Form 8821 Rev December

What is the Form 8821 Rev December

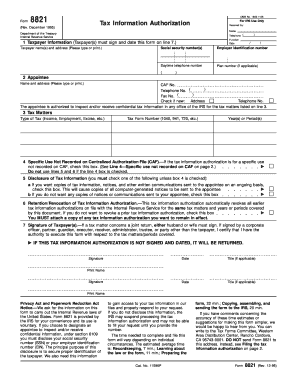

The Form 8821 Rev December is an IRS form used to authorize an individual or organization to receive confidential tax information on behalf of a taxpayer. This form is particularly useful for taxpayers who wish to allow a third party, such as a tax professional or family member, to access their tax records. The form ensures that the IRS can share sensitive information while maintaining the taxpayer's privacy and security.

How to use the Form 8821 Rev December

To use the Form 8821 Rev December, a taxpayer must fill out the form with their personal information, including name, address, and taxpayer identification number. The taxpayer must also specify the individual or organization they are authorizing to receive their tax information. After completing the form, it should be submitted to the IRS, which will process the authorization. This allows the designated party to access the taxpayer's records for the specified tax matters.

Steps to complete the Form 8821 Rev December

Completing the Form 8821 Rev December involves several key steps:

- Provide your name, address, and taxpayer identification number in the designated sections.

- Enter the name and address of the individual or organization you are authorizing.

- Specify the type of tax information you wish to disclose, such as income tax, employment tax, etc.

- Sign and date the form to validate your authorization.

- Submit the completed form to the IRS by mail or electronically, if applicable.

Legal use of the Form 8821 Rev December

The Form 8821 Rev December is legally binding once signed by the taxpayer. It provides a clear framework for the authorized party to access tax information while ensuring compliance with IRS regulations. The form does not grant the authorized individual or organization the power to make decisions on behalf of the taxpayer; it strictly allows for information access. Therefore, it is essential to choose a trustworthy individual or organization when granting this authorization.

Filing Deadlines / Important Dates

While there are no specific deadlines for submitting Form 8821 Rev December, it is advisable to file the form as soon as the need for third-party access arises. This ensures that the authorized party can obtain the necessary tax information promptly. Taxpayers should also be aware of any deadlines related to their specific tax situations, such as filing tax returns or responding to IRS inquiries.

Who Issues the Form

The Form 8821 Rev December is issued by the Internal Revenue Service (IRS), which is the federal agency responsible for tax administration in the United States. The IRS provides this form to facilitate the process of authorizing third parties to access taxpayer information, ensuring that all parties comply with the necessary legal requirements.

Quick guide on how to complete form 8821 rev december

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained traction among companies and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed papers, as you can easily find the right template and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly without delays. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

Easily Modify and eSign [SKS] Without Hassle

- Find [SKS] and click Get Form to commence.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive details with tools that airSlate SignNow specifically offers for this purpose.

- Generate your eSignature with the Sign feature, which takes only seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose your preferred method for sharing your form, whether it be via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Edit and eSign [SKS] and guarantee excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 8821 Rev December

Create this form in 5 minutes!

How to create an eSignature for the form 8821 rev december

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8821 Rev December?

Form 8821 Rev December is a tax document used to authorize a third party to receive confidential tax information from the IRS. It simplifies the process for taxpayers who need assistance managing their tax matters by allowing designated individuals or businesses access to their tax records.

-

How can airSlate SignNow help with Form 8821 Rev December?

airSlate SignNow provides an efficient platform for filling out, signing, and sending Form 8821 Rev December electronically. Users can manage their documents seamlessly, ensuring that they are completed correctly and submitted in a timely manner.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to meet your business needs. These plans include individual, business, and enterprise options, making it affordable for everyone who needs to utilize Form 8821 Rev December and other document services.

-

Are there any special features for managing Form 8821 Rev December with airSlate SignNow?

Yes, airSlate SignNow includes features specifically designed for managing Form 8821 Rev December, such as templates, reminders, and secure cloud storage. These features enhance user experience, making the document management process easy and efficient.

-

Can I integrate airSlate SignNow with other applications for Form 8821 Rev December?

Absolutely! airSlate SignNow integrates with various applications such as Google Drive, Dropbox, and CRM systems, allowing you to easily manage Form 8821 Rev December alongside other important tools. This integration streamlines workflows and enhances productivity.

-

What are the benefits of using airSlate SignNow for Form 8821 Rev December?

Using airSlate SignNow for Form 8821 Rev December offers numerous benefits, including time-saving electronic signatures, ease of use, and robust security measures. This platform ensures that your documents are handled efficiently while keeping your sensitive information protected.

-

Is it easy to track the status of Form 8821 Rev December submissions with airSlate SignNow?

Yes, airSlate SignNow provides users with the ability to track the status of all document submissions, including Form 8821 Rev December. This feature allows you to stay informed about who has signed the document and whether it has been successfully submitted.

Get more for Form 8821 Rev December

Find out other Form 8821 Rev December

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement

- eSignature Florida Loan agreement Online

- eSignature Florida Month to month lease agreement Later

- Can I eSignature Nevada Non-disclosure agreement PDF

- eSignature New Mexico Non-disclosure agreement PDF Online

- Can I eSignature Utah Non-disclosure agreement PDF

- eSignature Rhode Island Rental agreement lease Easy

- eSignature New Hampshire Rental lease agreement Simple

- eSignature Nebraska Rental lease agreement forms Fast

- eSignature Delaware Rental lease agreement template Fast

- eSignature West Virginia Rental lease agreement forms Myself

- eSignature Michigan Rental property lease agreement Online

- Can I eSignature North Carolina Rental lease contract

- eSignature Vermont Rental lease agreement template Online

- eSignature Vermont Rental lease agreement template Now

- eSignature Vermont Rental lease agreement template Free

- eSignature Nebraska Rental property lease agreement Later