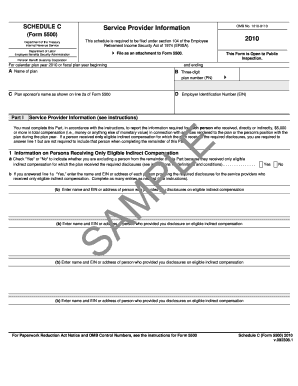

This Schedule is Required to Be Filed under Section 104 of the Employee Form

What is the Schedule Required Under Section 104 of the Employee?

The Schedule required under Section 104 of the Employee refers to a specific document that employers must file to report certain employee benefits and compensation. This schedule is essential for ensuring compliance with federal regulations regarding employee compensation and benefits. It includes detailed information about the types of benefits provided, such as health insurance, retirement contributions, and other forms of compensation that may be taxable or non-taxable. Understanding this schedule is crucial for both employers and employees to ensure accurate reporting and compliance with tax obligations.

Steps to Complete the Schedule Required Under Section 104 of the Employee

Completing the Schedule required under Section 104 involves several key steps. First, gather all necessary documentation related to employee benefits and compensation. This may include payroll records, benefit statements, and any relevant tax documents. Next, accurately fill out the schedule by providing detailed information about each employee's benefits, ensuring that all entries align with IRS guidelines. After completing the form, review it for accuracy before submitting it to the appropriate tax authority. It is crucial to keep a copy for your records as well.

Filing Deadlines for the Schedule Required Under Section 104 of the Employee

Filing deadlines for the Schedule required under Section 104 are critical to avoid penalties. Typically, this schedule must be filed annually, with the deadline coinciding with the employer's tax return due date. For most employers, this means filing by March fifteenth if they operate on a calendar year basis. However, if an extension is filed for the tax return, the schedule must also be submitted by the extended deadline. It is essential to stay informed about any changes to these deadlines to ensure timely compliance.

Key Elements of the Schedule Required Under Section 104 of the Employee

The key elements of the Schedule required under Section 104 include detailed sections for reporting various types of employee benefits. This typically encompasses health insurance premiums, retirement plan contributions, and other taxable fringe benefits. Each section requires specific information, such as the name of the employee, the type of benefit provided, and the total amount contributed or paid by the employer. Accurate reporting of these elements is vital for compliance and for providing employees with clear information regarding their benefits.

Legal Use of the Schedule Required Under Section 104 of the Employee

The legal use of the Schedule required under Section 104 is to ensure compliance with federal tax regulations concerning employee compensation and benefits. Employers are obligated to file this schedule to accurately report the benefits provided to employees, which helps the IRS monitor compliance with tax laws. Failure to file this schedule or inaccuracies in reporting can lead to penalties and potential audits. Therefore, understanding the legal implications of this schedule is crucial for maintaining compliance and avoiding legal issues.

Examples of Using the Schedule Required Under Section 104 of the Employee

Examples of using the Schedule required under Section 104 include scenarios where an employer provides health insurance benefits to employees or contributes to a retirement plan. For instance, if an employer pays a portion of an employee's health insurance premium, this amount must be reported on the schedule. Similarly, if an employer matches employee contributions to a 401(k) plan, these contributions should also be documented. Each example highlights the importance of accurate reporting to ensure compliance and transparency in employee compensation.

Quick guide on how to complete this schedule is required to be filed under section 104 of the employee

Complete [SKS] effortlessly on any device

Digital document management has become increasingly popular among companies and individuals alike. It offers an excellent eco-friendly substitute to conventional printed and signed documents, as you can find the right template and securely save it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any device with airSlate SignNow Android or iOS applications and simplify any document-oriented process today.

How to modify and eSign [SKS] with ease

- Find [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Put an end to lost or mislaid documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your choice. Edit and eSign [SKS] and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the this schedule is required to be filed under section 104 of the employee

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is 'This Schedule Is Required To Be Filed Under Section 104 Of The Employee'?

'This Schedule Is Required To Be Filed Under Section 104 Of The Employee' refers to a specific form that must be submitted to comply with certain employee benefits regulations. It ensures proper reporting and adherence to legal standards. Businesses using airSlate SignNow can streamline this process through digital signatures, making compliance easier and more efficient.

-

How can airSlate SignNow assist with filing 'This Schedule Is Required To Be Filed Under Section 104 Of The Employee'?

airSlate SignNow allows you to electronically sign and send documents, including those related to 'This Schedule Is Required To Be Filed Under Section 104 Of The Employee'. This platform simplifies the submission process, ensuring timely filing and reducing the risk of errors. With our solutions, you can keep track of all submissions effortlessly.

-

What features does airSlate SignNow offer for compliance with employee-related documents?

airSlate SignNow provides features such as secure electronic signatures, customizable templates, and real-time tracking for document submissions, which are crucial for 'This Schedule Is Required To Be Filed Under Section 104 Of The Employee'. These tools enhance the overall workflow, making it easier to manage essential documents and maintain compliance with regulations.

-

Is there a free trial available for airSlate SignNow?

Yes, airSlate SignNow offers a free trial allowing you to explore our services without any financial commitment. During this trial, you can familiarize yourself with features that assist in filing important documents like 'This Schedule Is Required To Be Filed Under Section 104 Of The Employee'. This helps you assess if our solution meets your business needs.

-

What are the pricing plans for airSlate SignNow?

airSlate SignNow offers competitive pricing plans that cater to different business sizes and needs. Whether you need basic features or more advanced capabilities for filing 'This Schedule Is Required To Be Filed Under Section 104 Of The Employee', you’ll find a plan that fits your budget. Each plan provides exceptional value through our comprehensive eSigning features.

-

Can airSlate SignNow integrate with other business tools?

Absolutely! airSlate SignNow seamlessly integrates with many popular business applications, enhancing your workflow when dealing with documents like 'This Schedule Is Required To Be Filed Under Section 104 Of The Employee'. This integration capability ensures that you can connect with your existing systems, improving efficiency and organization.

-

What are the benefits of using airSlate SignNow for document management?

Using airSlate SignNow for document management provides numerous benefits, including increased speed in processing and signing documents. You can manage 'This Schedule Is Required To Be Filed Under Section 104 Of The Employee' and other essential forms digitally, reducing paper usage and improving access to important documents. Our platform ensures security and compliance throughout the process.

Get more for This Schedule Is Required To Be Filed Under Section 104 Of The Employee

Find out other This Schedule Is Required To Be Filed Under Section 104 Of The Employee

- eSign Texas Insurance Affidavit Of Heirship Myself

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free