Keystone Form Itr 1 Schedule Return

What is the Keystone Form Itr 1 Schedule Return

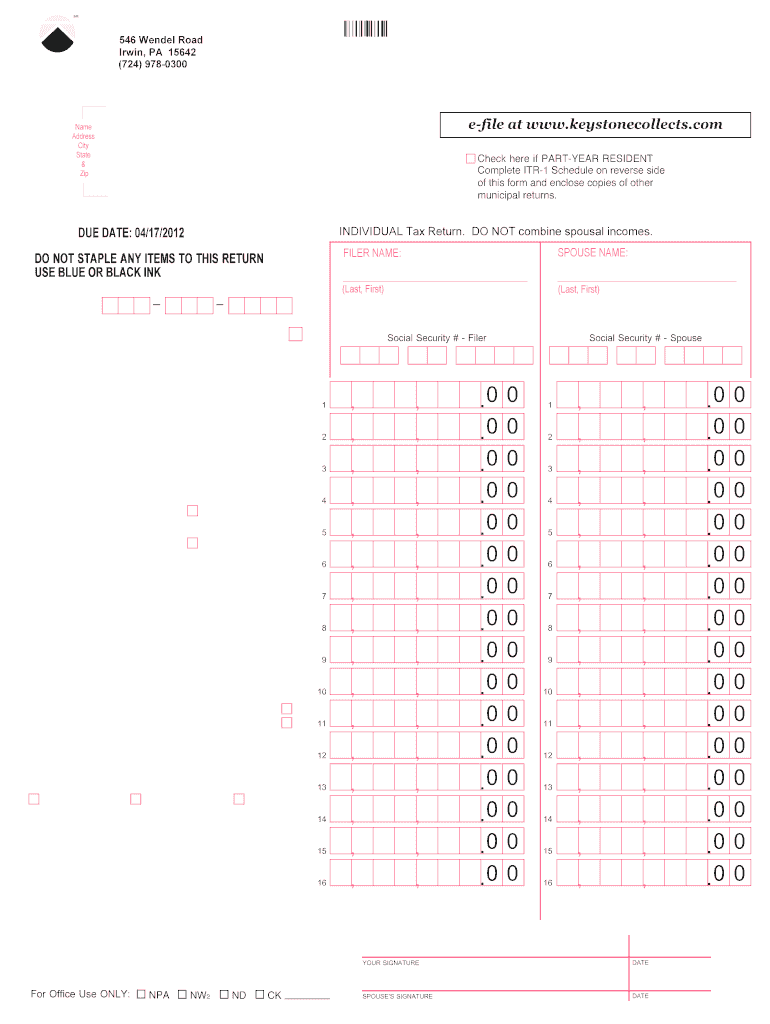

The Keystone Form Itr 1 Schedule Return is a tax form used by residents of Pennsylvania to report their earned income and calculate their state tax liability. This form is essential for individuals who earn income within Pennsylvania and need to comply with state tax regulations. It is specifically designed for reporting wages, salaries, and other forms of earned income, ensuring that taxpayers accurately fulfill their tax obligations.

Steps to complete the Keystone Form Itr 1 Schedule Return

Completing the Keystone Form Itr 1 Schedule Return involves several key steps:

- Gather necessary documents, including W-2 forms and any other income statements.

- Fill out personal information, such as your name, address, and Social Security number.

- Report your total earned income from all sources, ensuring accuracy in figures.

- Calculate your taxable income by applying any deductions or exemptions that you qualify for.

- Determine your tax liability using the provided tax tables or rates for Pennsylvania.

- Review your completed form for errors before submission.

Required Documents

To accurately complete the Keystone Form Itr 1 Schedule Return, you will need several documents:

- W-2 forms from all employers for the tax year.

- 1099 forms if you received income from freelance work or other non-employment sources.

- Records of any other earned income, such as rental income or business profits.

- Documentation for any deductions you intend to claim, such as education expenses or retirement contributions.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the Keystone Form Itr 1 Schedule Return to avoid penalties:

- The standard deadline for filing is April 15 of the following year.

- If April 15 falls on a weekend or holiday, the deadline is extended to the next business day.

- Extensions may be available, but it is important to file for an extension before the original deadline.

Form Submission Methods (Online / Mail / In-Person)

The Keystone Form Itr 1 Schedule Return can be submitted through various methods:

- Online submission through the Pennsylvania Department of Revenue's e-filing system.

- Mailing a paper form to the appropriate state tax office address.

- In-person submission at designated state tax offices, if applicable.

Eligibility Criteria

To file the Keystone Form Itr 1 Schedule Return, you must meet specific eligibility criteria:

- You must be a resident of Pennsylvania or have earned income in the state.

- Your income must exceed the minimum threshold set by the state for tax filing.

- You should have documentation for all sources of earned income during the tax year.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the keystone form itr 1 schedule return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is itr1 earned tax and how does it relate to airSlate SignNow?

The itr1 earned tax refers to the income tax return form for individuals earning income from salaries, pensions, and other sources. airSlate SignNow simplifies the process of signing and submitting your itr1 earned tax documents electronically, ensuring compliance and efficiency.

-

How can airSlate SignNow help me with my itr1 earned tax filing?

With airSlate SignNow, you can easily eSign your itr1 earned tax forms and send them securely. Our platform streamlines the document management process, allowing you to focus on your finances rather than paperwork.

-

What are the pricing options for using airSlate SignNow for itr1 earned tax documents?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of individuals and businesses. You can choose a plan that fits your budget while ensuring you have all the necessary features to manage your itr1 earned tax documents efficiently.

-

Are there any features specifically designed for itr1 earned tax management?

Yes, airSlate SignNow includes features such as customizable templates, automated reminders, and secure storage that are ideal for managing itr1 earned tax documents. These tools help you stay organized and ensure timely submissions.

-

Can I integrate airSlate SignNow with other software for itr1 earned tax preparation?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax preparation software, making it easier to manage your itr1 earned tax filings. This integration enhances your workflow and reduces the chances of errors.

-

What are the benefits of using airSlate SignNow for my itr1 earned tax documents?

Using airSlate SignNow for your itr1 earned tax documents offers numerous benefits, including increased efficiency, reduced paper usage, and enhanced security. Our platform ensures that your sensitive information is protected while making the signing process quick and easy.

-

Is airSlate SignNow compliant with tax regulations for itr1 earned tax?

Yes, airSlate SignNow is designed to comply with all relevant tax regulations, including those pertaining to itr1 earned tax. Our platform ensures that your electronic signatures and document submissions meet legal standards.

Get more for Keystone Form Itr 1 Schedule Return

Find out other Keystone Form Itr 1 Schedule Return

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online