N Ew York State Department of Taxation and Finance Claim for EZ Investment Tax Credit and EZ Employment Incentive Credit T Ax La Form

Understanding the EZ Investment Tax Credit and EZ Employment Incentive Credit

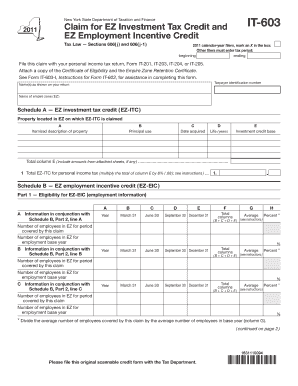

The N Ew York State Department Of Taxation And Finance Claim For EZ Investment Tax Credit And EZ Employment Incentive Credit is designed to provide tax benefits to eligible businesses in New York. This program aims to encourage investment and job creation in economically distressed areas. Sections 606 and 606 1 of the tax law outline the requirements and benefits associated with these credits. Businesses that qualify can significantly reduce their tax liabilities, making it a valuable resource for growth and development.

Steps to Complete the Claim Form

Completing the claim form for the EZ Investment Tax Credit and EZ Employment Incentive Credit involves several key steps. First, ensure that your business meets the eligibility criteria outlined in the tax law. Gather all necessary documentation, including proof of investment and employment. Fill out the form accurately, marking an X in the designated box for calendar year filers. Review the completed form for any errors before submission to avoid delays in processing.

Eligibility Criteria for the Credits

To qualify for the EZ Investment Tax Credit and EZ Employment Incentive Credit, businesses must meet specific eligibility criteria. These include operating within designated zones and demonstrating a commitment to creating new jobs. Additionally, businesses must maintain compliance with state regulations and provide necessary documentation to support their claims. Understanding these criteria is crucial for ensuring that your application is successful.

Required Documents for Submission

When submitting the claim for the EZ Investment Tax Credit and EZ Employment Incentive Credit, certain documents are required. These typically include proof of business location, tax identification numbers, and records of qualified investments and job creation. It is essential to compile these documents carefully to support your claim and facilitate a smooth review process by the New York State Department of Taxation and Finance.

Form Submission Methods

The claim form for the EZ Investment Tax Credit and EZ Employment Incentive Credit can be submitted through various methods. Businesses may choose to file online, which often expedites processing times. Alternatively, forms can be mailed or submitted in person at designated tax offices. Each method has its own guidelines, so it is important to follow the instructions provided for the chosen submission method.

Penalties for Non-Compliance

Failing to comply with the regulations surrounding the EZ Investment Tax Credit and EZ Employment Incentive Credit can result in significant penalties. Businesses may face fines, loss of credit eligibility, or additional scrutiny from tax authorities. It is crucial to maintain accurate records and adhere to all filing requirements to avoid these consequences and ensure continued eligibility for the credits.

Quick guide on how to complete n ew york state department of taxation and finance claim for ez investment tax credit and ez employment incentive credit t ax

Effortlessly prepare [SKS] on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can access the correct template and securely save it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents swiftly without any holdups. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to edit and eSign [SKS] with ease

- Locate [SKS] and click Get Form to initiate the process.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information carefully and click on the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, text message (SMS), invite link, or download it to your computer.

Put an end to missing or lost documents, cumbersome form searching, or errors that necessitate printing new document versions. airSlate SignNow meets your document management requirements in just a few clicks from your chosen device. Modify and eSign [SKS] to ensure excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the n ew york state department of taxation and finance claim for ez investment tax credit and ez employment incentive credit t ax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the airSlate SignNow solution for the New York State Department of Taxation and Finance Claim?

airSlate SignNow offers a comprehensive solution to help businesses manage their documentation for the New York State Department of Taxation and Finance Claim for EZ Investment Tax Credit and EZ Employment Incentive Credit. Our platform simplifies the process of eSigning and sending required documents efficiently and securely, ensuring compliance with Tax Law Sections 606 and 606.1.

-

How does airSlate SignNow assist with filings under Tax Law Sections 606 and 606.1?

With airSlate SignNow, businesses can easily prepare and submit their filings for the New York State Department of Taxation and Finance Claim for EZ Investment Tax Credit and EZ Employment Incentive Credit under Tax Law Sections 606 and 606.1. Our platform streamlines the document preparation process, allowing you to collect signatures and manage all documents in one place.

-

What features does airSlate SignNow provide for managing tax credit claims?

airSlate SignNow equips you with robust features for managing tax credit claims, including customizable templates, eSignature capabilities, and secure document storage. By streamlining the workflow for submitting the New York State Department of Taxation and Finance Claim for EZ Investment Tax Credit and EZ Employment Incentive Credit, we enable businesses to focus on growth rather than paperwork.

-

Are there any costs associated with using airSlate SignNow for tax credit documentation?

Yes, airSlate SignNow offers flexible pricing options to accommodate various business needs. Our solutions for managing and eSigning documents related to the New York State Department of Taxation and Finance Claim for EZ Investment Tax Credit and EZ Employment Incentive Credit are cost-effective, designed to save you time and resources while ensuring compliance.

-

Can airSlate SignNow integrate with other software?

Absolutely. airSlate SignNow integrates seamlessly with various business software, enhancing your ability to process the New York State Department of Taxation and Finance Claim for EZ Investment Tax Credit and EZ Employment Incentive Credit. This integration ensures that you can combine your existing workflows with our eSigning solutions for maximum efficiency.

-

How secure is the airSlate SignNow platform?

Security is a top priority for airSlate SignNow. Our platform uses advanced encryption and compliance measures to protect your documents while handling claims for the New York State Department of Taxation and Finance. You can eSign and store sensitive information with confidence knowing that we adhere to high-security standards.

-

How can airSlate SignNow improve the efficiency of my tax filing process?

By using airSlate SignNow, businesses can signNowly enhance the efficiency of their tax filing process. Our solution simplifies the management of documents required for the New York State Department of Taxation and Finance Claim for EZ Investment Tax Credit and EZ Employment Incentive Credit, allowing for quick eSigning and direct submission, ultimately reducing processing times.

Get more for N Ew York State Department Of Taxation And Finance Claim For EZ Investment Tax Credit And EZ Employment Incentive Credit T Ax La

Find out other N Ew York State Department Of Taxation And Finance Claim For EZ Investment Tax Credit And EZ Employment Incentive Credit T Ax La

- How Do I eSignature Michigan Expense Statement

- How Can I Electronic signature North Dakota Profit Sharing Agreement Template

- Electronic signature Ohio Profit Sharing Agreement Template Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Secure

- Electronic signature Florida Amendment to an LLC Operating Agreement Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Simple

- Electronic signature Florida Amendment to an LLC Operating Agreement Safe

- How Can I eSignature South Carolina Exchange of Shares Agreement

- Electronic signature Michigan Amendment to an LLC Operating Agreement Computer

- Can I Electronic signature North Carolina Amendment to an LLC Operating Agreement

- Electronic signature South Carolina Amendment to an LLC Operating Agreement Safe

- Can I Electronic signature Delaware Stock Certificate

- Electronic signature Massachusetts Stock Certificate Simple

- eSignature West Virginia Sale of Shares Agreement Later

- Electronic signature Kentucky Affidavit of Service Mobile

- How To Electronic signature Connecticut Affidavit of Identity

- Can I Electronic signature Florida Affidavit of Title

- How Can I Electronic signature Ohio Affidavit of Service

- Can I Electronic signature New Jersey Affidavit of Identity

- How Can I Electronic signature Rhode Island Affidavit of Service