Form it 252 ATT Employment Incentive Credit for the Tax Ny

What is the Form IT 252 ATT Employment Incentive Credit For The Tax Ny

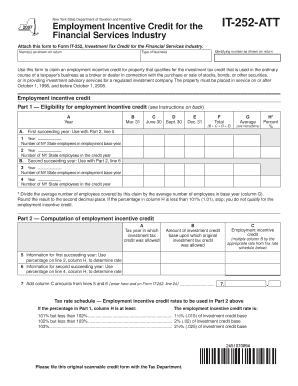

The Form IT 252 ATT is a tax form used in New York State to claim the Employment Incentive Credit. This credit is designed to encourage businesses to hire new employees and provide financial relief by reducing the amount of tax owed. The credit is available to eligible employers who meet specific criteria, including hiring individuals from targeted groups. Understanding the purpose and eligibility requirements of this form is crucial for businesses looking to benefit from tax incentives.

How to use the Form IT 252 ATT Employment Incentive Credit For The Tax Ny

To effectively use the Form IT 252 ATT, employers must first determine their eligibility for the Employment Incentive Credit. Once eligibility is confirmed, the form should be completed with accurate information regarding the new hires and the corresponding credit amount. Employers must then submit the completed form along with their tax return to the New York State Department of Taxation and Finance. Proper use of this form can lead to significant tax savings for businesses.

Steps to complete the Form IT 252 ATT Employment Incentive Credit For The Tax Ny

Completing the Form IT 252 ATT involves several key steps:

- Gather necessary documentation, including employee information and details about the business.

- Review the eligibility criteria to ensure compliance with the requirements.

- Fill out the form, providing accurate data on new hires and the incentive credit being claimed.

- Double-check all entries for accuracy to avoid delays or rejections.

- Submit the form with your tax return by the designated deadline.

Eligibility Criteria

Eligibility for the Employment Incentive Credit outlined on Form IT 252 ATT requires that businesses hire individuals from specific groups, such as veterans or long-term unemployed individuals. Additionally, the hiring must occur within a defined timeframe, and the employees must meet certain wage thresholds. Employers should carefully review the criteria to ensure they qualify for the credit before submitting the form.

Required Documents

When completing the Form IT 252 ATT, employers need to have several documents ready:

- Employee identification information, including Social Security numbers.

- Records of employment dates and wages for new hires.

- Documentation proving the employee's eligibility for the targeted group.

- Any additional forms or schedules required by the New York State Department of Taxation and Finance.

Filing Deadlines / Important Dates

It is essential for employers to be aware of filing deadlines associated with the Form IT 252 ATT. Typically, the form must be submitted along with the annual tax return, which is due on April fifteenth for most businesses. However, specific deadlines may vary based on the type of business entity. Staying informed about these dates can help avoid penalties and ensure that businesses can take full advantage of the Employment Incentive Credit.

Quick guide on how to complete form it 252 att employment incentive credit for the tax ny

Finish [SKS] effortlessly on any gadget

Digital document management has gained traction among organizations and individuals alike. It offers a superb environmentally friendly alternative to conventional printed and signed papers, as you can easily locate the right template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage [SKS] on any gadget with airSlate SignNow Android or iOS applications and simplify any document-based task today.

How to edit and eSign [SKS] without any hassle

- Obtain [SKS] and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and then click the Done button to save your changes.

- Select your preferred method to deliver your form: by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced papers, tedious form searches, or inaccuracies that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign [SKS] and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form it 252 att employment incentive credit for the tax ny

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form IT 252 ATT Employment Incentive Credit For The Tax Ny?

Form IT 252 ATT Employment Incentive Credit For The Tax Ny is a form used by taxpayers to claim credits for employment incentives on their New York state tax returns. This form helps to reduce the overall tax liability for businesses hiring qualified employees. By using airSlate SignNow, you can effortlessly manage and eSign this form and ensure compliance with state requirements.

-

How can airSlate SignNow help me with Form IT 252 ATT Employment Incentive Credit For The Tax Ny?

airSlate SignNow offers a user-friendly platform to eSign and send Form IT 252 ATT Employment Incentive Credit For The Tax Ny seamlessly. Our solution simplifies the documentation process, allowing for quick approvals and storage. You'll save valuable time and reduce errors while ensuring your tax credit claims are handled properly.

-

What are the pricing options for airSlate SignNow related to Form IT 252 ATT Employment Incentive Credit For The Tax Ny?

airSlate SignNow provides flexible pricing plans tailored for businesses of all sizes, allowing you to choose the one that best fits your needs. Each plan includes features essential for managing documents like Form IT 252 ATT Employment Incentive Credit For The Tax Ny. Contact our sales team for detailed pricing information and to discuss which plan works best for you.

-

Are there any benefits to using airSlate SignNow for Form IT 252 ATT Employment Incentive Credit For The Tax Ny?

Using airSlate SignNow for Form IT 252 ATT Employment Incentive Credit For The Tax Ny allows for efficient document management and quick eSigning capabilities. It enhances collaboration within your team and with external stakeholders, improving accuracy and speeding up the process. Additionally, advanced tracking features help ensure your submissions are completed on time.

-

Can I integrate airSlate SignNow with other tools for managing Form IT 252 ATT Employment Incentive Credit For The Tax Ny?

Yes, airSlate SignNow integrates with various business applications, making it easy to manage Form IT 252 ATT Employment Incentive Credit For The Tax Ny alongside your other tools. Popular integrations include CRM systems, document storage solutions, and more. This connectivity streamlines your workflow so you can focus more on your business operations.

-

Is airSlate SignNow secure for handling Form IT 252 ATT Employment Incentive Credit For The Tax Ny?

Absolutely! airSlate SignNow employs advanced security measures to protect your documents, including Form IT 252 ATT Employment Incentive Credit For The Tax Ny. With features like encryption, secure access, and compliance with industry standards, you can trust that your sensitive information is safe throughout the eSigning process.

-

How can I get started with airSlate SignNow for Form IT 252 ATT Employment Incentive Credit For The Tax Ny?

Getting started with airSlate SignNow is simple. Sign up for a free trial to explore our features focused on simplifying the management of Form IT 252 ATT Employment Incentive Credit For The Tax Ny. Our user-friendly interface guides you through the setup process, and our customer support team is ready to assist you with any questions.

Get more for Form IT 252 ATT Employment Incentive Credit For The Tax Ny

Find out other Form IT 252 ATT Employment Incentive Credit For The Tax Ny

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed

- Help Me With Sign North Dakota Government Quitclaim Deed

- Sign Oregon Government Last Will And Testament Mobile

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online

- Sign Alabama Healthcare / Medical Quitclaim Deed Mobile

- Can I Sign Alabama Healthcare / Medical Quitclaim Deed

- Sign Utah Government Month To Month Lease Myself

- Can I Sign Texas Government Limited Power Of Attorney

- Sign Arkansas Healthcare / Medical Living Will Free

- Sign Arkansas Healthcare / Medical Bill Of Lading Later