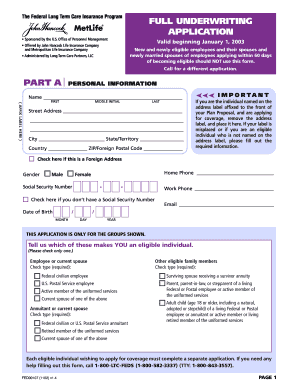

FULL UNDERWRITING Form

What is the FULL UNDERWRITING

FULL UNDERWRITING is a comprehensive evaluation process used primarily in the lending and insurance industries. This process involves a thorough assessment of an applicant's financial history, creditworthiness, and overall risk profile. The goal is to determine the applicant's ability to meet financial obligations and to evaluate the potential risks associated with providing a loan or insurance coverage.

During FULL UNDERWRITING, underwriters review various documents, including income statements, credit reports, and asset documentation. This detailed analysis helps lenders and insurers make informed decisions, ensuring that they mitigate risks while providing necessary financial support to individuals and businesses.

Steps to complete the FULL UNDERWRITING

Completing the FULL UNDERWRITING process involves several key steps that ensure a thorough evaluation of the applicant's financial situation. These steps typically include:

- Gathering Documentation: Collect necessary documents such as tax returns, pay stubs, bank statements, and any other financial records that provide insight into the applicant's financial health.

- Submitting the Application: Complete and submit the application form along with the gathered documentation to the lender or insurance provider.

- Credit Evaluation: The underwriter will conduct a credit check to assess the applicant's credit history and score, which plays a crucial role in the decision-making process.

- Risk Assessment: The underwriter will analyze the applicant's financial data to evaluate risks, including debt-to-income ratios and overall financial stability.

- Decision Making: Based on the gathered information, the underwriter will make a decision to approve, deny, or conditionally approve the application.

Key elements of the FULL UNDERWRITING

FULL UNDERWRITING encompasses several critical elements that contribute to a comprehensive assessment of an applicant's financial profile. These elements include:

- Credit History: A detailed review of the applicant's credit report, including payment history, outstanding debts, and credit utilization.

- Income Verification: Confirmation of the applicant's income sources, including employment verification and any additional income streams.

- Asset Evaluation: Assessment of the applicant's assets, such as savings accounts, investments, and property ownership, to gauge financial stability.

- Debt Analysis: Examination of existing debts to determine the applicant's debt-to-income ratio and overall financial obligations.

Legal use of the FULL UNDERWRITING

FULL UNDERWRITING is legally recognized as a necessary process in various financial transactions, particularly in lending and insurance. It ensures compliance with federal and state regulations, protecting both the lender and the borrower. The process must adhere to the Fair Credit Reporting Act (FCRA) and other relevant laws, which govern how consumer information is collected, used, and shared. This legal framework helps maintain transparency and fairness in the underwriting process.

Required Documents

To successfully complete the FULL UNDERWRITING process, applicants must provide specific documentation that supports their financial claims. Commonly required documents include:

- Recent pay stubs or proof of income

- Tax returns for the past two years

- Bank statements from the last few months

- Credit reports from major credit bureaus

- Documentation of any additional income sources, such as rental income or investments

Eligibility Criteria

Eligibility for FULL UNDERWRITING typically depends on various factors, including the applicant's credit score, income level, and overall financial stability. Lenders and insurers may have specific criteria that applicants must meet, such as:

- A minimum credit score threshold

- Stable employment history

- A satisfactory debt-to-income ratio

- Proof of sufficient assets to cover down payments or premiums

Quick guide on how to complete full underwriting

Complete [SKS] effortlessly on any device

Digital document management has become popular among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents quickly without delays. Manage [SKS] on any platform using airSlate SignNow's Android or iOS apps and simplify any document-related process today.

How to edit and eSign [SKS] effortlessly

- Locate [SKS] and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or hide sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Select your preferred method to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Put aside concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign [SKS] and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to FULL UNDERWRITING

Create this form in 5 minutes!

How to create an eSignature for the full underwriting

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is FULL UNDERWRITING in the context of airSlate SignNow?

FULL UNDERWRITING refers to the comprehensive evaluation process that ensures all documents sent using airSlate SignNow are thoroughly vetted for accuracy, compliance, and legitimacy. This feature enhances trust and security for both senders and recipients, making it an essential aspect of our service.

-

How does FULL UNDERWRITING improve the eSigning experience?

FULL UNDERWRITING enhances the eSigning experience by providing additional layers of verification, thereby reducing the risk of disputes or fraudulent activities. With FULL UNDERWRITING, users can confidently sign documents knowing that their information is backed by a secure and reliable process.

-

What are the key features of FULL UNDERWRITING offered by airSlate SignNow?

The key features of FULL UNDERWRITING include identity verification, document authentication, and comprehensive audit trails. These features work together to ensure that every document signed through airSlate SignNow meets strict standards for safety and compliance.

-

Is there an additional cost for using FULL UNDERWRITING with airSlate SignNow?

There may be an additional cost associated with FULL UNDERWRITING, as it provides advanced security features. However, airSlate SignNow offers flexible pricing plans, allowing businesses to choose tiers that best fit their needs while ensuring they benefit from FULL UNDERWRITING capabilities.

-

Can FULL UNDERWRITING be integrated with other software tools?

Yes, FULL UNDERWRITING can be seamlessly integrated with various software tools and platforms. airSlate SignNow supports numerous integrations, allowing businesses to incorporate our eSigning solutions into their existing workflows alongside FULL UNDERWRITING functionality.

-

What benefits does FULL UNDERWRITING provide to businesses?

FULL UNDERWRITING provides numerous benefits, including enhanced compliance, reduced fraud risk, and increased trust among clients. By utilizing FULL UNDERWRITING, businesses can streamline their operations while ensuring that all signed documents are secure and legally binding.

-

How do I enable FULL UNDERWRITING for my airSlate SignNow account?

To enable FULL UNDERWRITING for your airSlate SignNow account, simply visit your account settings and select the appropriate options under security features. If you have any questions or need assistance, our customer support team is ready to help you set it up.

Get more for FULL UNDERWRITING

- Ptax 342 lake county illinois form

- Records release central orthopedic group form

- Imt operating plan for cooperating agency personnel 2 13 13 hawks opinion doc form

- St elizabeth ridgefield ct form

- Player code of conduct doc form

- Business proposal for jpo real estate jscholarship jscholarship library jhu form

- Ger3620 form

- Suncoast parkway map form

Find out other FULL UNDERWRITING

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast