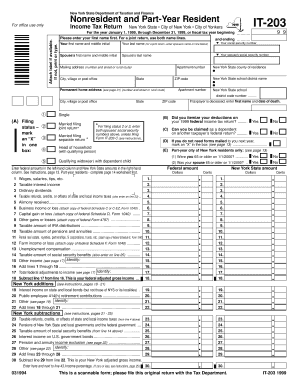

Form it 203 , Nonresident and Part Year Resident Income Tax

What is the Form IT 203, Nonresident And Part Year Resident Income Tax

The Form IT 203 is a tax document used by nonresidents and part-year residents of New York State to report income earned within the state. This form is essential for individuals who do not reside in New York for the entire year but have income sourced from New York. It allows these taxpayers to accurately calculate their tax obligations based on the income earned while in the state. The form is specifically designed to ensure compliance with New York State tax laws for those who may not be full-time residents.

Steps to complete the Form IT 203, Nonresident And Part Year Resident Income Tax

Completing the Form IT 203 involves several key steps to ensure accurate reporting of income. First, gather all necessary documents, including W-2 forms, 1099s, and any other income statements. Next, determine the total income earned while in New York, as well as any deductions or credits applicable to your situation. Follow the instructions on the form carefully, filling in your personal information, income details, and any adjustments. Finally, review the completed form for accuracy before submitting it to the appropriate tax authority.

How to obtain the Form IT 203, Nonresident And Part Year Resident Income Tax

The Form IT 203 can be obtained through various channels. It is available for download from the New York State Department of Taxation and Finance website. Additionally, physical copies can be requested from local tax offices or obtained at certain public libraries. It is advisable to ensure you have the most current version of the form to avoid any issues during filing.

Filing Deadlines / Important Dates

Filing deadlines for the Form IT 203 are typically aligned with the federal tax filing deadlines. Generally, nonresidents and part-year residents must file their returns by April fifteenth of the following year. If this date falls on a weekend or holiday, the deadline may be extended. It is crucial to stay informed about any changes in deadlines to avoid penalties.

Required Documents

To complete the Form IT 203, several documents are necessary. Taxpayers should have their W-2 forms, 1099 forms, and any other income statements that reflect earnings from New York sources. Additionally, documentation for any deductions or credits must be collected, such as receipts or statements related to business expenses, education, or other qualifying expenses. Having these documents organized will facilitate a smoother filing process.

Penalties for Non-Compliance

Failure to file the Form IT 203 or inaccuracies in reporting can lead to significant penalties. The New York State Department of Taxation and Finance may impose fines for late filings, which can accumulate over time. Additionally, underreporting income may result in interest charges on unpaid taxes. It is essential to adhere to filing requirements to avoid these potential financial repercussions.

Quick guide on how to complete form it 203 nonresident and part year resident income tax

Finish [SKS] effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers an optimal eco-friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] on any platform with the airSlate SignNow apps for Android or iOS and streamline any document-related procedure today.

How to edit and eSign [SKS] effortlessly

- Find [SKS] and click on Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal significance as a traditional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Choose your preferred method to send your form, whether via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and eSign [SKS] to ensure effective communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form IT 203 , Nonresident And Part Year Resident Income Tax

Create this form in 5 minutes!

How to create an eSignature for the form it 203 nonresident and part year resident income tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form IT 203, Nonresident And Part Year Resident Income Tax?

Form IT 203, Nonresident And Part Year Resident Income Tax, is used by individuals who are nonresidents or part-year residents of New York to report their income and calculate their state tax liability. This form allows you to accurately report your income earned while in New York, ensuring compliance with state tax regulations.

-

How can airSlate SignNow help with filling out Form IT 203?

airSlate SignNow simplifies the process of filling out Form IT 203, Nonresident And Part Year Resident Income Tax, by providing easy-to-use templates and electronic signing capabilities. With our platform, you can complete this tax form efficiently and securely, reducing errors and streamlining submissions.

-

Is there a cost associated with using airSlate SignNow for Form IT 203?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of businesses. Instead of worrying about the complexities of Form IT 203, Nonresident And Part Year Resident Income Tax, you can choose a plan that best fits your budget and enjoy our features at a competitive price.

-

What features does airSlate SignNow offer for managing Form IT 203?

airSlate SignNow provides numerous features such as template creation, automated workflows, and electronic signatures for managing Form IT 203, Nonresident And Part Year Resident Income Tax. These features aid in streamlining your tax documentation process while enhancing accuracy and compliance.

-

Can I integrate airSlate SignNow with other tools for Form IT 203?

Yes, airSlate SignNow supports integration with many leading software applications, making it easy to link your data and streamline workflows when dealing with Form IT 203, Nonresident And Part Year Resident Income Tax. This interoperability ensures you can seamlessly use our eSigning capabilities alongside your existing tools.

-

Why should I choose airSlate SignNow for my Form IT 203 needs?

Choosing airSlate SignNow for your Form IT 203, Nonresident And Part Year Resident Income Tax needs means opting for a user-friendly, secure, and efficient solution. Our platform is designed to simplify the paperwork process while guaranteeing compliance with state tax regulations.

-

How secure is airSlate SignNow for handling Form IT 203?

airSlate SignNow prioritizes your security by implementing robust encryption and compliance standards when handling Form IT 203, Nonresident And Part Year Resident Income Tax. You can trust that your data remains confidential and secure throughout the signing and submission process.

Get more for Form IT 203 , Nonresident And Part Year Resident Income Tax

- Clinical observation form american international college aic

- Authorized permit agent form columbusga

- Philadelphia traffic accident cluster analysis using gis and sanet form

- Stallion breeding report appaloosa horse club form

- Carolina panthers psl transfer form

- 10539 f med form

- Sme png application form

- Oc 400 1 form

Find out other Form IT 203 , Nonresident And Part Year Resident Income Tax

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now