Form 990 Schedule a

What is the Form 990 Schedule A

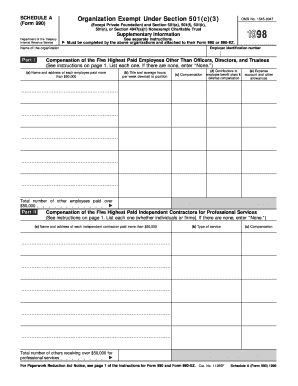

The Form 990 Schedule A is a critical document for tax-exempt organizations in the United States. It is used to provide detailed information about the organization's public charity status and the sources of its revenue. This form is an attachment to the main Form 990, which is filed annually by tax-exempt organizations, including charities and non-profits. Schedule A specifically helps the IRS determine whether an organization qualifies as a public charity under the Internal Revenue Code.

How to use the Form 990 Schedule A

Using the Form 990 Schedule A involves several steps. Organizations must complete the form accurately to maintain their tax-exempt status. The form requires information about the organization's public support, including contributions from the general public and government grants. Organizations must also detail any income from activities that are not related to their exempt purposes. Properly filling out this form helps ensure compliance with IRS regulations and provides transparency to stakeholders.

Steps to complete the Form 990 Schedule A

Completing the Form 990 Schedule A involves a systematic approach:

- Gather financial records, including income statements and donor information.

- Determine the organization's public support percentage by calculating total contributions and revenue.

- Fill out the form sections, providing accurate data on revenue sources and public support.

- Review the completed form for accuracy and completeness.

- Attach Schedule A to the main Form 990 before submission.

Legal use of the Form 990 Schedule A

The legal use of the Form 990 Schedule A is essential for compliance with IRS regulations. Organizations must file this form to demonstrate their eligibility for tax-exempt status. Failure to file or inaccuracies in the form can result in penalties or loss of tax-exempt status. It is crucial for organizations to understand the legal implications of the information provided in Schedule A and to ensure it is prepared according to IRS guidelines.

Filing Deadlines / Important Dates

Filing deadlines for the Form 990 Schedule A align with the main Form 990 deadlines. Generally, organizations must file their Form 990 by the 15th day of the fifth month after the end of their fiscal year. For organizations operating on a calendar year, this typically means a May 15 deadline. Extensions may be available, but organizations must file for them before the initial deadline to avoid penalties.

IRS Guidelines

The IRS provides specific guidelines for completing the Form 990 Schedule A. Organizations should refer to the IRS instructions for detailed requirements, including eligibility criteria for public charity status and how to calculate public support. Adhering to these guidelines is vital for ensuring that the information reported is accurate and compliant with federal tax laws.

Quick guide on how to complete form 990 schedule a

Complete [SKS] effortlessly on any device

Online document administration has become favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily find the correct form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents swiftly without delays. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and streamline any document-centric process today.

How to modify and electronically sign [SKS] without hassle

- Find [SKS] and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important portions of your documents or obscure confidential information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and then hit the Done button to save your edits.

- Choose your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign [SKS] and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 990 Schedule A

Create this form in 5 minutes!

How to create an eSignature for the form 990 schedule a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 990 Schedule A?

Form 990 Schedule A is a vital document that nonprofits must complete to provide detailed information about their public charity status. This schedule helps organizations to maintain their tax-exempt status by showing compliance with the Internal Revenue Service (IRS) requirements. Knowing how to properly manage your Form 990 Schedule A is essential for avoiding penalties and ensuring transparency.

-

How does airSlate SignNow assist with Form 990 Schedule A?

airSlate SignNow offers a seamless platform for nonprofits to gather signatures and eSign documents, including Form 990 Schedule A. The intuitive interface allows users to send and track documents effortlessly, ensuring timely filing. This enhances your efficiency in managing important documents related to nonprofit compliance.

-

What features does airSlate SignNow offer for managing Form 990 Schedule A?

airSlate SignNow provides features like customizable templates, document tracking, and automated reminders specifically tailored for Form 990 Schedule A. These tools streamline the document management process, facilitating easier collaboration among team members. With these features, you can ensure that all necessary signatures are obtained on time.

-

Is there a cost associated with using airSlate SignNow for Form 990 Schedule A?

Yes, airSlate SignNow offers various pricing plans based on the features you need, which includes support for managing Form 990 Schedule A. Their cost-effective solution caters to organizations of all sizes, ensuring that you find a plan that fits your budget. With transparent pricing, there are no hidden costs, making it easier to plan your finances.

-

Can I integrate airSlate SignNow with other software to manage Form 990 Schedule A?

Absolutely! airSlate SignNow allows seamless integrations with various software platforms that help with nonprofit management. By integrating with tools like CRM systems and accounting software, you can enhance your workflow and simplify the process of managing Form 990 Schedule A alongside other important documents.

-

What are the benefits of using airSlate SignNow for nonprofits handling Form 990 Schedule A?

Using airSlate SignNow can signNowly reduce the time and resources needed for managing Form 990 Schedule A. The document automation and eSigning features empower nonprofits to focus on their mission rather than paperwork. Furthermore, the security measures in place ensure that sensitive information is protected.

-

How secure is airSlate SignNow for documents like Form 990 Schedule A?

airSlate SignNow prioritizes security, using advanced encryption and authentication processes to protect documents like Form 990 Schedule A. User data and signatures are kept safe through compliance with industry standards. This commitment to security means you can trust airSlate SignNow with your organization's sensitive information.

Get more for Form 990 Schedule A

- Application for life time fishing linces for over 65 form

- 51a260 form

- The state of oregon follows the social security administration ssa guidelines for the filing of w 2 wage and form

- Or form or tm instructions 2019 fill out tax template

- Get the complete the fedex express pn transmission form using

- Form 10 ampquotnebraska and local sales and use tax return

- 941n nebraska income tax withholding return form

- Nebraska form 12n nebraska nonresident income tax agreement

Find out other Form 990 Schedule A

- Sign South Dakota Sales Invoice Template Free

- How Can I Sign Nevada Sales Proposal Template

- Can I Sign Texas Confirmation Of Reservation Or Order

- How To Sign Illinois Product Defect Notice

- Sign New Mexico Refund Request Form Mobile

- Sign Alaska Sponsorship Agreement Safe

- How To Sign Massachusetts Copyright License Agreement

- How Do I Sign Vermont Online Tutoring Services Proposal Template

- How Do I Sign North Carolina Medical Records Release

- Sign Idaho Domain Name Registration Agreement Easy

- Sign Indiana Domain Name Registration Agreement Myself

- Sign New Mexico Domain Name Registration Agreement Easy

- How To Sign Wisconsin Domain Name Registration Agreement

- Sign Wyoming Domain Name Registration Agreement Safe

- Sign Maryland Delivery Order Template Myself

- Sign Minnesota Engineering Proposal Template Computer

- Sign Washington Engineering Proposal Template Secure

- Sign Delaware Proforma Invoice Template Online

- Can I Sign Massachusetts Proforma Invoice Template

- How Do I Sign Oklahoma Equipment Purchase Proposal