Form 8814 Fill in Version Parent's Election to Report Child's Interest and Dividends

What is the Form 8814 Fill in Version Parent's Election To Report Child's Interest And Dividends

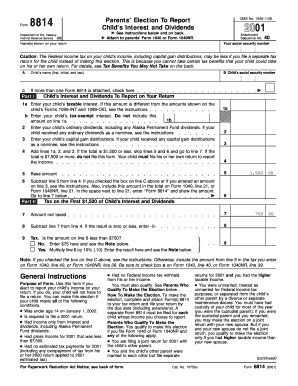

The Form 8814, officially known as the Parent's Election To Report Child's Interest And Dividends, is a tax form used by parents in the United States. This form allows parents to elect to report their child's interest and dividend income on their own tax return, rather than requiring the child to file a separate return. This option is beneficial for parents with children who have unearned income below a certain threshold, simplifying the tax process and potentially reducing the overall tax liability for the family.

How to use the Form 8814 Fill in Version Parent's Election To Report Child's Interest And Dividends

Using the Form 8814 involves several straightforward steps. First, parents must determine if their child's unearned income qualifies for reporting on their tax return. If eligible, they should complete the form by filling in the required information, including the child's name, Social Security number, and the amount of interest and dividends earned. Once completed, this form is attached to the parent's tax return, allowing the income to be reported appropriately. It is essential to follow IRS guidelines to ensure compliance and avoid any potential issues.

Steps to complete the Form 8814 Fill in Version Parent's Election To Report Child's Interest And Dividends

Completing the Form 8814 involves a series of clear steps:

- Gather necessary information, including the child's Social Security number and details of their interest and dividend income.

- Access the fillable version of the Form 8814 online or obtain a physical copy from the IRS.

- Fill in the child's information and the total amount of interest and dividends earned.

- Review the completed form for accuracy to ensure all information is correct.

- Attach the form to the parent's tax return before submission.

Legal use of the Form 8814 Fill in Version Parent's Election To Report Child's Interest And Dividends

The legal use of Form 8814 is defined by IRS regulations. Parents must ensure that their child's unearned income does not exceed the specified limits set by the IRS to qualify for this election. Additionally, the child must be under the age of 19 or a full-time student under the age of 24. Misuse of the form or failure to comply with IRS guidelines can result in penalties, making it crucial for parents to understand the legal implications of their election.

Filing Deadlines / Important Dates

Filing deadlines for Form 8814 align with the standard tax return deadlines. Typically, this means that parents must submit their tax returns, including the Form 8814, by April 15 of the following tax year. If the deadline falls on a weekend or holiday, it may be extended to the next business day. Parents should stay informed about any changes in tax law that could affect filing dates.

Eligibility Criteria

To use Form 8814, certain eligibility criteria must be met. The child must be under the age of 19 at the end of the tax year or a full-time student under the age of 24. Additionally, the child's total unearned income must be below the threshold set by the IRS, which is subject to change annually. Parents should verify these criteria each tax year to ensure compliance and eligibility for the election.

Quick guide on how to complete form 8814 fill in version parents election to report childs interest and dividends

Effortlessly prepare [SKS] on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow provides you with all the resources needed to create, modify, and electronically sign your documents quickly without any hurdles. Handle [SKS] on any platform with airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

How to edit and electronically sign [SKS] with ease

- Find [SKS] and then click Get Form to get started.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review the information and then click on the Done button to save your changes.

- Select how you want to share your form, whether by email, SMS, or invitation link, or download it to your PC.

Eliminate the hassle of lost or misfiled documents, cumbersome form navigation, or errors that necessitate reprinting new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from your preferred device. Edit and electronically sign [SKS] to ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 8814 Fill in Version Parent's Election To Report Child's Interest And Dividends

Create this form in 5 minutes!

How to create an eSignature for the form 8814 fill in version parents election to report childs interest and dividends

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 8814 Fill in Version Parent's Election To Report Child's Interest And Dividends?

The Form 8814 Fill in Version Parent's Election To Report Child's Interest And Dividends allows parents to report their child's interest and dividends on their tax return. This form simplifies the process by enabling parents to include their child's income with their own, often making filing easier. It's specifically designed for qualifying children under the age of 19.

-

How can I access the Form 8814 Fill in Version Parent's Election To Report Child's Interest And Dividends on airSlate SignNow?

You can easily access the Form 8814 Fill in Version Parent's Election To Report Child's Interest And Dividends through airSlate SignNow's platform. Simply create an account, and you can upload and fill in your tax forms directly online. Our user-friendly interface ensures a seamless experience for filling out tax documents.

-

Is there a cost associated with using airSlate SignNow for the Form 8814 Fill in Version?

Yes, while airSlate SignNow offers various pricing plans, our solution for the Form 8814 Fill in Version Parent's Election To Report Child's Interest And Dividends is cost-effective. We provide different subscription options tailored to suit individual or business needs, ensuring you only pay for what you use.

-

What are the main features provided for the Form 8814 Fill in Version?

With airSlate SignNow, users can electronically fill out and sign the Form 8814 Fill in Version Parent's Election To Report Child's Interest And Dividends. Our platform includes features like template management, document sharing, and secure cloud storage, making it easier for families to manage their tax submissions efficiently.

-

Can I send the Form 8814 Fill in Version for review before final submission?

Absolutely! airSlate SignNow allows you to send the Form 8814 Fill in Version Parent's Election To Report Child's Interest And Dividends for review before finalizing it. You can invite colleagues or family members to review the document, ensuring accuracy and compliance with tax regulations.

-

Does airSlate SignNow support integrations for filing the Form 8814?

Yes, airSlate SignNow supports various integrations that facilitate filing the Form 8814 Fill in Version Parent's Election To Report Child's Interest And Dividends. Our platform can easily integrate with accounting software and tax filing services, streamlining the entire tax preparation process for users.

-

What benefits does using airSlate SignNow provide for managing tax forms like Form 8814?

Using airSlate SignNow for the Form 8814 Fill in Version Parent's Election To Report Child's Interest And Dividends offers numerous benefits, including convenience and time savings. Our platform ensures that you can fill out your forms securely and collaborate with others easily, minimizing the hassle associated with traditional paper filing.

Get more for Form 8814 Fill in Version Parent's Election To Report Child's Interest And Dividends

- Ach debitcheckcancelstop payment remember or joint form

- Information for incoming wires zions bank

- Automatic transfer authorization agreement the clay city form

- Compassionate finance application form

- Woody phomopsis galls bygl ohio state university form

- Credit application account transtar industries form

- New tenant update alternate address form

- Sc 506 financial disclosure statement form

Find out other Form 8814 Fill in Version Parent's Election To Report Child's Interest And Dividends

- eSignature North Dakota Doctors Bill Of Lading Online

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast

- How To eSignature Kentucky Government Warranty Deed

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple