Form it 203 , Nonresident and Part Year Resident, IT203 Tax Ny

Understanding Form IT-203 for Nonresidents and Part-Year Residents

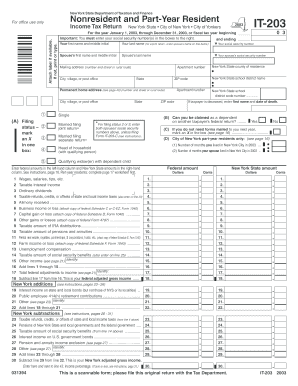

Form IT-203 is a tax form used by nonresidents and part-year residents of New York State to report income earned in the state. This form is essential for individuals who do not reside in New York for the entire tax year but have income sourced from New York. It allows taxpayers to calculate their tax liability based on their New York income, ensuring compliance with state tax regulations.

Steps to Complete Form IT-203

Completing Form IT-203 involves several key steps:

- Gather necessary documentation, including W-2 forms and any other income statements relevant to your New York earnings.

- Fill out personal information, such as your name, address, and Social Security number, in the designated sections of the form.

- Report your total income earned in New York, including wages, salaries, and any other taxable income.

- Calculate your tax liability based on the income reported and apply any applicable credits or deductions.

- Review the completed form for accuracy before submission.

Obtaining Form IT-203

Form IT-203 can be obtained through the New York State Department of Taxation and Finance website. It is available as a downloadable PDF, which can be printed and filled out. Additionally, physical copies may be available at local tax offices or public libraries. Ensure you have the most current version of the form to avoid any issues during filing.

Legal Use of Form IT-203

Form IT-203 is legally required for nonresidents and part-year residents who earn income in New York. Failure to file this form can result in penalties and interest on unpaid taxes. It is crucial to understand the legal obligations associated with this form to maintain compliance with state tax laws.

Key Elements of Form IT-203

Several key elements must be included when filling out Form IT-203:

- Identification information, including your name and Social Security number.

- Details of income earned in New York, categorized by type.

- Calculation of tax owed based on the reported income.

- Any credits or deductions that may apply to reduce the overall tax liability.

Filing Deadlines for Form IT-203

The deadline for filing Form IT-203 typically aligns with the federal tax filing deadline, which is usually April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important to verify the specific deadline each tax year to ensure timely submission and avoid penalties.

Quick guide on how to complete form it 203 nonresident and part year resident it203 tax ny

Effortlessly Prepare Form IT 203 , Nonresident And Part Year Resident, IT203 Tax Ny on Any Device

Online document management has become increasingly popular among businesses and individuals alike. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and eSign your documents without delays. Manage Form IT 203 , Nonresident And Part Year Resident, IT203 Tax Ny on any device using airSlate SignNow's Android or iOS applications and simplify any document-related processes today.

How to Alter and eSign Form IT 203 , Nonresident And Part Year Resident, IT203 Tax Ny with Ease

- Locate Form IT 203 , Nonresident And Part Year Resident, IT203 Tax Ny and click Get Form to begin.

- Utilize the tools we provide to finish your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign option, which only takes seconds and holds the same legal force as a conventional wet ink signature.

- Review all details and click on the Done button to save your modifications.

- Choose how you'd like to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tiring form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Modify and eSign Form IT 203 , Nonresident And Part Year Resident, IT203 Tax Ny and ensure outstanding communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form it 203 nonresident and part year resident it203 tax ny

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form IT 203, Nonresident And Part Year Resident, IT203 Tax NY?

Form IT 203, Nonresident And Part Year Resident, IT203 Tax NY is a tax form that individuals who are nonresidents or part-year residents of New York State need to file. This form allows taxpayers to report their income earned within New York and calculate the appropriate tax owed. It is essential for compliance and ensuring that you meet your tax obligations while maximizing potential refunds.

-

How can airSlate SignNow assist with completing Form IT 203, Nonresident And Part Year Resident, IT203 Tax NY?

airSlate SignNow provides easy-to-use features that streamline the completion of Form IT 203, Nonresident And Part Year Resident, IT203 Tax NY. You can electronically fill out, sign, and send the form, ensuring that it is submitted quickly and accurately. Our platform simplifies document management, which can help reduce errors and save time.

-

What are the pricing options for airSlate SignNow when using Form IT 203, Nonresident And Part Year Resident, IT203 Tax NY?

airSlate SignNow offers competitive pricing plans that cater to different business needs, particularly for managing Form IT 203, Nonresident And Part Year Resident, IT203 Tax NY. Each plan includes essential features such as eSigning, document templates, and cloud storage. You can choose a plan based on your volume of transactions and the required features.

-

What integrations does airSlate SignNow offer for Form IT 203, Nonresident And Part Year Resident, IT203 Tax NY?

airSlate SignNow integrates seamlessly with various third-party applications to help manage Form IT 203, Nonresident And Part Year Resident, IT203 Tax NY. Our platform works well with popular tools such as Google Drive, Salesforce, and other document management systems. These integrations enhance productivity and allow for a more streamlined workflow.

-

What features make airSlate SignNow beneficial for handling Form IT 203, Nonresident And Part Year Resident, IT203 Tax NY?

Key features of airSlate SignNow include document templates, secure eSigning, and real-time tracking, all of which are beneficial for handling Form IT 203, Nonresident And Part Year Resident, IT203 Tax NY. These tools ensure your documents are processed efficiently and securely while providing a user-friendly experience. Additionally, our cloud-based system allows for easy access from anywhere.

-

Can I access past forms of Form IT 203, Nonresident And Part Year Resident, IT203 Tax NY using airSlate SignNow?

Yes, with airSlate SignNow, you can easily access your past forms of Form IT 203, Nonresident And Part Year Resident, IT203 Tax NY. Our platform stores your documents securely in the cloud, allowing you to retrieve and review previous submissions whenever necessary. This feature aids in record-keeping and tax preparation for future filings.

-

Is airSlate SignNow secure for submitting Form IT 203, Nonresident And Part Year Resident, IT203 Tax NY?

Absolutely, airSlate SignNow employs robust security measures to ensure that your Form IT 203, Nonresident And Part Year Resident, IT203 Tax NY submissions are safe and secure. Our platform uses industry-standard encryption to protect your data, along with compliance with legal regulations. You can sign and submit documents with confidence knowing your information is secured.

Get more for Form IT 203 , Nonresident And Part Year Resident, IT203 Tax Ny

- Copd name action plan uhc military west form

- Occupational therapy intake form elite dna therapy

- The craap test worksheet form

- Answer and plan of care parties other than childrenamp39s aid society form

- Holiday faire vendor contract peoria unified school district peoriaunified form

- Ptt admission sitagarha 2014 2019 form

- Woodbridge high school ptsa payment authorization form date woodbridgeptsa

- Tams residency documentation request form

Find out other Form IT 203 , Nonresident And Part Year Resident, IT203 Tax Ny

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online