires careful attention to detail. Follow these steps:

- Begin by entering your business information, including the legal name and address.

- Provide details about the capital investments made, specifying the types of assets acquired.

- Calculate the total amount of credit being claimed based on the investments.

- Attach any required supporting documents, such as receipts or financial statements.

- Review the form for accuracy before submission.

Eligibility Criteria for the Form IT-602 Claim for EZ Capital Tax Credit

To qualify for the EZ Capital Tax Credit, businesses must meet specific eligibility criteria. Generally, these criteria include being a registered business entity within the state, making qualified capital investments, and operating within designated sectors that the credit aims to support. It is essential to review state-specific regulations to ensure compliance and eligibility.

Required Documents for the Form IT-602 Claim for EZ Capital Tax Credit

When filing the Form IT-602, several documents are typically required to substantiate your claim. These may include:

- Proof of capital investments, such as purchase invoices or contracts.

- Financial statements that reflect the business's operations and investments.

- Any additional documentation requested by the state tax authority.

Form Submission Methods for the IT-602 Claim for EZ Capital Tax Credit

The Form IT-602 can usually be submitted through various methods. Common submission options include:

- Online submission via the state tax authority's website, if available.

- Mailing a hard copy of the form to the designated tax office.

- In-person delivery at a local tax office, depending on state regulations.

Quick guide on how to complete form it 602claim for ez capital tax creditit602

Finalize [SKS] effortlessly on any device

Managing documents online has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can easily access the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Handle [SKS] on any platform with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and eSign [SKS] without hassle

- Find [SKS] and click on Get Form to commence.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, cumbersome form navigation, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Alter and eSign [SKS] and ensure excellent communication at any stage of the form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form it 602claim for ez capital tax creditit602

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form IT 602Claim For EZ Capital Tax CreditIT602?

Form IT 602Claim For EZ Capital Tax CreditIT602 is a tax form issued for claiming the EZ Capital Tax Credit in your business applications. This form allows eligible businesses to benefit from signNow tax reductions. Understanding how to fill it out correctly can maximize your benefits, so it’s important to utilize reliable software for seamless submission.

-

How can airSlate SignNow help with Form IT 602Claim For EZ Capital Tax CreditIT602?

airSlate SignNow streamlines the process of filling out and submitting Form IT 602Claim For EZ Capital Tax CreditIT602 by allowing users to electronically sign and send the document efficiently. With our user-friendly platform, you can collaborate with team members to ensure everything is accurate before submission. This eliminates delays in processing your claim.

-

What features does airSlate SignNow offer for handling Form IT 602Claim For EZ Capital Tax CreditIT602?

airSlate SignNow provides features such as customizable templates, audit trails, and real-time collaboration specifically designed to assist users with Form IT 602Claim For EZ Capital Tax CreditIT602. These features help maintain compliance and reduce the risk of errors. Additionally, our platform supports seamless integrations with other tools to enhance your workflow.

-

Is there a cost associated with using airSlate SignNow for Form IT 602Claim For EZ Capital Tax CreditIT602?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs when handling Form IT 602Claim For EZ Capital Tax CreditIT602. Each plan is designed to provide cost-effective solutions without compromising on essential features. We recommend checking our pricing page for detailed information and a free trial option.

-

Can multiple users collaborate on Form IT 602Claim For EZ Capital Tax CreditIT602 with airSlate SignNow?

Absolutely! airSlate SignNow allows multiple users to collaborate on Form IT 602Claim For EZ Capital Tax CreditIT602 simultaneously. This multi-user functionality ensures that all necessary stakeholders can contribute, review, and approve the document in real time, making the collaborative process efficient and productive.

-

What are the main benefits of using airSlate SignNow for Form IT 602Claim For EZ Capital Tax CreditIT602?

Using airSlate SignNow for Form IT 602Claim For EZ Capital Tax CreditIT602 offers numerous benefits such as reduced processing times, enhanced security, and streamlined compliance. Our platform simplifies document management and ensures your documents are legally binding and easily retrievable. Businesses can save both time and money by automating this process.

-

Does airSlate SignNow offer support for users facing issues with Form IT 602Claim For EZ Capital Tax CreditIT602?

Yes, we offer robust customer support for users needing assistance with Form IT 602Claim For EZ Capital Tax CreditIT602. Our support team is equipped to help you navigate any issues you encounter, from document preparation to electronic signing. You can signNow out through various channels, including chat, email, and phone support.

Get more for Form IT 602Claim For EZ Capital Tax CreditIT602

Find out other Form IT 602Claim For EZ Capital Tax CreditIT602

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement