Form it 604Claim for QEZE Tax Reduction Creditit604 Tax Ny

What is the Form IT-604 Claim For QEZE Tax Reduction Credit?

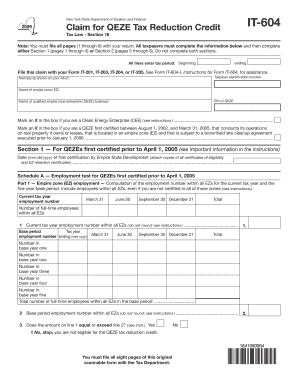

The Form IT-604 is a tax document used in New York State for claiming the Qualified Empire Zone Enterprise (QEZE) Tax Reduction Credit. This credit is designed to incentivize businesses located in designated Empire Zones by providing them with a reduction in their tax liabilities. Eligible businesses can lower their tax burden significantly, helping to stimulate economic growth and job creation in these areas. Understanding the purpose and benefits of this form is crucial for businesses aiming to take advantage of the available tax relief.

How to Use the Form IT-604 Claim For QEZE Tax Reduction Credit

To utilize the Form IT-604 effectively, businesses must first determine their eligibility based on their location and the nature of their operations within an Empire Zone. Once eligibility is confirmed, the form must be filled out accurately, reflecting the necessary financial information and tax details. It is essential to follow the instructions provided with the form closely to ensure that all required sections are completed. After completing the form, it should be submitted according to the guidelines set by the New York State Department of Taxation and Finance.

Steps to Complete the Form IT-604 Claim For QEZE Tax Reduction Credit

Completing the Form IT-604 involves several key steps:

- Gather necessary documentation, including financial statements and proof of eligibility.

- Fill out the form with accurate information regarding your business, including tax identification numbers and relevant financial data.

- Review the completed form for accuracy, ensuring all sections are filled out correctly.

- Submit the form by the specified deadline, either electronically or via mail, as per the instructions provided.

Eligibility Criteria for the Form IT-604 Claim For QEZE Tax Reduction Credit

To qualify for the QEZE Tax Reduction Credit using the Form IT-604, businesses must meet specific eligibility criteria. These typically include being located within a designated Empire Zone, engaging in eligible business activities, and meeting certain employment thresholds. Businesses should also ensure they have not previously claimed this credit for the same tax year. Understanding these criteria is essential to avoid potential issues during the application process.

Required Documents for the Form IT-604 Claim For QEZE Tax Reduction Credit

When preparing to submit the Form IT-604, businesses must gather several required documents to support their claim. These documents may include:

- Proof of business location within an Empire Zone.

- Financial statements reflecting income and expenses.

- Documentation of employment numbers and payroll records.

- Any prior tax filings relevant to the credit.

Having these documents readily available can streamline the completion and submission process.

Filing Deadlines for the Form IT-604 Claim For QEZE Tax Reduction Credit

Filing deadlines for the Form IT-604 are critical for businesses to note. Generally, the form must be submitted by the due date of the business's tax return for the year in which the credit is being claimed. It is important to stay informed about any changes to these deadlines, as late submissions may result in the denial of the credit. Keeping a calendar of important tax dates can help ensure timely filing.

Quick guide on how to complete form it 604claim for qeze tax reduction creditit604 tax ny

Effortlessly prepare [SKS] on any device

The management of documents online has gained immense popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the correct templates and securely store them online. airSlate SignNow provides all the resources necessary to create, modify, and electronically sign your documents swiftly and without delays. Handle [SKS] on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

Modify and electronically sign [SKS] with ease

- Locate [SKS] and click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize important sections of the documents or conceal sensitive details with the tools that airSlate SignNow provides for this specific purpose.

- You can craft your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review all the details thoroughly and then click the Done button to finalize your changes.

- Choose how you wish to send your form—via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow accommodates your requirements in document management with just a few clicks from any device you prefer. Modify and eSign [SKS] to guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form it 604claim for qeze tax reduction creditit604 tax ny

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form IT 604Claim For QEZE Tax Reduction Creditit604 Tax Ny?

Form IT 604Claim For QEZE Tax Reduction Creditit604 Tax Ny is a tax form used by qualified businesses in New York to claim tax reductions under the Qualified Empire Zone Enterprise (QEZE) program. This form allows businesses to reduce their tax burden, thereby facilitating growth and stability.

-

How can airSlate SignNow help with Form IT 604Claim For QEZE Tax Reduction Creditit604 Tax Ny?

airSlate SignNow simplifies the process of filling out and electronically signing Form IT 604Claim For QEZE Tax Reduction Creditit604 Tax Ny. With its user-friendly interface and powerful eSigning capabilities, businesses can easily manage their tax documents efficiently and securely.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow offers a range of features for managing tax documents, including customizable document templates, real-time tracking, and secure cloud storage. These features ensure that your Form IT 604Claim For QEZE Tax Reduction Creditit604 Tax Ny is completed accurately and on time.

-

Is there a cost associated with using airSlate SignNow for Form IT 604Claim For QEZE Tax Reduction Creditit604 Tax Ny?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The cost-effective solution includes access to all features necessary for filling out and signing Form IT 604Claim For QEZE Tax Reduction Creditit604 Tax Ny, making it affordable for businesses of all sizes.

-

Can I integrate airSlate SignNow with other tools I use for tax preparation?

Absolutely! airSlate SignNow integrates seamlessly with a variety of business applications and accounting software. This allows you to streamline your tax preparation process while efficiently handling Form IT 604Claim For QEZE Tax Reduction Creditit604 Tax Ny.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for managing your tax documents, including Form IT 604Claim For QEZE Tax Reduction Creditit604 Tax Ny, provides numerous benefits. These include improved document security, faster turnaround times for signatures, and a hassle-free experience in managing your tax obligations.

-

Is airSlate SignNow compliant with tax regulations for Form IT 604Claim For QEZE Tax Reduction Creditit604 Tax Ny?

Yes, airSlate SignNow is compliant with industry standards and regulations, ensuring that your Form IT 604Claim For QEZE Tax Reduction Creditit604 Tax Ny meets all required legal and security measures. This compliance helps protect sensitive tax information throughout the signing process.

Get more for Form IT 604Claim For QEZE Tax Reduction Creditit604 Tax Ny

Find out other Form IT 604Claim For QEZE Tax Reduction Creditit604 Tax Ny

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile