Adjusted Employer S Quarterly Federal Tax Return or Claim for Refund 2025-2026

What is the Adjusted Employer’s Quarterly Federal Tax Return Or Claim For Refund

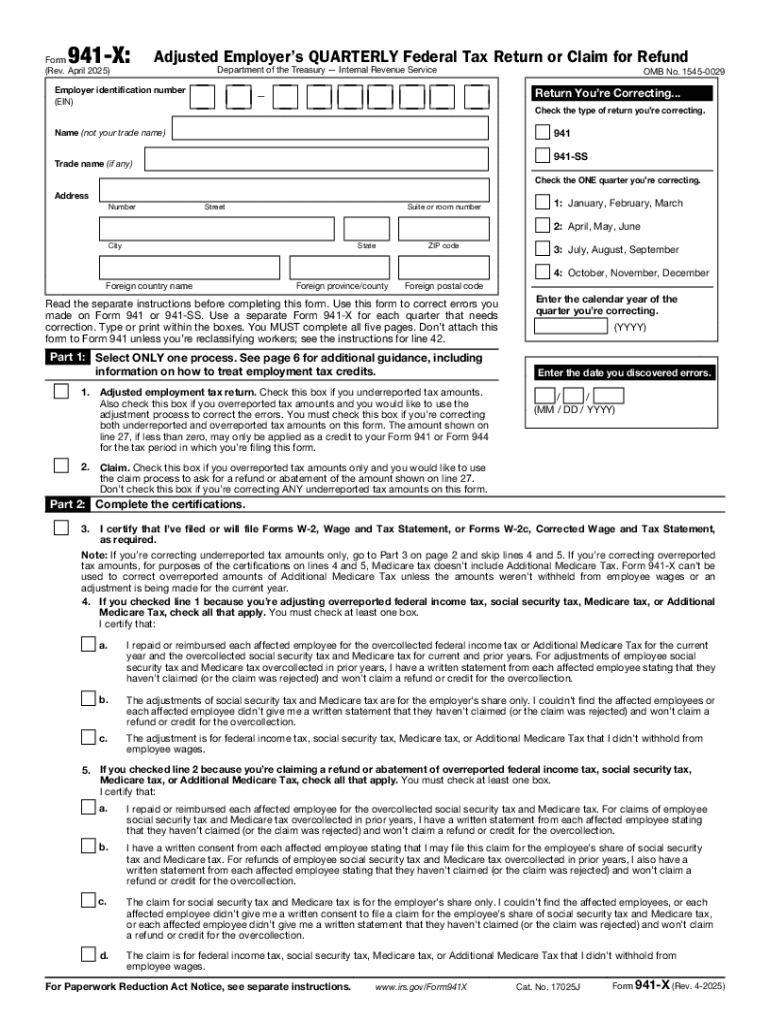

The Adjusted Employer’s Quarterly Federal Tax Return Or Claim For Refund, often referred to as Form 941-X, is a crucial document for employers in the United States. This form is used to correct errors made on previously filed Form 941, which reports income taxes, Social Security tax, and Medicare tax withheld from employee wages. Employers can also use this form to claim refunds for overreported taxes or to adjust their tax liabilities. Understanding its purpose is essential for maintaining compliance with IRS regulations and ensuring accurate tax reporting.

Steps to complete the Adjusted Employer’s Quarterly Federal Tax Return Or Claim For Refund

Completing the Adjusted Employer’s Quarterly Federal Tax Return Or Claim For Refund involves several key steps:

- Gather all necessary information, including the original Form 941 and any supporting documentation related to the adjustments.

- Determine the specific errors that need correction and the amounts that require adjustment.

- Fill out Form 941-X, ensuring that all sections are completed accurately, including the specific lines that reflect the adjustments.

- Provide a clear explanation of the adjustments in Part 2 of the form, detailing the reasons for the changes.

- Review the completed form for accuracy before submission.

Key elements of the Adjusted Employer’s Quarterly Federal Tax Return Or Claim For Refund

Several key elements are essential when filling out the Adjusted Employer’s Quarterly Federal Tax Return Or Claim For Refund:

- Employer Identification Number (EIN): This unique number identifies the business entity and must be included on the form.

- Tax Period: Indicate the specific quarter for which the adjustments are being made.

- Adjustment Amounts: Clearly state the amounts being adjusted for each relevant tax line.

- Explanation of Changes: A detailed description of the reasons for adjustments helps clarify the corrections to the IRS.

Filing Deadlines / Important Dates

Timely filing of the Adjusted Employer’s Quarterly Federal Tax Return Or Claim For Refund is critical to avoid penalties. The deadlines for submitting Form 941-X align with the filing deadlines for Form 941. Employers should be aware of the following important dates:

- For the first quarter, the deadline is April 30.

- For the second quarter, the deadline is July 31.

- For the third quarter, the deadline is October 31.

- For the fourth quarter, the deadline is January 31 of the following year.

IRS Guidelines

The IRS provides specific guidelines for using the Adjusted Employer’s Quarterly Federal Tax Return Or Claim For Refund. Employers must adhere to these guidelines to ensure compliance:

- Only use Form 941-X to correct errors on previously filed Form 941.

- Submit the form for the same quarter in which the original error occurred.

- Keep a copy of the completed form and any supporting documents for your records.

- Follow the instructions provided by the IRS to ensure all adjustments are properly documented.

Eligibility Criteria

To use the Adjusted Employer’s Quarterly Federal Tax Return Or Claim For Refund, employers must meet certain eligibility criteria:

- Employers must have filed Form 941 for the relevant quarter.

- Adjustments must pertain to amounts reported on the original Form 941.

- Employers should have valid reasons for making adjustments, such as correcting overreported wages or taxes.

Handy tips for filling out Adjusted Employer s Quarterly Federal Tax Return Or Claim For Refund online

Quick steps to complete and e-sign Adjusted Employer s Quarterly Federal Tax Return Or Claim For Refund online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining filling in forms can be. Get access to a GDPR and HIPAA compliant platform for maximum simpleness. Use signNow to electronically sign and share Adjusted Employer s Quarterly Federal Tax Return Or Claim For Refund for e-signing.

Create this form in 5 minutes or less

Find and fill out the correct adjusted employers quarterly federal tax return or claim for refund

Create this form in 5 minutes!

How to create an eSignature for the adjusted employers quarterly federal tax return or claim for refund

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an Adjusted Employer’s Quarterly Federal Tax Return Or Claim For Refund?

An Adjusted Employer’s Quarterly Federal Tax Return Or Claim For Refund is a form used by employers to report adjustments to previously filed tax returns. This form allows businesses to correct errors or claim refunds for overpaid taxes. Understanding this process is crucial for maintaining compliance and optimizing tax liabilities.

-

How can airSlate SignNow help with filing an Adjusted Employer’s Quarterly Federal Tax Return Or Claim For Refund?

airSlate SignNow simplifies the process of filing an Adjusted Employer’s Quarterly Federal Tax Return Or Claim For Refund by providing an intuitive platform for document management and eSigning. Users can easily prepare, send, and sign necessary documents, ensuring a smooth filing experience. This efficiency can save time and reduce the risk of errors.

-

What are the pricing options for using airSlate SignNow for tax-related documents?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Each plan includes features that facilitate the preparation and submission of documents like the Adjusted Employer’s Quarterly Federal Tax Return Or Claim For Refund. You can choose a plan that best fits your budget and requirements.

-

Are there any integrations available with airSlate SignNow for tax filing?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software, enhancing the efficiency of filing an Adjusted Employer’s Quarterly Federal Tax Return Or Claim For Refund. These integrations allow for easy data transfer and document management, streamlining your workflow. This connectivity ensures that all your tax-related documents are in one place.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides a range of features designed for effective document management, including customizable templates, secure eSigning, and real-time tracking. These features are particularly beneficial when preparing an Adjusted Employer’s Quarterly Federal Tax Return Or Claim For Refund, as they ensure accuracy and compliance. Users can manage their documents efficiently from anywhere.

-

How does airSlate SignNow ensure the security of my tax documents?

Security is a top priority for airSlate SignNow, which employs advanced encryption and secure cloud storage to protect your tax documents. When filing an Adjusted Employer’s Quarterly Federal Tax Return Or Claim For Refund, you can trust that your sensitive information is safeguarded. Regular security audits and compliance with industry standards further enhance document safety.

-

Can I track the status of my Adjusted Employer’s Quarterly Federal Tax Return Or Claim For Refund with airSlate SignNow?

Absolutely! airSlate SignNow allows you to track the status of your documents in real-time. This feature is particularly useful for monitoring the progress of your Adjusted Employer’s Quarterly Federal Tax Return Or Claim For Refund, ensuring you stay informed throughout the filing process. Notifications keep you updated on any changes or actions required.

Get more for Adjusted Employer s Quarterly Federal Tax Return Or Claim For Refund

- Inz 1015 work visa application form

- Requirement specfications for submission of form ir56e in ird

- Sponsorship form for religious workers inz 1190 immigration

- The fastest and easiest way to apply for a student visa is online form

- Form 81c efm

- Habitual residence condition form

- Form33b1

- Consent form and terms of use for amazon aws

Find out other Adjusted Employer s Quarterly Federal Tax Return Or Claim For Refund

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Computer

- eSignature Wyoming LLC Operating Agreement Later

- eSignature Wyoming LLC Operating Agreement Free

- How To eSignature Wyoming LLC Operating Agreement

- eSignature California Commercial Lease Agreement Template Myself

- eSignature California Commercial Lease Agreement Template Easy

- eSignature Florida Commercial Lease Agreement Template Easy

- eSignature Texas Roommate Contract Easy

- eSignature Arizona Sublease Agreement Template Free

- eSignature Georgia Sublease Agreement Template Online

- eSignature Arkansas Roommate Rental Agreement Template Mobile

- eSignature Maryland Roommate Rental Agreement Template Free

- How Do I eSignature California Lodger Agreement Template

- eSignature Kentucky Lodger Agreement Template Online

- eSignature North Carolina Lodger Agreement Template Myself

- eSignature Alabama Storage Rental Agreement Free

- eSignature Oregon Housekeeping Contract Computer