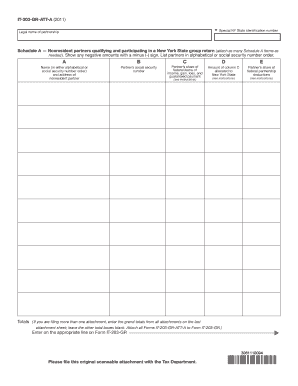

It 203 GR ATT a Special NY State Identification Number Legal Name of Partnership Schedule a Nonresident Partners Qualifying and Form

Understanding the IT 203 GR ATT A Special NY State Identification Number

The IT 203 GR ATT A is a crucial form for partnerships filing a group return in New York State. This form is specifically designed for nonresident partners who qualify and participate in a New York State group return. It requires the legal name of the partnership and the special identification number assigned by New York State. Each nonresident partner must be accurately represented on the form to ensure compliance with state tax regulations.

Steps to Complete the IT 203 GR ATT A Form

Filling out the IT 203 GR ATT A involves several key steps:

- Gather all necessary information about the partnership, including its legal name and identification number.

- List all nonresident partners who qualify for the group return.

- Complete each Schedule A form for nonresident partners, ensuring all details are accurate.

- Attach all completed Schedule A forms to the IT 203 GR ATT A.

- Review the entire submission for accuracy before filing.

Eligibility Criteria for Nonresident Partners

To qualify as nonresident partners participating in the New York State group return, partners must meet specific criteria. They should not be residents of New York State for tax purposes and must have income sourced from New York. Additionally, they need to be part of a partnership that is filing the group return. Understanding these criteria is essential for compliance and to avoid potential penalties.

Required Documents for Filing

When preparing to file the IT 203 GR ATT A, it is important to gather the following documents:

- The legal name of the partnership and its special NY State identification number.

- Completed Schedule A forms for each nonresident partner.

- Any supporting documentation that verifies the income and residency status of nonresident partners.

Legal Use of the IT 203 GR ATT A Form

The IT 203 GR ATT A form is legally required for partnerships that wish to file a group return in New York State. It ensures that all nonresident partners are accounted for and that the partnership complies with state tax laws. Misuse or failure to file this form can lead to legal repercussions and financial penalties.

Filing Deadlines for the IT 203 GR ATT A

It is essential to be aware of the filing deadlines for the IT 203 GR ATT A. Typically, the form must be submitted by the due date of the partnership's tax return. Late submissions can result in penalties, so ensuring timely filing is crucial for compliance with New York State tax regulations.

Quick guide on how to complete it 203 gr att a special ny state identification number legal name of partnership schedule a nonresident partners qualifying and

Simplify [SKS] on any device effortlessly

Digital document management has become favored among companies and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can access the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents quickly and without holdups. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

Steps to edit and electronically sign [SKS] effortlessly

- Find [SKS] and click Get Form to initiate.

- Utilize the tools provided to complete your document.

- Emphasize applicable sections of your documents or redact confidential information using tools offered by airSlate SignNow specifically for this purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Wave goodbye to lost or misfiled documents, tedious form searching, or errors that necessitate printing additional document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and electronically sign [SKS] and guarantee outstanding communication at any point in your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to IT 203 GR ATT A Special NY State Identification Number Legal Name Of Partnership Schedule A Nonresident Partners Qualifying And

Create this form in 5 minutes!

How to create an eSignature for the it 203 gr att a special ny state identification number legal name of partnership schedule a nonresident partners qualifying and

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IT 203 GR ATT A Special NY State Identification Number?

The IT 203 GR ATT A Special NY State Identification Number is required for partnerships in New York that wish to file a group return. This unique identifier helps the New York State Department of Taxation and Finance to process and track group returns effectively. Ensuring you have this number is essential for accurate filing.

-

Who needs to file Schedule A for nonresident partners?

Schedule A must be filed by nonresident partners of a partnership who are qualifying and participating in a New York State group return. This schedule allows for the accurate reporting of income and deductions specific to nonresident partners. It is important to attach as many Schedule A forms as needed for all nonresident partners involved.

-

How does airSlate SignNow simplify the process of filing Schedule A?

airSlate SignNow streamlines the process of filing Schedule A by providing a user-friendly platform to create, send, and eSign required documents. With our solution, you can easily attach as many Schedule A forms as needed and ensure all nonresident partners are accurately represented on the group return. This minimizes errors and enhances compliance.

-

Is there a cost associated with using airSlate SignNow for filing Schedule A?

Yes, airSlate SignNow offers a cost-effective solution for managing document signatures and filings, including IT 203 GR ATT A Special NY State Identification Number processes. Our pricing is designed to cater to businesses of all sizes, ensuring that you only pay for features you need. We recommend checking our pricing page for the most up-to-date information.

-

What features does airSlate SignNow offer for handling group returns?

airSlate SignNow provides features specifically tailored for managing group returns, including document templates, bulk sending capabilities, and seamless eSigning. These features make it easier to manage multiple Schedule A forms for nonresident partners. With its robust tools, you can ensure compliance with state regulations effectively.

-

Can airSlate SignNow integrate with other software for tax filing?

Yes, airSlate SignNow integrates with various accounting and tax filing software, making it easier to manage documents related to the IT 203 GR ATT A Special NY State Identification Number. This integration ensures that you can pull in relevant data, simplifying the filing process for Schedule A forms. Check our integration list to see compatible applications.

-

What are the benefits of using airSlate SignNow for partnership tax filings?

By using airSlate SignNow, you gain access to a streamlined, efficient way to handle partnership tax filings, including IT 203 GR ATT A Special NY State Identification Number requirements. The platform allows for quick document creation, eSigning, and tracking, which can save valuable time and reduce errors. Additionally, it enhances collaboration among partners and assures compliance with New York State tax regulations.

Get more for IT 203 GR ATT A Special NY State Identification Number Legal Name Of Partnership Schedule A Nonresident Partners Qualifying And

- Birmingham al 35283 0725 form

- Application for replacement license plate validation decal form

- 2019 schedule ca 540 california adjustments residents 2019 schedule ca 540 california adjustments residents form

- New colorado residentdepartment of revenue taxation form

- 40nr 2019 alabama department of revenue form

- Wwwmyalabamataxescom form booklet

- 2020 california form 593 v payment voucher for real estate

- Form i f t p 2019 20c d instructions corp alabama

Find out other IT 203 GR ATT A Special NY State Identification Number Legal Name Of Partnership Schedule A Nonresident Partners Qualifying And

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter