Individuals Enter the Line 6 Amount on Form it 201 ATT, Line 15, or Form it 203 ATT, Line 14 Tax Ny

Understanding the Individuals Enter The Line 6 Amount On Form IT 201 ATT, Line 15, Or Form IT 203 ATT, Line 14 Tax Ny

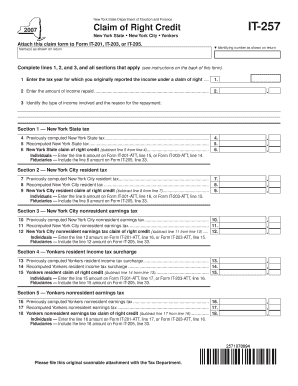

The Individuals Enter The Line 6 Amount On Form IT 201 ATT, Line 15, Or Form IT 203 ATT, Line 14 Tax Ny refers to specific tax forms used by individuals in New York State to report their income and calculate their tax liabilities. Form IT-201 ATT is primarily for resident individuals, while Form IT-203 ATT is for non-residents and part-year residents. The amounts entered on these lines are crucial for determining the correct tax owed or refund due.

Steps to Complete the Individuals Enter The Line 6 Amount On Form IT 201 ATT, Line 15, Or Form IT 203 ATT, Line 14 Tax Ny

Completing these forms involves several steps. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, calculate your total income and any deductions you may qualify for. After determining your taxable income, refer to Line 6 on Form IT 201 ATT or Line 14 on Form IT 203 ATT to enter the appropriate amount. Ensure that all figures are accurate to avoid discrepancies.

Key Elements of the Individuals Enter The Line 6 Amount On Form IT 201 ATT, Line 15, Or Form IT 203 ATT, Line 14 Tax Ny

Key elements of these forms include personal identification information, total income, adjustments, and the final tax calculation. Specifically, Line 6 on Form IT 201 ATT and Line 14 on Form IT 203 ATT require the taxpayer to report their New York adjusted gross income. This figure is essential for determining the tax rate applicable to your income level.

Filing Deadlines and Important Dates for Individuals Enter The Line 6 Amount On Form IT 201 ATT, Line 15, Or Form IT 203 ATT, Line 14 Tax Ny

It is important to be aware of the filing deadlines associated with these forms. Typically, the deadline for filing New York State tax returns is April fifteenth. However, if this date falls on a weekend or holiday, the deadline may shift to the next business day. Late filings may incur penalties, so timely submission is crucial.

Required Documents for Individuals Enter The Line 6 Amount On Form IT 201 ATT, Line 15, Or Form IT 203 ATT, Line 14 Tax Ny

To accurately complete Form IT 201 ATT or Form IT 203 ATT, you'll need several documents. These include your W-2 forms from employers, any 1099 forms for additional income, records of deductions or credits, and any other financial statements that reflect your income. Having these documents organized will streamline the filing process.

Examples of Using the Individuals Enter The Line 6 Amount On Form IT 201 ATT, Line 15, Or Form IT 203 ATT, Line 14 Tax Ny

Examples of using these forms can vary based on individual circumstances. For instance, a full-time employee who receives a W-2 will report their wages on Line 6 of Form IT 201 ATT. Conversely, a part-time resident who earns income in New York but lives elsewhere would use Form IT 203 ATT and report their income on Line 14. Each scenario requires careful attention to ensure compliance with state tax laws.

Quick guide on how to complete individuals enter the line 6 amount on form it 201 att line 15 or form it 203 att line 14 tax ny

Effortlessly complete [SKS] on any device

Managing documents online has gained signNow traction among businesses and individuals. It serves as an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to find the appropriate form and save it securely on the web. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and electronically sign [SKS] effortlessly

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we offer to fill in your document.

- Emphasize important sections of the documents or redact sensitive information using the tools provided by airSlate SignNow specifically for this purpose.

- Generate your signature with the Sign tool, which takes moments and has the same legal validity as a manual ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to deliver your form, whether by email, text (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, and mistakes that necessitate reprinting new copies. airSlate SignNow caters to your document management needs with just a few clicks from any device you prefer. Modify and electronically sign [SKS] and guarantee excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Individuals Enter The Line 6 Amount On Form IT 201 ATT, Line 15, Or Form IT 203 ATT, Line 14 Tax Ny

Create this form in 5 minutes!

How to create an eSignature for the individuals enter the line 6 amount on form it 201 att line 15 or form it 203 att line 14 tax ny

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of entering the Line 6 amount on Form IT 201 ATT, Line 15, or Form IT 203 ATT, Line 14 Tax NY?

Individuals Enter The Line 6 Amount On Form IT 201 ATT, Line 15, Or Form IT 203 ATT, Line 14 Tax NY to ensure accurate reporting of taxable income and deductions. This information is crucial for determining the total tax liability and potential refunds during the filing process.

-

How does airSlate SignNow help with tax document management?

AirSlate SignNow provides a streamlined platform where individuals can easily eSign and manage their tax documents, including Form IT 201 ATT and Form IT 203 ATT. This ensures that documents are securely signed, stored, and accessible, making it easier to keep track of important tax filing requirements.

-

What features does airSlate SignNow offer for eSigning documents?

AirSlate SignNow offers features such as customizable workflows, document templates, and real-time tracking. These tools empower individuals to complete forms like IT 201 ATT and IT 203 ATT efficiently while ensuring compliance with tax regulations.

-

Is there a cost associated with using airSlate SignNow for tax documents?

Yes, airSlate SignNow provides various pricing plans tailored to meet different needs and budgets. By choosing a plan, individuals can simplify their tax document processes, including entering the Line 6 amount on Form IT 201 ATT and Form IT 203 ATT.

-

Can I integrate airSlate SignNow with other software for my tax preparation?

Absolutely! AirSlate SignNow integrates seamlessly with popular tax preparation software, enhancing your ability to manage forms like IT 201 ATT and IT 203 ATT. This integration allows you to streamline your workflow and ensure all necessary amounts are accurately entered and documented.

-

How secure is airSlate SignNow for handling sensitive tax documents?

AirSlate SignNow prioritizes security and employs industry-standard encryption to protect sensitive tax information. When individuals enter the Line 6 amount on Form IT 201 ATT or Form IT 203 ATT, their data remains confidential and secure throughout the signing process.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents offers several benefits, including increased efficiency, reduced paperwork, and improved organization. By leveraging the platform, individuals can easily enter the Line 6 amount on Form IT 201 ATT or Form IT 203 ATT and focus on other important aspects of their tax filing.

Get more for Individuals Enter The Line 6 Amount On Form IT 201 ATT, Line 15, Or Form IT 203 ATT, Line 14 Tax Ny

- District attorney philadelphia youth aid panel form

- Emory healthcare authorization for the release of protected health information

- Amalgamation checklist form

- Esthetician intake form

- Wireshark lab ssl v7 0 solution form

- Online fill transition form

- Student parent laptop agreement orange county schools form

- Maestro cnc software download form

Find out other Individuals Enter The Line 6 Amount On Form IT 201 ATT, Line 15, Or Form IT 203 ATT, Line 14 Tax Ny

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free